Stocks of the Week!

In this email:

Buy the Fraud Case!🚨

Undervalued Erection Unicorn 🦄

Buy the Fraud Case!🚨

Buy the fraud?! Am I luring you into insider trading? Is it some hot tips straight from the dark net?

Unfortunately, it’s neither of those things.

I’m talking about AstraZeneca. A surprise fraud investigation in China because of a few bad eggs has sent the stock spiraling. 📉

But I love news like this. Little bit of short term drama to scare off the paper hands so we can get a great stock at a better price.

Let’s get in to exactly what happened & why I think any draw down from this news is only a better reason to buy.

Finishing over 7% down on the day last week before consolidating

China Drama🍿

Some reps at AstraZeneca have been a bit naughty. Reports say a few of the senior execs in China have been busted selling fake prescriptions of their cancer wonder-drug, Tagrisso, to cheat the insurance system. Not a great look.

To make things worse, Tagrisso isn’t just any drug for AstraZeneca; it’s a heavy hitter. I’m talking 13% of the company’s total revenue in 2023. And they had China down as a high growth market so it might put a dampener on things.

The immediate impact?

Not pretty. Shares dropped over 7%. The biggest single-day drop of the year so far.

AstraZeneca have released a statement saying “we will fully cooperate with the Chinese authorities” to get thing’s investigated & resolved so it gives hope that this whole thing is the result of a few bad employees & isn’t going to derail their whole operation.

Because apart from this blip, AstraZeneca have been running up the numbers &….

The Numbers Don’t Lie 🔢

if you’re like me & you love a bit of value, you have to be paying attention to AstraZeneca after the recent price drop. Here’s what makes it interesting:

1/ Solid Earnings: AstraZeneca’s first half of 2024 was impressive. Revenue & core earnings per share (EPS) are growing. They’ve even turned the dial up on revenue outlook from “low double-digit” to “mid-teen” percentage growth. To go out of their way to bump revenue outlooks, they have to be pretty confident they can pull it off. It’s a good sign.

2/ Discounted Valuation: Thanks to the dip, AstraZeneca’s forward P/E is now sitting at 15.3x. That’s a decent discount compared to its five-year average of 18.45x. If we’re using forward PE, that means means it’s now trading about 20% cheaper than usual.

The fundamentals are strong, the stock’s taken a hit & the valuation is looking tempting. And from a technical view, we’ve bounced from a price that was giving support towards the end of last year before rallying between 9%-38%.

Price traded in this range towards the end of last year before moving up 38%

Roll the Dice Short Term 🎲

For me, this is a long(er) term play.

But even if you’re only interested in quick cash grabs, AstraZeneca could tick that box.

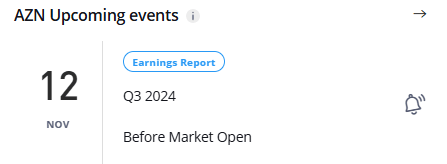

Q3 results (dropping on November 12) could make everyone quick to forget the fraud accusations in China. Analysts are expecting beefy numbers at 19% year-over-year increase in EPS & 13.9% revenue growth for the quarter.

Put the date in your calendar if you’re holding

If expectations are met or exceeded, I wouldn’t be surprised to see AstraZeneca start making it’s way back up & to the right.

The bad news?

If China’s investigation starts casting a shadow that looks like slower growth on future projections, AstraZeneca might have to revise its outlook. If that’s the case it could take all the wind out the sails in the short term.

China’s the Wild Card 🃏

It’s not just the fraud case to pay attention to in China, either. There’s lots of moving parts. Here’s why the Chinese market matters so much:

1/ Tagrisso’s Big Bet: Tagrisso was just approved for advanced lung cancer in China in June, so any hit to its rollout there could hurt future growth. Losing momentum on this drug alone would have a pretty big top line impact.

2/ More Skin in the Game: AstraZeneca’s put more on the table by acquiring Gracell Biotechnologies, a Chinese oncology company, earlier this year. Gracell is still pre-revenue but gives AstraZeneca a better foothold in the Chinese oncology market. Oncology currently makes up 37% of AZNs revenue so they know how to make money in the space. An open door to the Chinese market through this acquisition can only be a good thing.

3/ Weight Management Bet: AstraZeneca also has a licensing deal with Eccogene for a weight-management treatment, which is another hot growth area. Eli Lilly & Novo Nordisk are already raking in the cash in this space & AZN wants in.

Where Does That Leave Us? 🤔

I think on the surface AstraZeneca’s recent drop might look like trouble. But if you’re able to stay rational & stomach the uncertainty, the value is definitely there.

The fundamentals are strong, growth forecasts are up & the stock’s trading at a discount. There’s even a 2.26% dividend yield right now to sweeten the deal.

The biggest risk? The China investigation being dragged out & leaving a dent in their growth potential in that market. I think the risk of that actually happening is worth the potential upside right now…

I’ll make it a small part of my portfolio around 1%ish for now….

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Undervalued Erection Unicorn 🦄

Hair loss & erectile dysfunction.

Turns out, those are areas you can print cash. And because it’s not a very sexy area to be in, it looks like they’re being overlooked by investors.

I’m talking about Hims & Hers.

They’ve gone a little broader since their first range of products & just served up a massive Q3’24.

Latest earnings report for Hims was super impressive

1/ Q3 Revenue: Over $400 million, beating estimates by just under $19 million. That’s a big win.

2/ Subscriber Surge: 2 million subscribers, up 44% YoY. A lot of this growth has come from personalized services which has grown 175%.

3/ Big Q4 Potential: Guiding for up to 90% growth in Q4. Yes. You read it right. 90%. 🤯

So why isn’t everyone on Wall St filling their baskets with Him’s & Her’s shares?

My best guess is that they’re part of the 2 million subscribers & too busy in the mirror admiring their Tarzan-like hair growth.

HIMS is trading at under 3x 2025 sales & only 22x adjusted EBITDA. At this valuation with this insane growth, it’s like finding a Hermes Birkin Bag in the bargain bucket of your local charity shop.

And with $51 million in adjusted EBITDA this quarter, they’re not just scaling. They’re profitable, too.

I think their earnings report will do just a good a job as their ED pills for investors…

So how are they doing it?

The Secret Sauce: Retention & Personalisation 🍲

Hims isn’t just pulling in new users. They’re keeping them with personalised plans which companies in the wellness space struggle to do.

For context, 70% of HIMS’s GLP-1 weight-loss patients stick around after 12 weeks, compared to 30% retention with typical branded meds. Here’s why:

1/ Tailored Med Management: Plans are customised to the user's weight-loss goals, medical history, & lifestyle. Any time it feels like I’m getting special treatment & feel listened to, I immediately have more affinity to the brand. I can see why this works here.

2/ 24/7 Support: Message the care team anytime, anywhere.

3/ Digital Tracking: Monitor hydration, movement, sleep, and progress right in the app.

So what’s the plan?

HIMS just guided Q4 revenues up to $470 million & is forecasted to hit a 12% adjusted EBITDA margin. I always love it when a company puts their money where their mouth is & Hims are doing that, too. They’re using spare cash for share buy backs & picked up 1.9 million shares at $15.83 each last quarter.

Price is already a little higher since then but plenty of steam left if the growth keeps going the way it is. Another small position I’ll be adding to the portfolio at market open….

What did you think of today's update?

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️