Stocks of the Week!

In this email:

Is This My Safest Bet Yet?! 🍫

Profit From Commodities 🛢

62 Years Strong & Still Going 📈

Is This My Safest Bet Yet?! 🍫

Who doesn’t love a choccy snack? I’m eating my advent calendar chocolate every day so maybe it’s inspired me to find a stock that’d benefit from it. Maybe it’s a coincidence.

In any case, Nestle is lining up for a "“Buy” in my portfolio.

They’re the Swiss guy’s behind things like KitKats, Nescafé, & Purina pet food. Basically, they’re in your snack basket, your dog bowl & they should be in your stock portfolio!

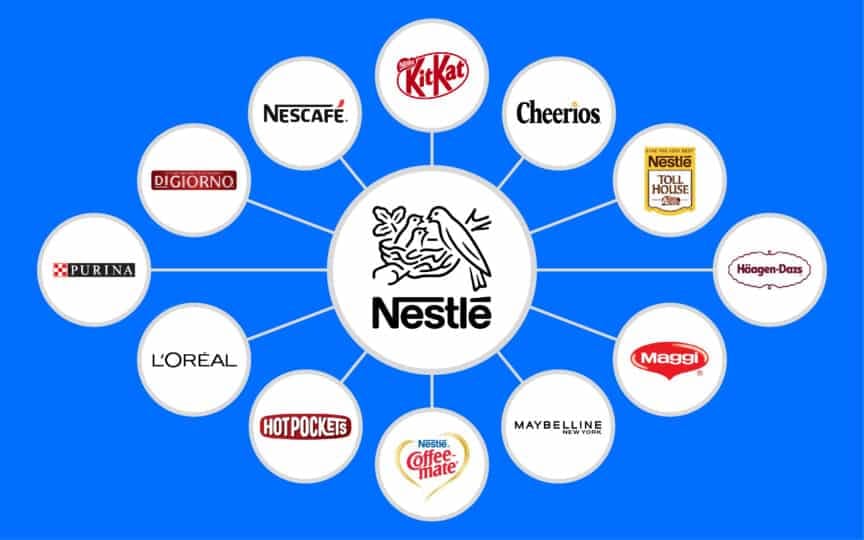

A tiny sample of some of the brands under the Nestle umbrella

The Tea on Nestlé 🍵🫖

Nestlé is a consumer staple kingpin. They make stuff people buy no matter what. Coffee, chocolate, baby formula, pet food. (I’m including that because I like to think even in a recession people are feeding their pets….) And if you’re safety first when investing, they’re globally diversified & have cash cows across a brands like:

Coffee (Nespresso, Nescafé)

PetCare (Purina🐕)

Confectionary (KitKat, Aero, Milkybar, Smarties 🍫)

I couldn’t list all the brands. We’d be here all day. It’s over 2,000 brands across 186 countries. If you want a finger cramp from scrolling, here’s a list of all the brands they own.

They’ve had a rough 12 months but does that mean it’s time to buy?

Even with all that brand power, they’ve been on a skid the last 12 months. But why?

Well, there’s a few reasons.

First up is that word that’s been thrown around a lot lately. Inflation. Higher ingredient prices & logistics costs = tighter margins.

If you pass those costs onto consumers to save margins it can hurt revenue. Just because you’re selling “necessities” doesn’t mean people can’t opt for own brand alternatives.And being being based out of Switzerland means the strong Swiss Franc hurts global sales. How does that work?

Because foreign earnings lose value when converted to CHF & Swiss-made goods become more expensive for international buyers.

The dollar has been falling against the Swiss Franc for a few years now

With all this going against them, I think now is the perfect time to buy. Crazy, right? But this isn’t their first rodeo.

Why I’m Buying 💰

One word. Value.

If there’s one way to stay safe in this wild west world of investing, it’s look for the value. Not the hype. Not the big green bars on meme coins. It’s “how much bang do I get for my buck?”.

Right now, Nestle is trading at a PE ratio of 17.7x. It historically averages somewhere around 21x-ish. That means we’re paying a decent multiple less for a dollar earned in a company that’s stood the test of time with 344 factories, 2,000+ brands in 186 countries. Nestle could probably team up with Elon & deliver Kitkats to the moon if they wanted to!

PE ratio has been on the way down are hovering in the low 20s for most of the last year

Add in a near 4% dividend that’s been raised the past 25+ years & analysts projecting annual returns between 12-20% once they catch their stride again & I’ve heard enough. Take my money.

Before I hand it all over, let me play devil’s advocate for a second….

The Risks 🚨

Time for the balanced view. Where could it all go wrong here?

Well, there’s no denying things are definitely slower for Nestle right now. They’ve cut organic growth guidance for 2024 from 4-5% to just 2%. That’s a pretty significant drop.

And that comes with warnings that EPS might stay flat or even take a slight drop this year.

All this is baked into what I’ve already spoken about so a “buy” in Nestle is taking a bet that consumers will come back to the brands they know & love. It’s not a meme stock, it’s not a "too the moon” play. It’s more like an ETF for food stocks. I think it’s worth it.

If you’re big on ESG investing you might want to take a closer look at Nestle. I know they’ve been caught up in a few controversies but have a few initiatives like the Nestle Cocoa Plan to make sure everything’s above board.

Profit From Commodities 🛢

Are oil & gas royalties right for you?

Klondike Royalties invites you to own a stake in the North Block of Alaska's Kitchen Lights Unit, with an estimated 300 million barrels of recoverable reserves. Our royalty-based model offers potential for steady returns without the complexities of direct asset ownership.

62 Years Strong & Still Going 📈

From sugary snacks to the OG of healthcare stocks. I do it all here!

I’m talking about Johnson & Johnson. Another pretty safe bet.

These kinds of companies make me feel like I’m taking my money & tucking it under a nice, cosy quilt with a hot chocolate by the fire. Safe, consistent & quietly paying dividends.

That said, the stocks been under a little pressure lately. Market drama, what’s new? But when the markets noisy, just take a look at the fundamentals.

Dividend Royalty👑

I swear I’m not turning into a dividend investor. They just happen to be coming with stocks that are undervalued so it’s a win-win.

Anyway, when it comes to dividends, JNJ is that guy. 62 straight years of dividends increases. Yes, you read that right. They’ve been increasing dividends for nearly twice as long as I’ve been alive. 😅

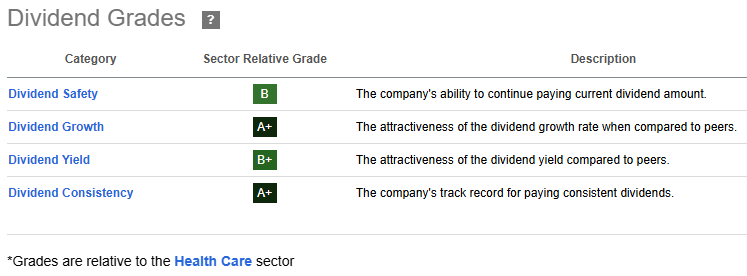

JNJ scores highly for dividends against it’s peers in the healthcare sector

Right now the the yield is sitting at 3.3%. That puts it at 21% higher than it’s 4 year average yield so if you are into dividends, now would be the time to be scooping up JNJ. It’s one of the highest yields they’ve been sitting at in the past decade.

And the stock price isn’t all that bad either….

JnJ’s Valuation is a Bargain 🛍

Bad news with no real bearing on the future of the company that causes red days is my favourite.

They’ve been caught up in some lawsuit drama that’s been a drag on the stock price, down over 6% in the last month.

Law suit has been a drag on the stock price

And don’t get me wrong, I’m not saying the law suit is a good thing. It looks like best case scenario it’s going to cost them over $8Billion!

It’ll hurt earnings in the short term, for sure. But does it make a material difference on the long term performance of JNJ? I don’t think so. That’s why I think it’s good to buy on the back of news like this.

It leaves them at a forward PE ratio of 15x. That’s 28% below the average for the sector. I think a stock with JNJ’s history of performance & momentum into the future deserves a valuation that would at least make them an average player in the space, don’t you?

I mean, look at the earnings performance history…

Consistent beats across the board

Dividend Safety 🦺

Another point on the dividend. You don’t want a company dishing out dividends like your pal who buys rounds they can’t afford.

JNJ’s got a cash payout ratio of just 57%. That leaves plenty of wiggle room to keep paying dividends even if the economy gets a little shaky or this law suit raids their pockets a little more than they’re expecting.

My Plan 🗺

It’s not always AI, memecoin’s & leveraged positions.

Sometimes boring, consistent wealth creation is the move. JNJ is current just under 1% of the portfolio. I’m going to increase that a little at market open.

A return back to recent highs around $165 is a 10%+ gain which is more than reasonable with current fundamentals & earnings.

A view of JNJ over the past few years & what we can reasonably expect moving forwards

If it can get the same momentum is had between ‘21 -’23 we could be looking at something closer to 20%+.

And did I mention that dividend? 😉

What did you think of today's update?

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️