In today’s post:

$795M SAYS PLTR’s WINNING 💰

HANDS UP PET LOVERS 🙌

TRADE TRUCE MELTDOWN 😟

$795M SAYS PLTR’s WINNING 💰

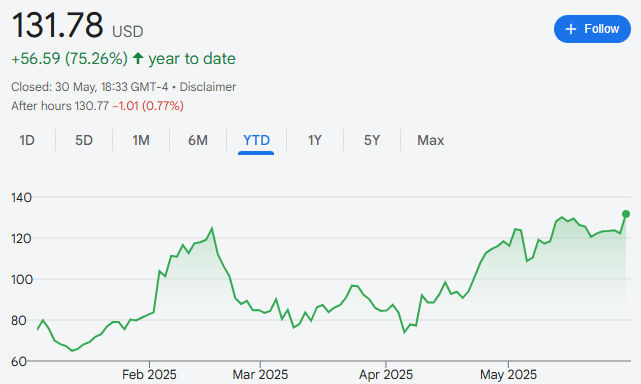

Palantir $PLTR ( ▼ 1.35% ) just gave the market a reminder on why it's still the US government’s favorite data nerd. Shares are up over 7% for the day as I’m writing this. 🤯

Palantir up over 7.5% at the time of writing

Why? A hot streak of big-time contract wins and some juicy rumors about Uncle Sam's latest wishlist will do that.

Let’s unpack the madness.

Last week, Palantir locked in a near $800 million modification to a U.S. Army contract. $795 million to be precise. It’s all for the Maven Smart System. Think military-grade brain powered by AI.

Next up: The Golden Dome

Trump teased a $175 billion global missile defense system. Think Iron Dome, but for the US. Palantir's name is in the hat. They’ve already pitched proposals and, let’s be real. This sounds exactly like the kind of sci-fi-meets-government contract Palantir lives for.

The New York Times spilled the beans on this one this morning. Palantir might be the lucky ones picked to take the reins on a federal data merger effort. Sounds snazzy, right?

Basically, they’re helping the government turn a bunch of ancient databases into a system that actually works. They're chatting with the Social Security Administration and IRS too.

But it’s not just relying on shaking hands with the orange man to make some cash.

Palantir’s public sector game is strong, but the commercial side? Pulls it’s own weight too. Q1 saw commercial revenue climb 70% year over year. Total revenue up 40%.

And like a sexy single that loves a situation-ship, the partnerships keep coming.

Joint Commission — Palantir’s helping modernize how healthcare orgs track and share data

Fannie Mae — They're teaming up to tackle fraud detection with AI and data science

The stock? Mooning like a meme coin.

Palantir shares are up 75% this year. Compare that to:

IGV (the big software ETF): +3%

S&P 500: +0.25%

NASDAQ: -1%

I can feel my FOMO muscle twitching just writing that.

YTD chart triggers my FOMO

But not everyone’s convinced

Some analysts think PLTR’s getting a bit too spicy on the valuation. One called it “nosebleed levels.” Another slapped a sell on it. “The growth can’t keep up with the hype!” they said.

Optimists are pinning their hopes and dreams on the Golden Dome as the upside play. Palantir’s got the tech (Foundry, Gotham, Maven). And it doesn’t look like the US government’s appetite for AI-powered defense is slowing down. Could be a match made in heaven.

What do I think?

I don’t love Palantir at it’s current valuation. Not even a little bit tbh.

It’s riding a wave of government money, flashy projects, and commercial growth. And the stock is super reactive to the headlines. If you go in eyes wide open and happy with sky-high valuations, volatility and a bit of political drama, I think there will still be fuel in the rocket.

If not? Might be time to parachute out or sit on the sidelines.

HANDS UP PET LOVERS 🙌

Only about 4% of U.S. pet owners have pet insurance

Pet care costs are rising, yet not enough people are doing something about it. Pet insurance can significantly offset rising costs – all for as low as $10 a month. Want to join the 4% club?

TRADE TRUCE MELTDOWN 😟

U.S. & China got a relationship status update. It’s complicated.

Here’s the TL;DR of how it went:

The U.S., “Hey China, we’ll pause the whole tariff thing for 90 days if you speed up rare earth exports.”

China, “Fine.”

China ghosts the whole rare earth exports part.

Will they ever settle down & learn to love each other?

Amazing. You’re all up to speed. But what the heck are rare earths? And why does it even matter?

Astro bros calm down. They’re not magical crystals.

They’re critical elements used to make EVs, smartphones, computer chips. Anything with a battery or a brain.

So when China slows down exports, the entire tech and auto supply chain starts sweating bullets.

Why did China do that if everyone agreed to play nice?

Well, the US kinda brought it on themselves. A quiet little warning from the U.S. Commerce Dept. on May 12: “Hey world, maybe don’t use Huawei’s AI chips. Anywhere.”

China saw it and went: “Oh, so it’s like that?”

Boom goes the truce. We’re practically back to where we started… which is where exactly?

U.S. companies (especially automakers) are freaking out.

Some are warning they might have to shut down plants if the minerals don’t start flowing.

Trump and Trade Rep. Greer called out China on Friday, saying they’re not holding up their end of the deal.

How did the market feel about all this?

Pretty chill by the looks of it.

Stocks ended flat. Apparently, investors are numb to trade wars when they happen every other day.

But things are getting tense. Doomsday ringers are saying if supply chains break again, we’re looking at some pandemic-style factory stoppages. I think that’s a bit of a stretch… right now, anyway.

How can we profit from this? The T.A.C.O. trade is something I’ve been using. It’s a cooler way of saying “Buy the Dip”.

China controls ~60% of rare earth production so if they pull the plug on exports, the rules of supply & demand will print money for the 40% of miners outside of China.

MP materials $MP ( ▲ 4.92% ) and Lynas Rare Earths $LYSDY ( ▲ 2.4% ) are both interesting bets for that line of thinking.

I don’t think it’ll come to that. Trump & XI will kiss and make up before any huge supply chain disruptions, in my opinion.