In today’s post:

Berkshire Cuts Apple?! 😲

AI Spending Isn’t Slowing 📈

$3M Bet From The CEO 💰

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

BERKSHIRE CUTS APPLE?! 😲

They left the tech aisle with slightly fewer apples.

Here’s what Berkshire Hathaway did in Q4, straight from its 13F filing (aka: “Here’s what we bought and sold, don’t freak out”).

New Kid in the Cart: The New York Times

Buffett added 5.07 million shares of New York Times. $NYT ( ▲ 1.99% )

Price tag? $351.7M.

No toe-dips here. Just straight cannonballs.

Why it’s interesting:

Legacy media.

Subscription revenue.

Sticky digital business.

Brand moat you could drive a Berkshire-owned railroad through.

This isn’t Buffett buying hype. This is Buffett buying habit-forming revenue.

Think: “People cancel Netflix before they cancel news.”

More Oil. More Pizza. More Insurance.

Buffett also bulked up on some old favorites:

Chevron $CVX ( ▲ 1.84% ) → 130.2M shares ($19.8B)

Chubb $CB ( ▼ 0.78% ) → 34.3M shares ($10.7B)

Domino's Pizza $DPZ ( ▲ 2.54% ) → 3.35M shares ($1.40B)

Energy. Insurance. Pizza.

Sounds more like a dad’s weekend than a solid portfolio. But zoom out and you’ll see the pattern:

Oil = cash flow machine

Insurance = float printer

Domino’s = high-margin carb dispenser with pricing power

Buffett isn’t chasing AI buzzwords.

He’s stacking businesses that throw off predictable cash like a broken ATM.

Trimmed the Apple Tree (But Still Owns the Orchard)

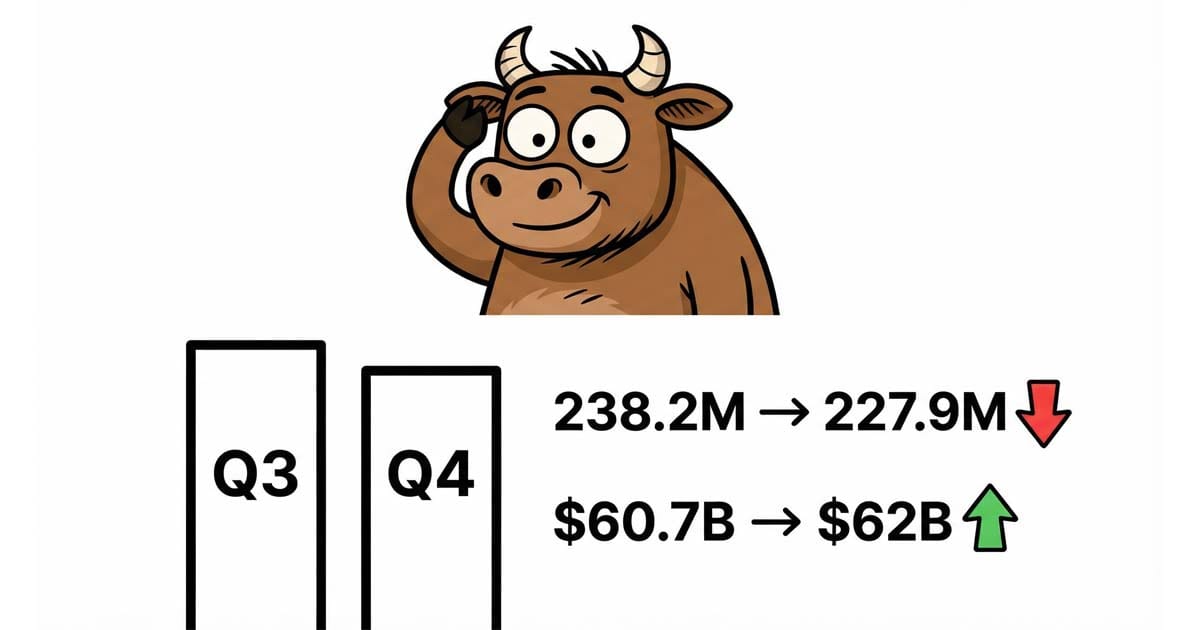

Yes, he reduced Apple. $AAPL ( ▲ 0.18% )

Shares dropped from 238.2M → 227.9M.

But here’s the thing:

Even after trimming, Apple is still Berkshire’s largest holding.

And the value of the stake?

Up to $62B.

So Buffett technically sold some shares…

…but the position is worth more than before.

That’s like selling 10% of your house and somehow ending up richer.

Retail investors: don’t misread trims as breakups.

Sometimes it’s just portfolio gardening.

Lightened Up on Bank of America

He reduced Bank of America $BAC ( ▲ 1.18% ) from 548.1M shares to 517.3M.

Still a monster position at $23.5B.

Not a divorce. More like switching from supersized to large.

Banks are cyclical. Buffett adjusts sizing when risk/reward shifts.

Simple as that.

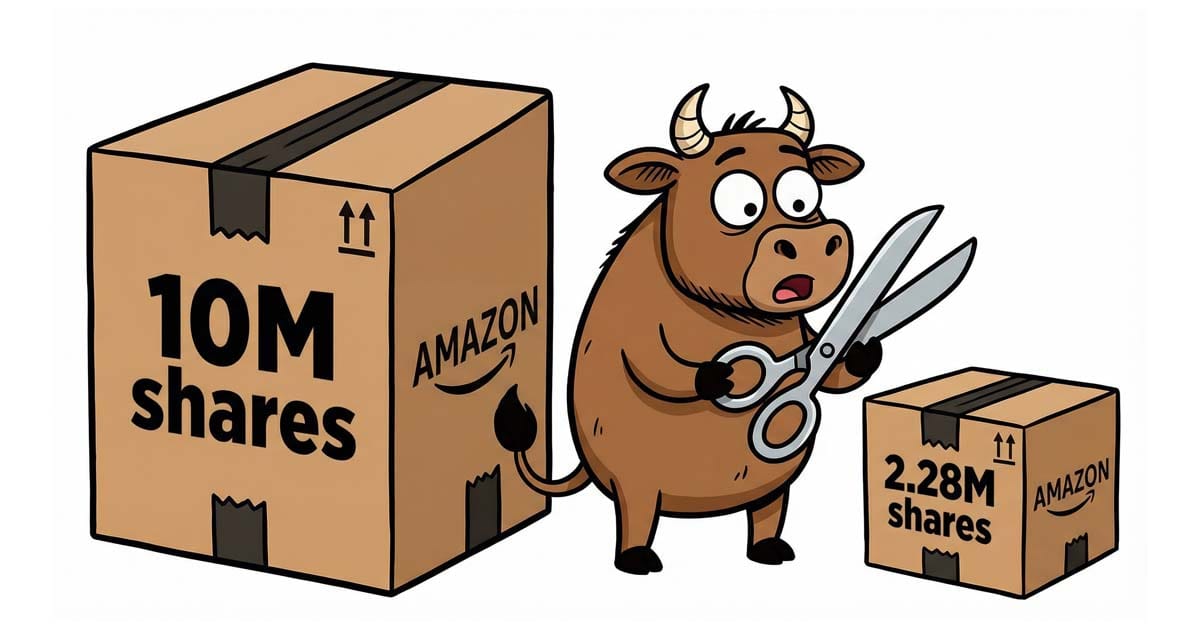

And Amazon? That Was a Real Cut

Amazon $AMZN ( ▲ 1.81% ) went from 10M shares to 2.28M.

That’s not trimming. That’s proper decluttering.

Compared to the rest of Berkshire’s portfolio, Amazon is now a rounding error.

What’s the Big Picture?

Buffett’s moves scream three things:

1️⃣ Cash Flow > Hype

Energy, insurance, subscriptions, pizza.

All boring. All profitable.

Buffett has openly said he built his investing philosophy after reading The Intelligent Investor (which you can read here) — and filings like this are that philosophy in action.

2️⃣ Tech Is Still Core — Just Managed

Apple remains king of the portfolio.

But concentration risk? Slightly dialed down.

3️⃣ Optionality Mode

Berkshire has mountains of cash.

When Buffett adjusts positions, he’s positioning for flexibility — not panic.

He’s not reacting.

He’s calibrating.

Retail Investor Takeaways

Don’t panic when big funds trim positions.

Portfolio management ≠ conviction change.

Buffett still loves durable brands.

Cash-generating machines win long term.

If anything, this filing looks less like “new strategy”…

…and more like “fine-tuning the empire.”

TL;DR

Buffett bought $351M of $NYT ( ▲ 1.99% ) .

Added to Chevron, Chubb, Domino’s.

Trimmed Apple and Bank of America.

Slashed Amazon.

Apple still the biggest holding at $62B.

Boring businesses. Big cash flow. Light portfolio pruning.

Classic Buffett.

1. Follow the Cash Flow Trail

Berkshire added to Chevron, Chubb, and Domino's Pizza. That’s a clear tilt toward businesses with strong free cash flow, pricing power, defensive demand.

📌 Action: Increase exposure to high-FCF sectors (energy, insurance, consumer staples). Allocate 5–15% of your portfolio toward cash-generating “boring compounders.” Reinvest dividends automatically. Boring scales quietly.

2. Rebalance Concentration Risk

Berkshire trimmed Apple, but it’s still the largest holding at ~$62B. That’s textbook portfolio discipline. Reduce size, maintain conviction, lower risk.

📌 Action: If any single stock is >25–30% of your portfolio, consider trimming 5–10% and redeploy into underweighted sectors. Do this quarterly. Mechanical > emotional. Trim strength. Don’t panic sell.

3. Lean Into Subscription Moats

Berkshire initiated a $351M position in New York Times. This signals appetite for recurring revenue, high retention, digital subscription growth.

📌 Action: Screen for companies with >70% recurring revenue and rising ARPU. Build a 3–5 stock basket of subscription-based businesses and hold long term. Predictable revenue = smoother compounding.

AI SPENDING ISN’T SLOWING 📈

Meta just walked into Nvidia’s store…

…and said:

“Yeah, we’ll take the whole aisle.”

Nvidia + Meta = AI on Steroids

Nvidia and Meta just announced a multi-year AI infrastructure partnership.

Meta is doubling down on Nvidia hardware like it’s Costco bulk-buy season.

After-hours reaction:

Nvidia: +1.8%

Meta: +1.5%

Nothing crazy.

But the implications? Big.

(Nvidia was today’s premium analysis stock. We took a look at this and whether supply constraints mean Nvidia is worth taking out of your portfolio. Take a look here)

What’s Actually Happening?

Meta is upgrading its AI factory.

And Nvidia is supplying the machinery.

Here’s the breakdown:

1. Grace CPUs Are Moving In

NVIDIA Grace CPU is getting deployed at scale inside Meta’s data centers.

This is Nvidia’s first major Grace-only deployment.

That’s like someone finally buying the side dish Nvidia’s been hyping for two years.

Why it matters:

Nvidia isn’t just a GPU company anymore.

It’s building the full AI stack — CPU + GPU + networking + software.

They want the whole meal, not just the fries.

2. Vera Is Coming Next

Meta is also preparing to roll out Nvidia’s upcoming Vera CPUs next year at scale.

Future-proofing the AI empire.

Think of this as Meta pre-ordering the next iPhone…

Before anyone’s even seen it.

3. Faster Pipes = More AI

Meta is adding more of Nvidia’s Spectrum-X Ethernet to boost network speed and efficiency.

Because here’s the dirty secret of AI:

It’s not just about chips.

It’s about moving data between chips.

If GPUs are Ferraris, networking is the highway.

And Nvidia wants to own the highway too.

4. AI… But Make It Private

Meta is also using Nvidia’s Confidential Computing for WhatsApp.

That allows AI features while keeping user data protected.

In theory, that means:

Smarter AI tools

Without your messages becoming training data soup

(Yes, privacy investors, you can exhale.)

5. The Big One: GB300 Systems

Meta will use Nvidia’s GB300 systems in its data centers and lean on Nvidia’s cloud partners to simplify operations.

Meta is building AI clusters so powerful they could probably simulate your next three bad trades.

The Bigger Picture

This isn’t just a hardware order.

This is deep co-design.

Jensen Huang (Nvidia CEO) basically said: We’re integrating CPUs, GPUs, networking, and software into Meta’s infrastructure.

That’s Nvidia embedding itself directly into Meta’s AI brain.

The deeper Nvidia goes into hyperscaler infrastructure, the stickier the revenue becomes.

And that’s what Wall Street really cares about.

Why This Is Bullish for Nvidia

Let’s zoom out.

Meta is one of the largest AI infrastructure spenders on the planet.

If Meta:

Is increasing Grace deployment

Prepping Vera

Scaling GB300

Expanding networking

That means AI capex isn’t slowing down.

The narrative that hyperscalers might cut AI spending?

This announcement just punched that theory in the face.

Why This Is Smart for Meta

Meta runs:

The largest personalization engines in the world

Recommendation systems for billions of users

AI research at frontier scale

To compete in AI, Meta needs:

Compute

More compute

Even more compute

This partnership ensures:

Performance

Scale

Hardware roadmaps aligned with Meta’s needs

In AI, whoever trains fastest wins.

Meta doesn’t want to bring a knife to a GPU fight.

The Strategic Takeaway

Nvidia is no longer just selling GPUs.

It’s becoming:

The operating system of AI infrastructure

The Apple of AI hardware stacks

The toll booth on the AI highway

And Meta is building toward what Zuckerberg calls “personal superintelligence.”

Which is either:

The future of productivity

Or the beginning of a sci-fi movie

Possibly both.

TL;DR

Meta just expanded a multi-year AI infrastructure deal with Nvidia.

Grace CPUs are being deployed at scale.

Vera CPUs are coming next.

Networking and confidential computing are expanding.

GB300 systems are going into Meta data centers.

$3M BET FROM THE CEO 💰

ServiceNow just did something Wall Street loves more than rate cuts and stock splits…

The execs said:

“Actually… never mind. We’re not selling.”

Yep.

ServiceNow $NOW ( ▲ 1.79% ) shares popped early Tuesday after multiple top dogs canceled their future stock sale plans.

And not just random VPs either.

We’re talking:

CEO William McDermott

CFO Gina Mastantuono

Chief People & AI Enablement Officer Jacqueline Canney

Special counsel Russell Elmer

That’s not a coincidence.

That’s a group chat decision.

Why this matters

When executives plan to sell shares, investors squint.

When they cancel those sales? Investors lean in.

Because insider selling can mean a million things:

Diversification

Tax planning

Buying a yacht shaped like a yacht

But insider buying?

That usually means one thing:

“I think this thing is going higher.”

And then the CEO doubled down

McDermott didn’t just cancel a sale.

He announced a plan to buy $3 million worth of stock at market prices on February 27.

Not options.

Not discounted shares.

Not “performance-based magic stock.”

Cold. Hard. Open-market buying.

That’s the equivalent of the head chef eating his own cooking in front of the restaurant.

The fine print (that actually matters)

The filing notes this purchase is happening at the earliest date allowed under Section 16 short-swing rules.

What are the rules?

Execs can’t buy and flip shares within six months without triggering regulatory headaches.

So this isn’t a quick trade.

It’s structured to avoid legal issues — which makes it feel more intentional, less tactical.

What the market hears

When multiple execs cancel planned sales + the CEO commits fresh capital?

The signal reads like: “We’re not cashing out.

We’re strapping in.”

And in a market obsessed with AI infrastructure, enterprise automation, and mission-critical software, that narrative matters.

ServiceNow isn’t some speculative meme rocket.

It’s the boring-but-powerful workflow engine behind huge enterprises.

Which is exactly the kind of stock where insider alignment matters more than hype.

The investing angle

Let’s be clear:

One insider buy does not equal guaranteed moon mission.

But clusters of executive behavior? That’s where things get interesting.

Institutional investors track insider transactions like hawks.

Because when leadership aligns incentives with shareholders, it reduces one key risk:

“Are they playing the same game as us?”

Right now, it looks like yes.

Markets run on earnings. But they move on confidence.

And nothing screams confidence like:

“I’m putting $3M of my own money into this.”

Especially after voluntarily canceling stock sale plans.

TL;DR

Multiple ServiceNow execs canceled planned stock sales

CEO William McDermott plans to buy $3M worth of shares

Purchase structured to avoid short-swing liability (so not a quick flip)

Insider alignment tends to be a bullish signal

Not a guarantee — but definitely a vote of confidence

When the captain buys more tickets for the cruise, passengers feel better about the route.

Here’s the link to today’s Daily Bull Run Premium+ stock analysis if you haven’t seen it in your inbox already today!

We take a look at whether Nvidia is still worth a spot in your portfolio or if a failing supply chain is going to hurt them long term!

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.