In today’s post:

9 Straight Wins... And Counting 📈

The $30B Profit Paradox 😕

Brazil’s Billion-Dollar Secret 🛢

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

9 STRAIGHT WINS… AND COUNTING 📈

$TSM ( ▲ 4.25% ) (Taiwan Semiconductor Manufacturing Company) isn’t just another chipmaker — it’s the chipmaker.

They’re the silent force behind Nvidia, Apple, AMD, and basically every fancy AI brain cell that powers the modern world. While most “fabless” semiconductor companies design chips, TSMC is the one actually building them — with surgical precision and profit margins that make even tech giants jealous.

With a market cap north of $1.15 trillion, TSMC’s now one of the world’s most valuable companies. And arguably one of the best-run.

In the past year alone:

Revenue up ~40% (sector average: 7%)

Net income up 54%

Stock up 48% year-to-date

And the best part? They’re just getting started.

Another Quarter, Another Mic Drop

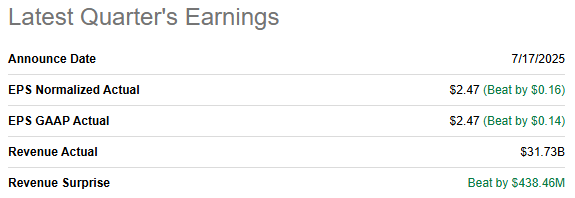

FQ2 2025 Results (reported July 17):

This was TSMC’s ninth consecutive double beat — they’ve literally not missed once in over two years.

Here’s the scorecard:

Revenue: $31.73 billion (+54% YoY), beating estimates by $438 million

EPS: $2.47 (+71% YoY from $1.48)

Gross margin: 59%

Net margin: 42%

EBITDA margin: 69%

TSMC’s printing cash faster than the Fed in 2020.

Beat, beat, beat for TSMC

What’s Driving The Growth?

In short: AI, baby.

TSMC’s High-Performance Computing (HPC) segment — where all the AI chips live — made up 60% of total revenue last quarter, jumping 14% QoQ. Smartphones followed at 27%.

The global AI chip market was $112 billion in 2024 and is expected to hit $360 billion by 2029 — a 26% CAGR. Guess who’s sitting right in the middle of that growth wave? Yep.

Coming Up Next: FQ3 2025

TSMC will drop its next report on October 16, and management’s guidance already looks juicy:

Revenue: ~$32.4B (midpoint), +38% YoY

Gross margin: ~56.5%

Operating margin: ~46.5%

Wall Street expects $31.45B in revenue and $2.66 EPS which would already be their highest-ever quarterly profit. But given their track record and surging AI demand, another beat looks pretty likely.

If they hit the high end of guidance again, that streak of double-beats might hit 10.

Wall Street’s expectations for the next earnings report with 6 upward revisions in the last 90 days

Sure, TSMC trades at a forward P/E of ~31, which is:

19% higher than the sector median (25.8x)

38% higher than the S&P 500 average (~23x)

But when you’re growing 4–5x faster than everyone else and pulling 42% net margins, that premium starts to look cheap.

Other valuation nuggets:

PEG (non-GAAP): 1.42 (22% discount to peers at 1.83)

EV/EBITDA: 13.7 (vs. peers’ 15.8)

Price/Sales: 9.9 (vs. industry 3.6 — yep, that’s the premium part)

Investors are basically paying up for one of the best businesses in the world. And that’s fair.

The Balance Sheet: A Fortress

TSMC’s got $90B+ in cash and just $34.6B in obligations. They could literally pay off all their debt tomorrow and still have enough left to buy another ASML lithography machine or two.

They even earned $735.5M in net interest income last quarter. That’s right. Their cash pile is now making them more money than their debt costs them.

The Moat: Margins, Margins, Margins

Compared to the rest of the semiconductor world, TSMC’s profit machine looks unreal:

Gross margin: 59% vs peers’ 49.6%

EBIT margin: 48.8% vs peers’ 6.4%

EBITDA margin: 69% vs peers’ 10.7%

Net margin: 42.5% vs peers’ 4.5%

ROE: 34.5% vs peers’ 5.4%

Operating cash flow: $73B vs sector median $123M

Those aren’t typos. That’s what a world-dominating business looks like.

The Math Behind The $365 Target

Wall Street expects $9.85 EPS for FY2025 and $11.49 for FY2026, a 16% YoY growth.

If we slap a 32x multiple (a modest premium given growth + margins) on that FY2026 EPS, we land right at a $365 price target. That’s about 30% upside from current levels.

And if AI demand stays as crazy as it’s been, that upside could come sooner rather than later.

The Risks (Because Nothing’s Risk-Free)

Market Overheating: Stocks have been running hot since April. Any correction could drag TSMC down short term.

Geopolitical Tension: Taiwan–China drama is a permanent overhang. Any escalation could hit supply chains and investor sentiment.

Concentration Risk: Most production is still in Taiwan. New fabs in the US are coming, but not overnight.

AI Hype Cooldown: If data center spending slows or AI hype fades, chip demand could follow.

But absent a geopolitical blowup, the long-term story still looks rock solid.

The Bottom Line

TSMC is the most important company you never think about. They quietly power every AI boom headline, every iPhone release, every Nvidia chip.

They’ve got fortress margins, a bulletproof balance sheet, and consistent execution that would make even Apple jealous.

Yes, it trades at a premium. But it’s earned it.

Rating: Strong Buy

12-month Target: $365 (30% upside)

If AI keeps booming, TSMC’s stock could do the same.

TL;DR

TSMC crushed FQ2 with 54% revenue growth and 71% EPS growth.

9th straight double-beat quarter and #10 looks likely.

$90B+ in cash, 59% gross margin, 42% net margin.

Trading at 31x earnings but still looks cheap vs growth.

$365 price target = 25% upside potential.

Risks: Taiwan-China tension, market correction, AI hype risk.

Still: It’s the most profitable chipmaker on Earth, and AI’s best friend.

You’re Only Seeing 1/3 of the Picture

Premium+ members unlock the full “Stocks of the Week” — at least 3 deep-dive stock picks, complete with risks, charts, and timing.

Right now, you’re only seeing one stock. That’s like watching the trailer and skipping the movie.

Here’s what Premium+ members are getting this weekend:

✅ 3+ exclusive stock picks

📊 In-depth analysis with charts

⏰ Early access before it goes public

💸 A clear playbook for the week ahead

Why settle for crumbs when you can eat the whole steak?

👉 Unlock the full “Stocks of the Week” — Upgrade to Premium+

If we don’t help you grow your portfolio, you’ll get a full refund.