Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 24th September 2024:

China Pushed The Button! 🟢

Debit Card Mafia 🔫

China Pushed The Button! 🟢

What can I say. Sometimes China & it’s banking system just pulls through for you.

They decided to hit the big green button that says “Boost the Economy”.

Take a look at all this green today….

Chinese stocks putting up numbers today.

I’ve been a fan of Chinese stocks for a while now, especially with valuations so low. I actually get some backlash every time I advocate for them.

And I get why people can are scared. The Chinese Communist Party can be unpredictable, there’s worries the Chinese economy is running out of steam….

But scared money don’t make money, son. Or to quote Warren Buffett…

Of course there’s caveats to that. You can’t just buy junk because everyone else isn’t buying chunk & call yourself a genius.

So what happened today? Why are all Chinese stops growing like crazy?

China’s central bank made two big plays.

First up, they injected $140 billion of liquidity into the market overnight. That’s a sure way to stimulate the economy & get the cash flowing.

But how did they just magic up $140 billion?

Well, they cut their reserve requirement ratio by 0.5%.

Ok, great…. so what does that mean?

The Reserve Requirement Ratio (RRR) is a rule that tells banks how much money they have to keep in reserve, or "set aside," from the deposits they get. This money can’t be loaned out to customers. It's a safety net to make sure the bank has enough cash in case a lot of people want to withdraw their money at the same time.

So if the RRR is 10%, & a bank has $100 in deposits, it has to keep $10 in reserve & can lend out the other $90. When the government lowers the RRR, like China did, banks are allowed to keep less in reserve & lend out more money. This makes it easier for businesses & people to borrow money, which helps boost the economy.

Second thing was they cut interest rates too. So not only is there more money available, it’s cheaper to use too.

If you had loads of money that didn’t cost very much to have what would you do with it? Probably spend it, right?

That’s what China’s hoping for. 🤞

The theory is that should stimulate consumer spend in China. That’s great for all business in China, especially e-commerce giants like JD.com, Alibaba & PDD. (Click on them to read my analysis)

Global brands that see a lot of spend from China are also in the green & set to benefit from this move by the People’s Bank of China. That includes LVMH who I shouted out on Sunday & up 3.3% today…

Global brands that see spend from China will be set to benefit from the rate cut too

How Can I Make Money from this? 🤔

There’s a few options.

You could invest in a China-based ETF which will give you broad exposure to the market. This is the “safest” option because it’ll iron out any volatility you might get from individual stocks, especially in an emerging market.

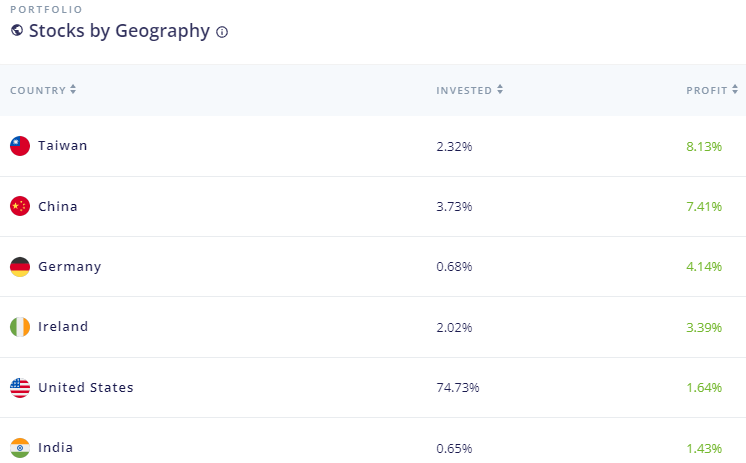

For transparency, here’s all the Chinese stocks I’m invested in with how much they make up of my portfolio. The only one missing is PDD because it’s listed on a US exchange. It makes up just over 2% of my portfolio.

My current holding’s in Chinese stocks

I still think there’s room to grow here. You haven’t missed the boat by missing today’s spike. In fact, I wouldn’t be surprised to see a pull back over the rest of the week as the hype dies down.

As long as you’re aware that it’s not without risk & size your positions accordingly, I think it’d be silly to not have at least some exposure to China right now.

My most profitable geographies I currently hold

China currently makes up just over 5% of my invested portfolio (if you include PDD on the US exchange). It’s also one of my most profitable region’s I’m currently invested… I’ll definitely be putting my hand in my pocket & upping that exposure.

Navigate the Stock Market with these Free Daily Trade Alerts

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Debit Card Mafia 🔫

That’s what happens when you bully the little guys. Your stock tanks nearly 5.5% on the day.

That’s where VISA found themselves today.

Big drop for VISA today

The Department of Justice (DOJ) is accusing Visa of monopolising the debit card market. That means they think VISA is rigging the game in their favour so nobody else stands a chance. Ethical? Not exactly. But if I could only invest in monopolies I would.

So how has this all come about?

It’s how Visa have been handling their debit card transactions.

When you swipe a debit card, there’s different networks that process the payment. The DOJ is saying Visa makes it hard for merchants to use cheaper alternatives. That forces them to use Visa’s network & pay higher fees.

It raises the question of whether Visa is competing fairly with other payment networks & ripping off merchants.

What’s Next for Visa?🚨

If they’re found guilty, it’ll likely be a fine. They’re no stranger to this. In fact, they’ve had to pay fines for similar accusations in 2019 in the EU, 2016 in Australia & 2012 in the US.

As bad as it sounds, I think the drops on the back of these accusations & fines makes a great buying opportunity for the long term. Gives me a bit of a discount.

I mean, take a look at this chart of Visa going back to 2015. Does it look like a slap on the wrist has slowed them down?

Up & to the right is my favourite kind of stock to buy

Now, there could be some cause for concern if there’s major changes to the way they do business. The DOJ could force Visa to change their practices, which might make them lose some business to cheaper networks.

Not ideal but I don’t think it changes the bigger picture.

Open your wallet. I’m pretty sure you’ll see that little Visa logo on the bottom right of your bank cards. Visa runs over 60% of debit transactions on their network & collects more than $7billion in fees each year from it.

I don’t see that changing any time soon, guilty or not.

I’m buying the dip.

What did you think of today's update?

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️