In today’s post:

Energy Cash Cow You Missed⚡🐮

Your Brain Will Thank You 🧠

Buffett’s Last Big Gift 🎁

Shark Tanks Backing This 🦈

ENERGY CASH COW YOU MISSED⚡🐮

Let’s talk about ET. Not the one with the finger. I mean Energy Transfer $ET ( ▼ 0.11% ). It’s not the sexiest stock on Wall Street. It doesn’t have a chatbot. It’s not building rocket ships. And it definitely isn’t trying to reinvent your toaster.

The New King of energy

Let me tell you what it is doing…

Moving literal mountains of natural gas, crude oil, and refined products through one of the largest pipeline networks in America... and paying fat distributions while doing it.

ET: From Gas Jockey to Energy King

Energy Transfer has transformed into a midstream juggernaut. Their pipeline empire stretches across the U.S., touching almost every major oil and gas basin.

Here’s the highlight reel:

Intrastate Natural Gas (Texas Edition): 6,900 miles of pipe. 12 Bcf/day of throughput. $3.43B in revenue.

Interstate Natural Gas: Connects the Permian and Rockies to the Midwest and California. $2.3B in revenue.

Midstream Ops: Gathering, processing, and treating natural gas in all the big basins. $12B in revenue.

NGLs + Refined Products: Handles over 1 million barrels/day of NGLs. $27.1B in sales.

Crude Oil: 50 million barrels of storage and 5 million barrels/day of crude capacity. $27.1B in sales.

ET are running to the bank with all the cash they’re printing

Oh and did I mention they own a stake in Sunoco and USA Compression Partners? Gas stations, compressors, and everything in between. It’s like the Costco of energy infrastructure.

Growth Story? Still Going Strong

Even after its stock doubled since 2021, ET isn’t slowing down. The company just doubled its 2025 growth CapEx to $5 billion. Why?

Data centers are thirsty for power, and ET is ready to serve them.

NGL exports are booming. ET’s terminals are ready to ride the wave.

The Lake Charles LNG project could be a jackpot once approved.

The building phase came with debt and exposure to energy prices. That risk now looks like a feature, not a bug. Over 90% of their revenue is fee-based, but they still retain upside when commodity spreads go wild.

Powering AI brains is going to be a money maker for ET and all energy providers in the future

The Money Printer Setup

Here’s some juicy metrics:

Free Cash Flow (FCF): Swung from -$6B to +$6B. Now spitting out a 9.9% FCF yield.

Valuation: P/E and EV/EBITDA are above average, but so is the growth. This ain’t a bargain-bin stock, but it’s priced like a midstream king.

EBITDA Growth: 10.6% over 3 years. Forecasting 14.95% growth in 2025.

Distributions: 7.24% yield. 14 consecutive quarters of hikes. 3-year CAGR? 23.95%.

Margins are lower than peers, but ET shines during chaotic times. When the Texas freeze hit in 2021? They made bank. When other companies cut spending, ET doubled down. And it’s paying off.

The Bad Stuff (Because No Empire Is Perfect)

Commodity Exposure: If oil and gas production tanks, ET feels it. even with its fee-based model.

Old Pipelines: Maintenance ain’t optional. One leak or outage could mean fines, lawsuits, or worse.

Green Energy Transition: If solar and wind start eating gas’s lunch, ET could face declining volumes and asset write-downs.

The volatility that naturally comes with commodities means you have to go in with eyes wide open

Where Does That Leave Us?

Energy Transfer is boring in the best way. It’s a cash-generating machine with infrastructure that’s nearly impossible to replace, and a management team that finally learned how to say “no” to reckless spending.

With growing demand from AI-driven data centers, solid distribution growth, and long-term projects like LNG on deck, ET looks like a strong buy for anyone who wants exposure to energy without betting it all on black oil prices.

Wall streets average price target gives over a 27% gain from current price so the upside is worth a small part of the portfolio.

Average price target of $22.70 on Wall Street

TL;DR

ET runs one of the biggest pipeline networks in America.

Business is booming thanks to NGL demand and data center growth.

FCF flipped from deep red to juicy green. Now yields over 7%.

Risks? Commodities, aging assets, and the clean energy push.

Still, ET looks like a buy for income investors with patience.

YOUR BRAIN WILL THANK YOU 🧠

Unbiased Business Insights, Every Week

Get a weekly knowledge digest of business insights from 1440’s Business & Finance newsletter. Expect concise rundowns, context-rich visuals, and curated links to keep you ahead of the finance curve. Join 1440 for crisp explanations of business trends —no MBA required.

BUFFETT’S LAST BIG GIFT 🎁

It’s no secret Buffett’s packing it in soon. And yeah, the stock dipped. Wall Street freaked out a little. But guess what didn’t change? Berkshire Hathaway still prints money, sits on a mountain of cash, and eats economic uncertainty for breakfast.

Wizard Warren is about to hand the reigns to someone new

Let’s get into it.

Berkshire’s Quarter: Not Flashy, Just Filthy Rich

Q1 revenue hit $89.7B. Not a massive jump, but nothing to cry over. Net operating earnings dropped 14%. Sounds scary on the surface but that’s mostly from one-off events like wildfire insurance payouts in California.

Meanwhile:

Railroad earnings chugged along with 6% growth.

Berkshire Energy lit up with a 50%+ jump in profit.

Insurance investments quietly grew from $2.6B to $2.9B.

They also hold $347B in cash and short-term securities. That’s more dry powder than your average central bank. And they’re not the type to YOLO it into crypto. (ehem $GME ( ▲ 0.55% ), $MSTR ( ▲ 0.73% ) 👀) They pick long-term winners and hold them longer than an old man holds grudges.

$347 BILLION in cash is no joke

Buffett Leaves… But Abel’s Already at the Wheel

This is what’s got a lot of people sweating. But let’s remember, Greg Abel isn’t just some new guy getting thrown into the fire.

He’s been in the mix since ‘99, sat on the board since 2018, and has been shadowing Buffett like an investment apprentice in an old kung fu movie.

The succession plan’s been years in the making. No chaos. No panic. Just quiet, boring, brilliant continuity.

The Macro Setup Screams “Safe Haven”

Rates are high. The Fed’s still in hawk mode. No cuts yet. Uncertainty is sky-high.

Meanwhile:

Gold is spiking (AKA investors are spooked).

Trump is warming up for another round of tariff tennis.

And $BRK.B ( ▲ 0.09% ) RSI is around 38ish… which is technical analysis for this thing is oversold and ready to bounce.

RSI is sitting right around 38ish and price has started to find a base

Valuation Check: Still Juicy

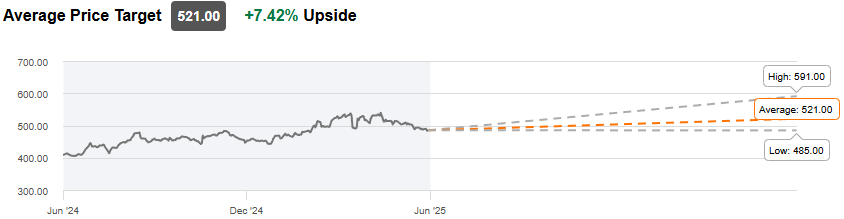

Berkshire is chilling in the $1T club. Its valuation multiples are close to historical averages That’s is wild considering the quality and scale they bring. Wall Street thinks it’s undervalued by ~7.5%, with an average price target of $521.

Everyone on Wall Street agrees that price goes up from here… but by how much?

The company isn’t just surviving. It’s thriving in slow motion. And that’s the whole point. It’s not sexy. It’s just stupidly reliable.

But Here’s What Could Ruin the Party

Growth stocks are back in fashion. That could steal some spotlight.

Buffett’s retirement, plus seasonal weakness (May and June usually suck for Berkshire), might keep the stock sleepy in the short term.

And if rate cuts actually do show up, investors might pile into riskier bets.

But long-term? The thought process is still air-tight.

TL;DR

Buffett’s stepping down, but the empire is built to last.

Greg Abel’s ready. He’s not new to this. He’s true to this.

$347B in cash. Oversold on the charts. Still a fortress.

Market is volatile, and Berkshire is the adult in the room.

It’s a Strong Buy. No cape, no hype. Just performance

Final Chance to Own a Piece of Virtuix

Virtuix is redefining the future of immersive entertainment — and time is running out to join in. Its flagship “Omni” treadmill lets users physically walk and run in 360 degrees through virtual worlds, with real-world applications across gaming, fitness, and military training.

✅ $18M+ in product sales

✅ 400K+ registered players

✅ 4X revenue growth in the last fiscal year

✅ Backed by $40M+ from top investors, including Shark Tank’s Kevin O’Leary

With over $2.7M raised in this round, investor demand is accelerating — but the raise closes June 20.

This is your final chance to back one of the most exciting players in the VR space.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.