Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 2nd December 2024:

Bet Big on Tiny Tech 💾

Profit from Pesky Bugs 🐛

Fraud? Nah, Just Drama 🎭

Bet Big on Tiny Tech 💾

+5% today for the undisputed king of making tiny chips that power, well…. basically everything. From the iPhone in your pocket to the AI models ready to steal your job.

I’m talking about TSMC (Taiwan Semiconductor Manufacturing Company).

Let’s see why they’re up & if there’s a way we can make money from it.

My current position for TSMC

TSMC isn’t big. It’s huge. I’m talking, “ literally makes more than half the world’s chips” huge. It owns 56.4% of the semiconductor foundry market. With those kinds of stats, I think they fly under the radar & don’t get nearly enough love. But that’s great for investors that do show them a little TLC.

That’s why I want to share it with you.

The pop today looks like a accumulation of lots of positives. Apple have placed some big orders for TSMC’s M5 chips, analysts have been upgrading the stock & a generally positive outlook on semiconductors.

Having Apple as a loyal customer is a dream

And that’s exactly what’s keeping TSMC on top.

Apple & Nvidia are TSMC’s biggest customers. Nvidia alone handed them $7.73B last year. That accounts for more than 35% of its cost of goods sold.

How have the managed to land the worlds 2 biggest companies?

By being the best. That’s how.

TSMC is dominating the 3nm & 5nm game. That’s the tech that powers AI, smartphones, & anything else with a microchip brain.

The Q3 numbers? 🔥

TSMC’s Q3 2024 earnings are as solid as on old Nokia. Some of the highlights were:

Revenue: $23.5B, up 36% YoY.

Gross margin: A beefy 57.8% (because making tiny chips is actually big business).

HPC (hello, AI!): 51% of total revenue & climbing.

Smartphones: 34% of revenue, with a 16% QoQ bump

They’re also sitting on a $69B cash pile & reinvesting big into R&D to stay ahead of the game.

Latest earnings report for TSMC was a win, win, win

I can see the incentive to stay ahead if it means you get to keep your customers with a combined $6 Trillion market cap.

Is it too late? ⏰

One word. No!

It’s tough to find a top company trading like an underdog. That’s where I think TSM finds itself. Trading in the shadows of an AI golden child like Nvidia.

Over the past month they’ve been trading pretty flat so today’s boost could be the kick start they need.

Not even a 1% gain over the past month (that includes today’s jump). Still plenty left in the tank here in my opinion.

The average price target from analysts sits at around $230 which is 18% upside from current price. I’d agree with that sentiment. If they hit targets for the next 12 months I’d see a fair price right around $233.

But… risks?

No free lunches in investing. That includes TSMC, no matter how much you love them.

The biggest concern with these guys is China. Geopolitics are messy. TSMC is very tied to Taiwan, so rising tensions with China? Not great.

Relationships with Apple & Nvidia are a double edged sword. It’s great when it’s great but any hiccups between them & it could leave a serious dent in revenues. The news alone would tank the share price before it’s even had any real effects.

And if AI becomes old news then margins could get squeezed. Of all the risks, I think this would be of least concern for now.

The Plan 📓

TSMC is my 8th largest position. It makes up over 2.4% of the portfolio.

TSMC are my 8th largest holding in the portfolio right now

I think that’s about right, for now.

I’ll keep adding to my position with deposits & keep them around that sort of position size the whole time they’re below fair value.

Profit from Pesky Bugs 🐛

Natural Is planning to list on the Nasdaq

This is a paid advertisement for Med-X’s Regulation CF Offering. Please read the offering circular at https://invest.medx-rx.com

Natural solutions are already better for the environment. Med-X is taking it a step further: their natural pesticides outperform various chemical alternatives. Better yet, they’re taking on private investors as they plan their Nasdaq listing (ticker: MXRX). And you now have a limited time to invest before it happens. Med-X has had 200% revenue growth in five years. And with the pesticide market expected to grow 3X by the end of the decade, now is the perfect time to join them.

Fraud? Nah, Just Drama 🎭

Accounting scandals to a 28% stock jump in a single day.

You love to see it when you’re in positions ready for the news.

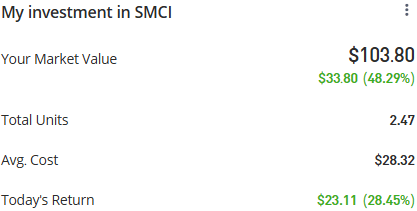

My current position in SMCI

I’ve mentioned SMCI once or twice in the past month because I think there’s huge potential for triple digit gains.

Let me show you my detective work 🔍

Previously, on “Super Micro”...

There’s been no shortage of drama with SMCI. Here’s a quick timeline of events to bring you up to speed.

August: Short-seller Hindenburg Research drops a report accusing SMCI of “accounting manipulation.” *Audience Gasps* It’s worth remembering these guys were holding short positions when they dropped these reports. The stock dropped over 24% in a day & made them millions.

October: Ernst & Young (their accountants) quit. It went from bad to worse. A report about dodgy accounting & then your accountants leave?! Not a good look. 😬

November: Then Nasdaq jumped on the bandwagon. I imagine the email in the inbox to management went something like “Hey, fix your stuff or we’re kicking you off the Nasdaq xoxox”

All this combined lead to a drop of over 70% from August highs.

Over a 72% price drop from August highs thanks to all the drama.

Fast Forward to Today…

And Super Micro dropped the receipts.

A 3 month investigation, 68 interviews across employees & board members & what did they find?

Nothing!

No fraud. No misconduct. Nothing to see here!

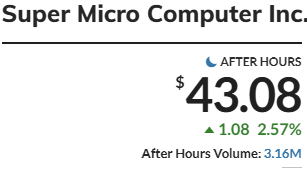

Cue the 28% jump today with a little victory lap sitting at +2.5% after market. 🏆

The momentum is keeping up in the after hours trading market

But Wait, There’s More…

We’re not quite out of the woods yet on this one. Yes, today’s report was a step in the right direction but there’s still more to come.

They’ve hired BDO to clean up the accounting mess. Will BDO cosign the “all-clear” or dig up more drama?

My guess would be it’ll be squeaky clean but you never know. And what about the Nasdaq delisting?

SMCI has a compliance plan in place, but it’s still a game of “will they or won’t they” with delisting.

Analysts at JPMorgan are keeping an “underweight rating” on them until we get some certainty on these points. My opinion is by the time we get the certified rubber stamp of approval it’ll be too late. Well, maybe not too late but how many days of 30% gains do I want to miss out on?!

My current open positions with SMCI

That’s why I’ve put a small (but over-sized) part of my portfolio here. Enough where the gains would be nice but if it runs to $0 it won’t have meaningful impact on my sleep or the portfolio.

The Bigger Picture 🖼

And believe it or not, behind all this drama, there’s a real business here. A really good one, too. Super Micro partners with Nvidia (NVDA) to make high-tech AI servers. The ones powering everything from language learning models to self-driving cars.

If you take out the scandals, their AI connection makes them a big player.

If you’re into risk, this stock looks like a steal. But if you’d rather not white-knuckle your portfolio, keep an eye on the compliance updates.

Either way, I’m here for the drama. 🍿

What did you think of today's update?

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️