In today’s post:

Bitcoin’s Forced Selling Trap 😨

This Is Why Uber Dropped 📉

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

BITCOIN’S FORCED SELLING TRAP 😨

Michael Burry is back!

And once again, he’s brought a flamethrower to a speculative party.

This time, the target is Bitcoin.

His warning?

A full-blown crypto death spiral — the kind that feeds on itself until everyone involved needs a stiff drink and a bankruptcy lawyer.

Bitcoin: hedge or hype machine?

Burry’s core take is simple but brutal:

Bitcoin isn’t acting like gold.

It’s acting like leverage with WiFi.

Instead of protecting against currency debasement (the whole “digital gold” pitch), Bitcoin has revealed itself as a purely speculative asset. One that rises on good vibes and falls on math.

If this sounds familiar, it’s because Burry’s been singing this tune since the days of dog-eared copies of Margin of Safety sitting on stressed-out desks (the book he wrote before disappearing for years is still floating around here for the curious)

And math doesn’t care about your laser-eye profile pic….

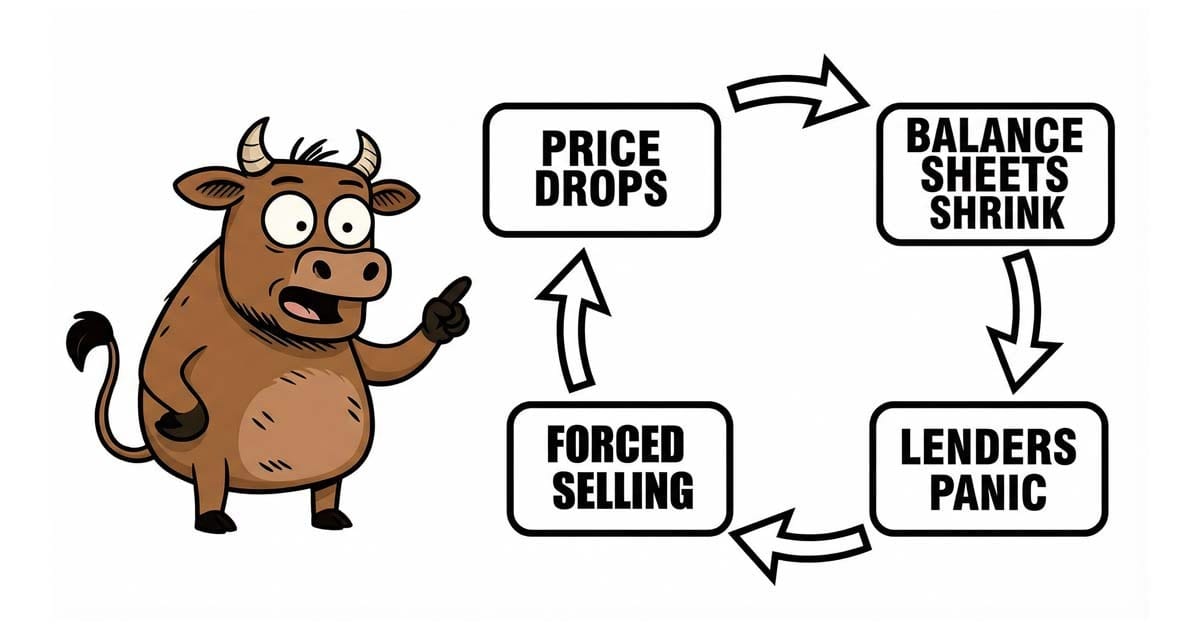

How the spiral starts

Here’s the ugly chain reaction Burry’s pointing at:

• Price drops

• Corporate balance sheets shrink

• Lenders panic

• Forced selling kicks in

• Price drops more

Repeat until morale improves (it won’t).

Burry says if Bitcoin falls another 10%, Strategy Inc. — the largest corporate holder — would be billions underwater and effectively locked out of capital markets.

No refinancing.

No fresh cash.

Just tears and margin calls.

Go lower than that?

Miners start tipping into bankruptcy.

No floor, no brakes

The most uncomfortable line in Burry’s warning:

There’s no organic use case forcing Bitcoin to stop falling.

Corporate treasuries?

ETFs?

Institutional adoption?

Nice narratives.

Not a price floor.

Markets don’t stop because the story sounds good.

They stop when selling stops.

And in a forced-selling loop… it doesn’t.

But what about the macro tailwinds?

Yes, the White House is crypto-friendly.

Yes, institutions are involved.

And yet…

Bitcoin is down ~40% from its early-October all-time high.

It just hit its lowest level since Trump’s re-election, sliding to ~$70,000.

Turns out “number go up forever” wasn’t a risk management strategy.

The real takeaway

This isn’t a “Bitcoin is dead” rant.

It’s a warning about structure.

When assets are:

• Widely leveraged

• Held on corporate balance sheets

• Priced on sentiment

• And financed with cheap money

Downturns don’t fade gracefully.

They cascade.

TL;DR

• Michael Burry says Bitcoin risks a self-reinforcing death spiral

• Falling prices could trigger forced selling by corporates and miners

• Another 10% drop could lock major holders out of capital markets

• ETFs and institutions don’t guarantee a price floor

• Bitcoin is down ~40% from its peak despite bullish narratives

1. De-Risk Crypto-Exposed Equities

Bitcoin volatility doesn’t stay in crypto. It leaks into balance sheets.

Companies holding BTC get hit twice: falling asset value + tighter funding.

📌 Action: Reduce or trim exposure to crypto-treasury stocks and miners after sharp BTC rallies. Re-enter only after BTC stabilises for multiple weeks.

2. Rotate Into “Real Cash Flow” Assets

When speculative assets wobble, markets quietly reprice certainty.

Burry’s warning highlights what survives stress: boring, profitable, liquid businesses.

📌 Action: Increase allocation to cash-generating sectors (utilities, consumer staples, healthcare) during crypto drawdowns. Let volatility elsewhere work in your favour.

3. Use Bitcoin Weakness as a Sentiment Signal

Bitcoin often moves before risk appetite resets elsewhere.

Sharp BTC drawdowns = risk coming off across growth, tech, and small caps.

📌 Action: When BTC breaks key levels, pause new risk-on buys. When forced selling exhausts and BTC stabilises, slowly redeploy into quality growth at better prices. Let other people panic first.

THIS IS WHY UBER DROPPED 📉

Uber’s stock tried to take a trip to the moon.

Then ran out of gas…

Shares of Uber Technologies opened strong after earnings… and then quietly gave it all back. Why? Because Wall Street heard two things at once:

• Double-digit growth

• Softer profits ahead

And when those two fight, margins usually win.

The vibe from management: confident, bordering on smug

CEO Dara Khosrowshahi sounded like a man who’s already picked out the champagne.

Uber, he said, kicked off 2026 with:

Momentum

Scale

Profits

And a “clear operating framework” (corporate for we know what we’re doing)

This thing is finally running like a real business.

The real flex: self-driving cars

Uber is still going hard on autonomous vehicles. And not in a “someday” way.

By end of this year, Uber expects AVs live in 15 cities, powered by partnerships with:

Waymo

NVIDIA

Waabi

Avride

Management claims AVs on Uber’s platform are:

Used more often

Faster to arrive

Straight-up better for customers

In other words: fewer humans, fewer excuses, more rides.

And because ridesharing is supply-led, more cars = faster rides = cheaper trips = more demand. It’s the Costco rotisserie chicken of transportation.

If you want the long-term mental model for how platforms quietly win while markets obsess over quarterly noise, this whole section reads like a case study straight out of The Psychology of Money, minus the metaphors.

So why did the stock flinch?

Because profits blinked first.

Uber’s forward adjusted EBITDA margin guidance came in… fine. Just not spicy.

Yes, margins are still expanding.

No, they’re not expanding as fast as before.

Wall Street saw: “+20 basis points year-over-year expansion”

And responded with: “Cool. We wanted more.”

The culprit: cheaper rides (on purpose)

Uber is leaning into affordability:

“Wait & Save”

Shared rides

More predictable pricing

Incoming CFO Balaji Krishnamurthy basically said: Lower prices now = stickier demand later

Which is true.

But it also means margins take a short-term punch to the jaw.

Insurance costs easing helps.

Scale helps.

AVs eventually help.

But investors hate the word eventually.

Strip out the noise and here’s the real story

Forget the margin hand-wringing for a second.

Uber is quietly hitting new all-time highs across its core platform:

More users

More trips

More reasons drivers and riders don’t leave

They’re digging a moat and filling it with water.

Uber isn’t trying to win the quarter.

It’s trying to own the map.

TL;DR

Uber stock dipped despite strong growth

Autonomous vehicles are coming fast (15 cities by year-end)

Margins are still expanding, just slower

Cheaper rides now = stronger demand later

Core business is hitting new highs

1. Buy the “Margin Fear” Dip

Uber sold off not because growth broke — but because margins paused. That’s classic short-term fear, not long-term damage.

📌 Action: Accumulate $UBER ( ▲ 1.75% ) on pullbacks when margin headlines hit. Scale in over multiple red days, not all at once.

2. Ride the Autonomous Tailwind (Without the Hype)

Autonomous vehicles aren’t priced into earnings yet — but capital is flowing there. Uber is positioning itself as the AV distribution layer.

📌 Action: Build a paired long-term position: $UBER ( ▲ 1.75% ) + $NVDA ( ▼ 1.33% ). Uber captures demand; Nvidia sells the picks and shovels.

3. Play the “Affordable Wins Recession” Theme

Cheaper rides, shared trips, predictable pricing — Uber is quietly leaning into value behavior, not luxury demand.

📌 Action: Tilt your portfolio toward consumer value platforms with pricing power (Uber-style models). Reduce exposure to premium discretionary names.

Here’s the link to today’s Daily Bull Run Premium+ stock analysis if you haven’t seen it in your inbox already today!

We revisited a stock we called out 6 days ago that jumped 18% TODAY before settling and why we think this is just the start of the gains!

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.