In today’s post:

Gold vs Bitcoin: Who Wins? 😤

Is This the Next 2008?! 😨

Daily Bull Run Premium+ Analysis

WHY I USE TRADING VIEW 📈

I don’t sit glued to charts all day. I’ve got a life. That’s why I use TradingView.

I use TradingView because alerts do the heavy lifting for me. Price hits my level? Ding. RSI crosses? Ding. That’s how I’m able to put this newsletter together for you every day.

The charts are clean, customisable, and packed with every tool I need. Fibonacci retracements, moving averages, weird indicators with names that sound like Pokémon… it’s all there.

And you can backtest strategies without burning cash. Instead of “hoping” an idea works, I test it against years of data. Saves me money, saves me headaches and I can share it with you.

If you’re still using your broker’s prehistoric charts, I’ve got good news. TradingView is giving everyone who uses this link $15 off.

Or click this link here - https://www.tradingview.com/?aff_id=155813

GOLD VS BITCOIN: WHO WINS? 😤

Gold just hit an all-time high this week. The shiny rock is… shining… in 2025. What’s fueling the rally? Rate cut expectations, central banks gobbling it up, Fed drama, and a world that feels like one giant geopolitical food fight.

But while gold was busy polishing its medal, Bitcoin was chilling above $110K. According to Deutsche Bank, institutions are adopting it, and the crypto is inching closer to safe haven status. In their words, it’s looking more like “digital gold.”

So the question is simple. Which one is king of the safe havens?

The Case for Gold

Central banks can’t get enough of it

It thrives when people freak out about inflation, wars, or government screw-ups

It’s the OG safe haven, and right now demand is through the roof

The Case for Bitcoin

Market cap hit $2.3T this year

Touched $123.5K back in August

Expected to hit $120K again by year-end

Capped supply of 21M makes it disinflationary

Easy to move compared to literal tons of gold

And here’s the thing. In March, the US set up a Strategic Bitcoin Reserve. That’s the government officially saying “Yep, we’re hodling now.”

Deutsche Bank’s Marion Laboure thinks gold and Bitcoin can both coexist on central bank balance sheets by 2030. Gold keeps its lead in official reserves while Bitcoin grows in private and alternative reserves. Volatility should ease over time, but don’t expect either asset to replace the US dollar as the primary reserve anytime soon.

The Big Picture

2025 is shaping up as a monster year for both assets. A weak dollar, rising geopolitical risks, and questions about the Fed have made both gold and Bitcoin the main event. Gold shines in official circles, Bitcoin is the rebel growing fast, and the dollar looks like it’s sitting in the corner with an ice pack.

TL;DR:

Gold just hit an all-time high and Bitcoin is steady above $110K.

Central banks are hoarding gold while institutions are adopting Bitcoin. The US even created a Strategic Bitcoin Reserve this year.

Deutsche Bank says both can coexist as safe havens, with gold staying dominant in reserves and Bitcoin gaining ground in private holdings.

Neither will dethrone the dollar yet, but both are eating into its shine.

1. Ride Gold’s Momentum

Gold just hit an all-time high thanks to rate cut bets, central bank buying, and geopolitical drama. Demand isn’t slowing.

📌 Action: Add exposure through $GLD ( ▼ 1.39% ) or physical gold ETFs like $IAU ( ▼ 1.39% ). Hold as a core safe haven play while uncertainty stays hot.

2. Lean Into Bitcoin’s Institutional Wave

Bitcoin is steady above $110K with a $2.3T market cap. Institutional adoption and the US Strategic Bitcoin Reserve strengthen its “digital gold” case.

📌 Action: Dollar-cost average into BTC directly or use $BITO ( ▼ 0.11% ) for ETF exposure. Target long-term growth as adoption widens.

3. Hedge with Dual Safe Havens

Deutsche Bank sees both gold and BTC coexisting on central bank balance sheets by 2030. In 2025, both are outpacing the dollar.

📌 Action: Build a 60/40 split between gold ETFs and Bitcoin ETFs in a separate “safe haven” sleeve of your portfolio. Rebalance quarterly to ride both uptrends.

IS THIS THE NEXT 2008?! 😨

Jerome Powell grabbed the mic this week and basically told us the US economy is stuck in a “choose your own disaster” book.

On one page you’ve got inflation risks tilting up. On the other page you’ve got jobs tilting down. Pick one and cry.

He summed it up with a banger line: “There is no risk free path.”

Well said, Jerome. No matter what the Fed does, someone is going to get smoked.

The Rate Cut Diet

The Fed trimmed its policy rate by 0.25% to 4.00%-4.25%. It’s the first cut this year. Powell called it “still modestly restrictive.”

It’s basically the econ version of diet pain. Just enough to make you sweat without passing out.

Jobs are Slipping

Powell admitted job creation is running below the breakeven level needed to keep unemployment steady. The once “solid” labor market is looking more like a wobbly folding chair.

Other job indicators are holding up, but he’s no longer pretending everything is fine.

Tariffs Enter the Chat

Powell also flagged tariffs as a stealth inflation booster. Retailers and importers are eating the costs now, but the full punch is coming next year.

Think of it like delayed stomach pain after questionable gas station sushi. You’re good for a while, then boom.

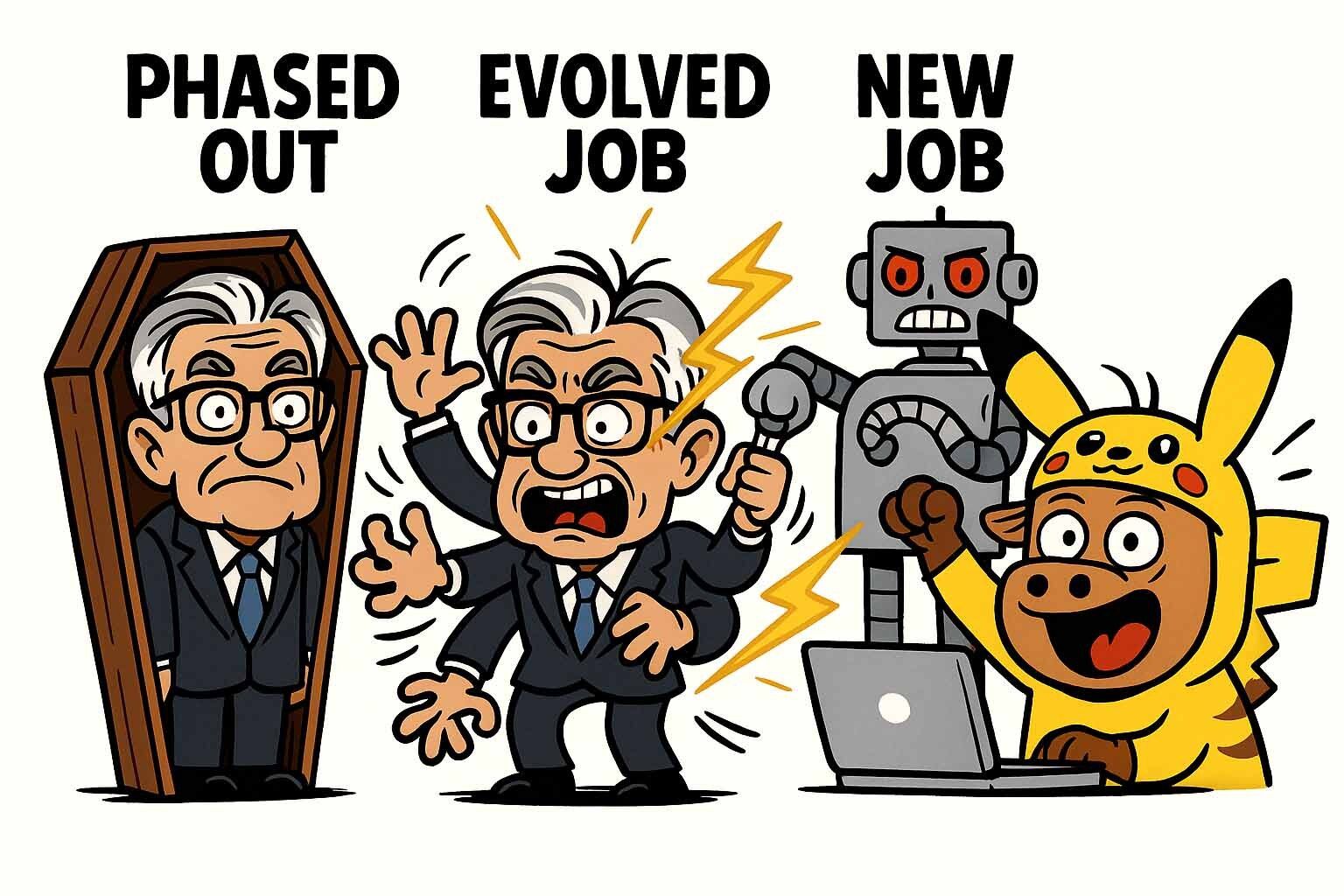

AI: Pokémon but With Jobs

On technology, Powell said AI is too early to call but expects some jobs will vanish, some will evolve, and new ones will spawn.

It’s basically Pokémon but with unemployment.

The Balancing Act

Bottom line: the Fed is trying to juggle inflation and jobs while tariffs and AI chaos swirl in the background. Move too fast and inflation sticks around. Move too slow and jobs disappear.

It’s less “win win” and more “choose which bruise hurts less.”

TL;DR

Inflation risks are rising, jobs are weakening

Fed cut rates 0.25% to 4.00%-4.25%

Labor market not “solid” anymore

Tariffs could make inflation worse next year

AI will shuffle the job deck like Pokémon evolutions

1. Position for Rate Cut Tailwinds

The Fed trimmed rates to 4.00%–4.25% and signaled more “flexibility.” That supports interest-sensitive sectors like real estate and utilities.

📌 Action: Accumulate REIT ETFs like $VNQ ( ▲ 0.25% ) or utility ETFs like $XLU ( ▲ 1.11% ) to ride rate cut momentum.

2. Hedge Against Tariff Inflation

Powell flagged tariffs as delayed inflation fuel. Retailers and importers eat costs now, but consumers feel it later.

📌 Action: Add inflation-resilient exposure with Treasury Inflation-Protected Securities $TIP ( ▲ 0.02% ) or commodity ETFs like $DBC ( ▼ 0.12% ).

3. Lean Into AI Job Shuffle

Powell admitted AI will phase out jobs, evolve others, and spawn new ones. Long-term tech adoption tailwind remains strong.

📌 Action: Dollar-cost average into AI-heavy ETFs like $BOTZ ( ▲ 1.12% ) or $QCLN ( ▲ 2.24% ) to capture secular growth.

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.