Stocks of the Week!

In this email:

Car Stock Crushed Then Crashed?!🔥🚒

Discounts and Profits Collide! 💥📈

Car Stock Crushed Then Crashed?!🔥🚒

General Motors’s shares tanked 6% after they released their Q2 results.

The results must’ve been terrible, right? Wrong!

They crushed estimates. And the stock dropped another 2% the next day for good measure.

Even though GMs on crashing right now it might be a good thing for us

So why is the stock dropping so hard if they posted great results for Q2? 🤔

It’s mainly because of an unexpected loss in their China business. But is it something we really need to worry about? Has it just given us a great discount on a company that’s already performing?

Let’s figure it out. 👇

The highlights of the earnings were:

Adjusted EPS: $3.06 per share (beat expectations by $0.36)

Revenue: $47.97 billion (higher than the forecasted $45.32 billion)

Adjusted EBIT: $4.4 billion (a 37% year-over-year increase)

The strongest performance come from its Internal Combustion Engine (ICE) division. 🚗💨 AKA regular cars.

EVs are what the cool kids are flexing on insta with but it’s GM’s pick-up trucks and SUVs where the money is right now. 🛻🔥

Now this is where we lose the sunshine & rainbows for a second🌧️

The China business took a hit & reported a $104 million loss.😬The EV market is super competitive in China. You’ve got BYD, Nio, SAIC to name a few. As you’d expect, GM’s joint venture struggled over there.

But GM has a plan! They’re restructuring to cut costs & better align with the market. Strong performance in other areas gives me confidence the operators know what they’re doing.

EV production is being cut back for the year which isn’t as bad as it sounds. They’re still expecting to turn a profit even at the lower production levels.

For context on what an overreaction I think the whole EV losses are, in Q2, they delivered nearly 22,000 electric vehicles, which is just 3.2% of their total deliveries. So, the ICE division remains their bread and butter for now.

I think the loss in China will be a bump in the road rather than a drive off a cliff.

The loss in China’s EV market is jump a bump in the road & nothing to be too concerned with yet, in my opinion.

And I’m not the only one who’s confident about it.

In fact, GM themselves are feeling so confident in their future that they’ve raised their forecast for 2024.

They’ve now penciled themselves in for $13-15 billion in adjusted EBIT (up by $0.5billion) & free cash flow around $9.5-11.5 billion (up by $1billion).

Companies don’t raise expectations for nothing. They’ll usually want to find themselves in the “under promise & over delivery” category rather than the other way around so that makes me feel even better about buying the stock.

Turns out GM are also wanting to buy their own stock too!

They’ve got a $6 billion stock buyback plan in place. That’s about 11.6% of the company’s outstanding shares & I love it when a back themselves this hard.

Here’s the facts of the matter: GM is trading at a super low 4.4x forward P/E ratio. For comparison, it’s historical average has been close to 9x. Similar companies like Ford is current trading at 5.7x.

(By the way I think Ford is also a solid buy right now. I don’t want to bore you with analysis on every single car company so here’s a post I wrote about Ford in June if you’re interested. I made 20%. It’s currently now trading at an even lower price than when I first thought it was a bargain…. anyway, back to GM)

35% gains to be had if we value GM the same as Ford. 50% gains to be had at previous highs.

GM’s strong performance & buyback potential make it a no-brainer value play in my book. If GM were to be valued similarly to Ford, we’d be looking at a price closer to $60 which is 35% upside from now. Old highs make it closer to 50% gains.

I guess what I’m saying is - there’s a lot room for growth! 📈🚀

So it sounds like a pretty sure bet but what are the risks?

The biggest risk is their biggest strength.

Reliance on ICE vehicles is a double-edged sword. It’s an advantage now but could be a risk if EV adoption suddenly skyrockets. And there’s always the risk of the broader economy. Recession means no one buying fancy new pick ups.

I think those are risks I’m willing to take as I build this portfolio to $100,000.

Strong demand for their trucks and SUVs, raised financial outlook, stock buyback plan. And 8% discount from the market over reacting?!

Yeah. Take my money

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%.

Are they undervalued?

Can they recover?

Read Value Investor Daily to find out.

We read hundreds of value stock ideas daily and send you the best.

Discounts and Profits Collide! 💥📈

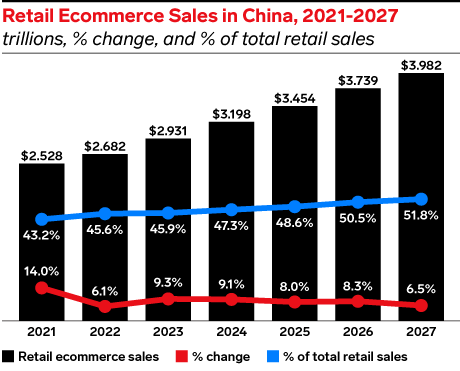

China's e-Commerce market is booming.

It makes sense. With a population of 1.4 billion, there's not exactly a shortage of potential customers.

And if there’s an e-commerce cash wave to ride, I’m gonna use PDD as the surfboard.

So who are PDD? And why are they my surfboard of choice?

PDD (full name Pinduoduo) is an e-commerce platform in China, sharing the stage with giants like Alibaba & Jd.com.

They’re the masterminds behind Temu who’ve built a loyal fan base of millions by selling everything you can think of at irresistible discounts.

Even though they sell everything at a bargain, the pennies are adding up.

Q1 raked in 86.8 billion Chinese Yuan ($12.0B) in revenue.

That 131% more than the same quarter last year.

Online marketing services alone brought in 42.5 billion Chinese Yuan ($5.9B), a 56% year-over-year increase.

Transaction-related revenue hit 44.4 billion Chinese Yuan ($6.1B), rocketing 327% year-over-year.

Yes. 327%. 🤯

Even with all these huge growth numbers, PDD is what they sell - a great bargain at a great price.

P/E ratio is trading over 25% below it’s long term average

People smarter than me have been saying PDD could easily trade at a P/E ratio of 10X, which make it fair value at around $150 (about 15% upside).

But with their strong growth momentum, a P/E of 12-13X is not unreasonable.

That’d put the value closer to $180-195 which is around 50% upside.🚀

And if the growth wasn’t already impressive enough, they’re still trying to kick it up a gear.

PDD generates quite a good chunk of free cash flow (money left over after it pays all its bills & buys what it needs to run the business)

Rather than sitting on the cash they’re pumping it into AI & innovation.

AI is being used to improve shopping experiences with tailored recommendations and personalized feeds.

Better shopping experience = better conversions = even more revenue at an efficient cost 🛒✨

Another thing free cash flow is good for is *drumroll* 🥁…

….Stock buy backs! 🎉

PDD aren’t heavily into stock buybacks like Alibaba just yet but they’ve got the potential to do it. With a low P/E ratio, buybacks are always on the table as a strategic move to boost shareholder value. 📊

I think the biggest threat to success right now is the broader Chinese economy. Sluggish growth and consumer spending could impact e-Commerce sales. That said. PDDs aggressive AI-driven strategies should help offset some of these risks by boosting customer engagement & sales.

To just label PDD as a discount e-commerce platform is doing it a huge disservice.

They’re a growth powerhouse 🚀🌕

Strong top line, positive profit momentum, and a focus on returning value to shareholders, 🚀💸

I’m hoping that powerhouse growth starts happening to the money I’m going to invest with them 🤑

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️