Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 4th December 2024:

Margin Gains, Growth Pains 😬

Profit From Smart Homes 🧠🏠

$40B Drama & a Plot Twist 🎥

Margin Gains, Growth Pains 😬

Double figure gains in a day will always get my attention.

Salesforce dropped their Q3 earnings yesterday & the markets gone wild. They were trading with an 11%+ gain at some points today before cooling off. Even with the cool down it pushes my current position to over 40% in profit.

My current position in CRM is showing healthy green

But I’ll be honest. The report didn’t blow my socks off. So what’s all the hype about?

The Headlines 📢

Here’s some of the highlights from the earnings report to bring you up to speed.

Revenue’s up +8%. Subscriptions? +9%.

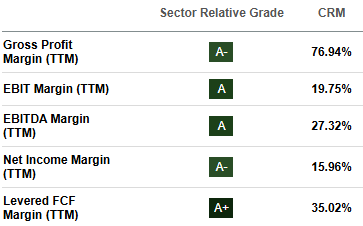

Margins at 20%+ (up from 2% in 2021).

Q4 guidance? A bit lackluster & whiffed on expectations.

Revenue: $9.9B–$10.1B (expectation was $10.5B so a little under).

EPS: $2.57–$2.62 (expectation was $2.65 so a little under, too)

Now don’t get me wrong. These numbers aren’t bad. They just don’t scream “To the Moon!” to me in the way I’d expect when I saw them at +11% today.

Where’s the spark coming from?

My guess is everyone’s excited about their shiny new AI today called Agentforce.

What’s Agentforce? 🤔

Imagine if Clippy went to private school, learned AI & got a job. That’s Agentforce.

Clippy was an icon. If ya know, ya know.

It’s Salesforce’s big bet on making workflows smarter with AI. It’ll automate stuff for doctors, tech support etc. That all sounds great but let’s keep our feet on the ground for a second. Right now, it’s just a really smart chatbot.

Cool, but does it justify a $30billion+ jump in market cap? Ehh, I’m not so sure.

I’ll tell you what is worth shouting about though….

That Fat Margin 🤤

Salesforce went from a scrawny 2% margin to a big fat 20%+. How have that done it? Is it a temporary number or can we expect margins to be at these levels in the future?

Well, by cutting the fluff, tightening up operations & swapping “growth at all costs” for “profits or bust.” they’ve created a much cleaner, leaner machine for the long haul. A little restructuring here, a dash of efficiency there, & there you have it. Margin glow-up complete. ✨

Salesforce gets an A+ for profitability

Now to be a Debbie Downer…

Growth is slowing. Especially in North America (+6% YoY). To be clear, slowing growth doesn’t mean they’re going backwards. It’s still moving in a positive direction.

The slower growth could be coming from sacrifices made to focus on bigger margins. If it means the a healthier bottom line then I think I’m for it. It seems like a lot of tech companies forget the objective of a company is to make profit so it’s nice to see from time to time. 😅

What’s my Plan? 🗺

Salesforce is a great company, no doubt. But with the run up they’ve had & the huge jump today, I’d say it’s priced for perfection.

I need to see Agentforce delivering on the hype to justify buying more at these levels. For me, it’ll be a “hold”. I think a fair price is right around $370 which is about 3% gain from where we are so not worth committing any more money to but I will have my eyes peeled for any pullbacks.

Profit From Smart Homes 🧠🏠

This Smart Home Company Hit $10 Million in Revenue—and It’s Just the Beginning

No, it’s not Ring or Nest—it’s RYSE, the company redefining smart home innovation, and you can invest for just $1.75 per share.

RYSE’s patented SmartShades are transforming how people control their window shades—offering seamless automation without costly replacements. With 10 fully granted patents and a pivotal Amazon court judgment safeguarding their technology, RYSE has established itself as a market leader in an industry projected to grow 23% annually.

This year, RYSE surpassed $10 million in total revenue, expanded to 127 Best Buy locations, and experienced explosive 200% month-over-month growth. With partnerships in progress with major retailers like Lowe’s and Home Depot, they’re set for even bigger milestones, including international expansion and new product launches.

This is your last chance to invest at the current share price before their next stage of growth drives even greater demand.

$40B Drama & a Plot Twist 🎥

We’ve seen Salesforce maybe getting overhyped. Now on to a stock that’s getting the cold shoulder.

Their earnings beat expectations across the board & they’re still down over 20% for the last 6 months.

A win on all fronts for Qualcomm on the latest earnings

They also dropped some hot guidance for the future & it still didn’t get them pumping. Let’s see what’s going on under the hood & if there’s any money to be made here. 🔍

The ARM-Wrestle

QCOM’s $40B ARM-based biz (smartphones, cars, IoT gadgets. Anything that looks like the future of tech) is stuck in a legal battle with ARM. ARM’s saying QCOM’s Nuvia acquisition broke the licensing rules. They’ve now got a court date for December to get this ironed out.

This is a pretty good reason for investors to stay out but I’m not worried.

Think back to 2022 with me. QCOM battled Apple in court, won & walked away with billions.

I’m not saying that means QCOM will win every legal battle for the rest of time, it’s just a nice track record to have. There’s also the fact that ARM needs QCOM as much as QCOM needs ARM. It’s a lovers tiff & a settlement feels inevitable. I’m pretty confident they’ll be able to settle their differences when there’s $40B at stake.

Intel Inside… QCOM? 🤔

Another negative in the rumor mill. Qualcomm wants to buy Intel. Uh, no.

In case you didn’t know, Intel have been doing less than well. This is their performance over the last 12 months…

Intel down over 47% in the last 12 months.

And to make things worse, Intels CEO, Pat Gilsenger,announced his retirement.

The good news is regulatory hurdles make this deal a non-starter. Remember when INTC’s Tower Semiconductor deal flopped? Or QCOM’s failed NXP Semiconductors bid? Neither of these guys have a history in acquisitions & I don’t think it’ll start here.

I think likely scenario is QCOM might scoop up some of INTC’s PC design assets to level up its ARM-based CPU game. A full-on takeover? Good clickbait. You nearly got me…

The Numbers Don’t Lie 📈

After the rumours, let’s get some cold, hard truths. Numbers that don’t lie.

Short-term: FQ1’25 revenue guidance = $10.9B (+9.8% YoY) Adjusted EPS? $2.95 (+7.2% YoY).

Long-term: By FY2029, QCOM is projecting:

$8B in automotive revenue (+22.4% CAGR)

$14B in IoT revenue (hello, AR/VR, PCs, industrials)

TAM (total addressable market) of $900B by 2030

Those numbers are impressive. The great thing for us is, that’s not reflected in the stock price.

With a 20% slump in 6 months & a forward P/E of 14x, I’d think QCOM is ready for a closing down sale if I didn’t know any better. Compare that to AMD (41x) or Broadcom (33x). That makes QCOM a steal.

Sprinkle in a 2.17% dividend yield with some aggressive stock buybacks & I really can’t see what there’s not to love?!

What’s my Plan? 🗺

The stocks found a support right around $156ish & we’ve found it at a few points this year. Right now, it’s trading just off the support at $163.

It has struggled to push above $176 since August but once this court case is out the way & we get some clarity on the intel takeover, a breakout is inevitable. (Even a move back to $176 would net an 8%+ profit).

Trading mostly range-bound for the majority of this year. I think the breakout is inevitable.

I’ll be adding more to my position, especially if there’s more pull backs. My first price target will be $200 which’d net me 23%+ profit.

Some optimists on Wall St have a number as high as $270 next to QCOM (66%+ gain) but I’ll see how we go for now!

What did you think of today's update?

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️