In today’s post:

Markets Just Broke Reality 🤯

Is AI Fueling a Bubble? 🫧

Nvidia Bets $2B on Elon Musk 😲

Daily Bull Run Premium+ Analysis

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.

MARKETS JUST BROKE REALITY 🤯

Wall Street just pulled off a double flex. The Nasdaq and S&P 500 both closed at all-time highs. Even gold shot past $4,000 an ounce for the first time ever.

The Dow decided to sit this one out, closing basically flat, but tech bulls didn’t care. The AI hype train keeps chugging, and traders are already pricing in cheaper money from the Fed.

What’s driving the rally

According to analyst Daniel Jones, this market is powered by two things:

AI euphoria. Every company that even whispers the word “neural” gets a 10% pop.

Rate cut hopes. Ten of the Fed’s 19 top members expect two more cuts before year-end, which would make borrowing cheaper.

But Jones also waved a caution flag. “Economic conditions are looking worse and worse,” he said. “We could be getting close to a rather painful downturn.”

Just say how it is, Jones. Enjoy the party while the lights are still on.

Sectors & yields

Seven of the 11 S&P sectors ended in the green, led by Info Tech. Energy, on the other hand, had a rough day and finished last.

Treasury yields ticked slightly higher. The 10-year closed at 4.13% and the 2-year at 3.58%. A $39B Treasury auction also showed weak demand, which doesn’t exactly scream “confidence.”

Gold goes full main character

Gold just smashed through $4,000/oz, pulling in record inflows from both institutional and retail investors.

U.S.-listed gold funds raked in $35B by the end of September, already topping 2020’s record.

Globally, inflows hit $64B year-to-date.

September alone? A chunky $17.3B.

Traders are piling into gold and stocks at the same time. That’s not normal. Usually one’s the “fear trade” and the other’s the “greed trade.” Right now, everyone’s just grabbing both.

The Fed & the shutdown

FOMC minutes showed most Fed officials are leaning toward more easing, but a few are still side-eyeing inflation. Markets are pricing in an 80% chance of two rate cuts by year-end, down from 90% last week.

Meanwhile, prediction markets now expect the government shutdown to drag on for about 22 days, back to previous highs after hopes of a quick deal faded.

TL;DR:

Nasdaq and S&P 500 hit record highs.

Gold broke $4,000/oz for the first time ever.

AI hype and Fed rate cut hopes are fueling optimism.

10-year Treasury yield rose to 4.13%.

Gold funds are seeing record inflows.

Markets expect two rate cuts this year, and the shutdown might last three weeks.

1. Ride the AI Wave

AI stocks are still fueling this rally as investors bet big on the next productivity boom. Info Tech led the market again while enthusiasm keeps building for AI-linked companies.

📌 Action: Add exposure to AI-heavy ETFs like $QQQ ( ▲ 1.07% ) or $SMH ( ▲ 1.52% ). Trim profits only if momentum stalls across major tech names.

2. Hedge with Gold Momentum

Gold just smashed through $4,000/oz, breaking records and attracting billions in new inflows. That signals strong institutional demand and possible inflation hedging.

📌 Action: Build a small position in gold ETFs like $GLD ( ▼ 1.39% ) or miners like $GDX ( ▲ 0.37% ) to balance equity exposure if risk sentiment flips.

3. Position for Rate Cuts

Ten Fed members expect two more rate cuts before year-end, which usually pushes bond prices up and borrowing costs down.

📌 Action: Add medium-duration bond ETFs like $IEF ( ▼ 0.02% ) or rate-sensitive dividend plays such as utilities and REITs before cuts kick in.

IS AI FUELING A BUBBLE? 🫧

Investors are starting to sweat. The Magnificent Seven — those tech and AI giants carrying the market on their backs — have gotten really expensive. Some are whispering “bubble.”

But Goldman Sachs just told everyone to chill out.

Yes, valuations are high. No, they’re not at dot-com levels.

Here’s the deal:

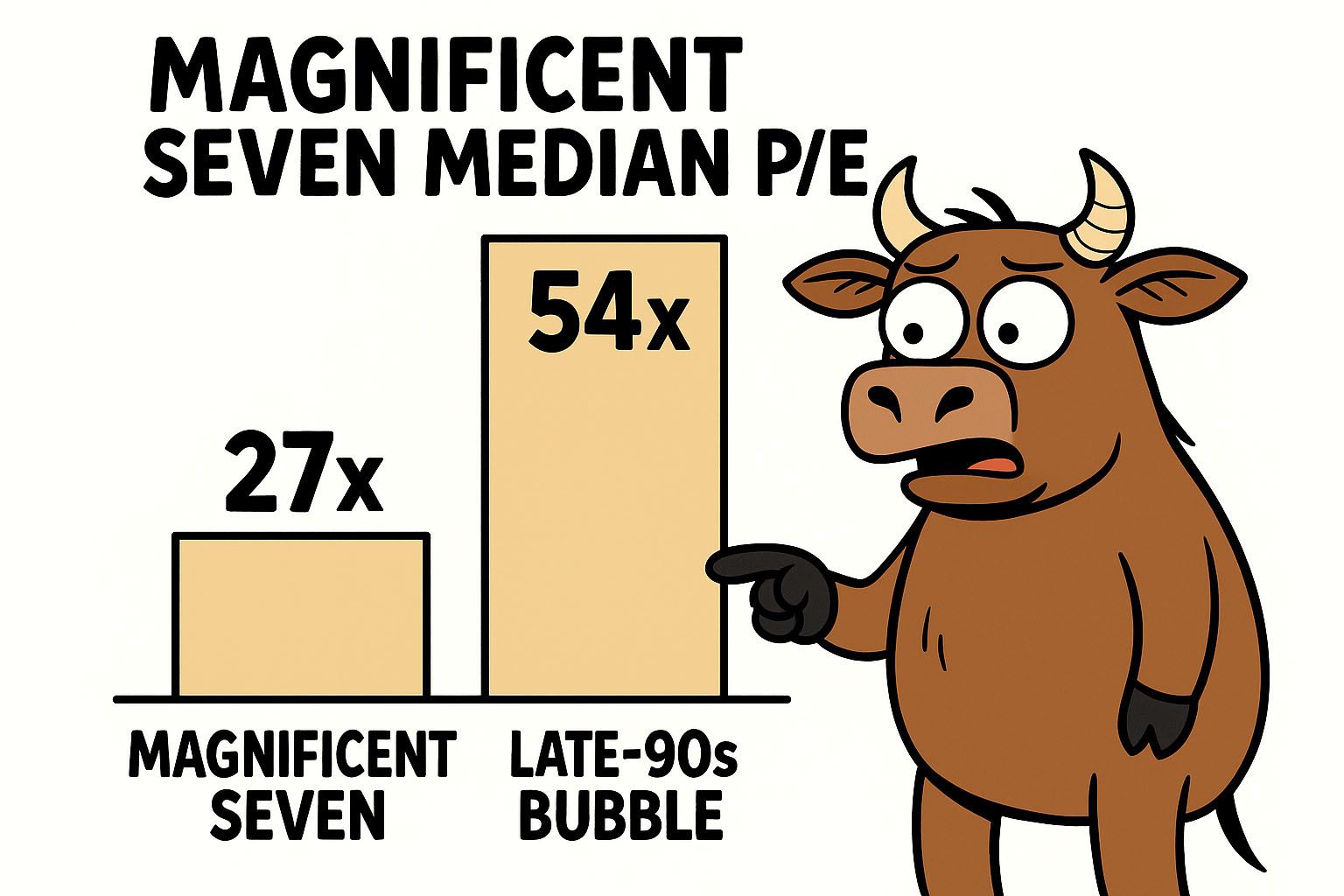

The Magnificent Seven’s median forward P/E ratio sits around 27x (or 26x if you kick out Tesla, which is doing its own thing on Planet Valuation).

Back in the late-90s tech bubble, the biggest seven companies traded at roughly double those multiples.

So while today’s market looks top-heavy, Goldman says it’s not full-on bubble mode.

Their words: “Valuations are high but generally not at levels that are as high as are typically seen at the height of a financial bubble.”

In simple terms? Overpriced, yes — apocalyptic, no.

The bank also pointed out that this market is built differently. These companies are actually making serious money. Unlike the dot-com era, where “eyeballs” were considered a business model, today’s giants have cash flow to back their hype.

Still, it’s a concentration game. The Magnificent Seven now make up a chunky slice of the S&P 500. That’s great when they’re flying, not so great when they stumble.

If you want to ride the group, you can do it through a few ETFs like $MAGS ( ▲ 1.15% ), $MAGX ( ▲ 2.23% ), $QQQU ( ▲ 2.1% ), and $QQQD ( ▼ 1.11% ) — but remember, you’re basically betting on the same handful of names.

TL;DR

Magnificent Seven are expensive but not dot-com bubble expensive.

Goldman Sachs says valuations aren’t at “burst” levels.

The risk? Market concentration. The reward? They’re still making bank.

1. Ride the Tech Titan Momentum

Goldman says valuations are high but not bubble-level. That means the Magnificent Seven still have room to run — especially those with strong earnings growth and AI tailwinds.

📌 Action: Accumulate shares of diversified tech ETFs like $QQQ ( ▲ 1.07% ) or $MAGS ( ▲ 1.15% ), using dollar-cost averaging to smooth out volatility. Take profits gradually if momentum slows.

2. Balance the Tech Weight

The market is heavily concentrated in a few mega-cap names. If one slips, your portfolio could too.

📌 Action: Add exposure to undervalued mid-cap growth ETFs like $IJH ( ▲ 0.9% ) or $VUG ( ▲ 1.02% ) to reduce concentration risk while keeping growth potential alive.

3. Play the “Not a Bubble” Rebound

When headlines scream “bubble,” many investors hesitate. But Goldman’s data says fear is overblown — and fear creates opportunity.

📌 Action: Use temporary dips in quality AI-driven names like $MSFT ( ▲ 1.18% ), $GOOGL ( ▼ 0.19% ), or $NVDA ( ▲ 0.68% ) to buy the panic. Focus on earnings strength, not hype.

NVIDIA BETS $2B ON ELON MUSK 😲

Nvidia’s CEO Jensen Huang is having a case of investor FOMO.

In an interview with CNBC, the 62-year-old tech boss confirmed that Nvidia joined Elon Musk’s latest funding round for his AI startup, xAI… and he already regrets not throwing in more.

Huang said he wants to be involved in everything Musk touches. That includes Tesla, SpaceX, Neuralink, and now xAI — the startup behind the ChatGPT rival “Grok.”

And it’s not a small bet either. Bloomberg reports xAI is raising a colossal $20 billion, made up of $12.5 billion in debt and $7.5 billion in equity. Nvidia alone could chip in up to $2 billion in equity.

Here’s the twist: the deal is backed by GPUs, not the company itself. A special purpose vehicle (SPV) will buy Nvidia’s processors for xAI’s upcoming “Colossus 2” data center, and xAI will rent them back over five years. Basically, it’s a rent-to-own model for supercomputers.

That means Nvidia gets paid no matter what — either as a lender, supplier, or investor. Not bad.

Huang’s other regrets

Huang also admitted he regrets not investing more in CoreWeave, another AI infrastructure company that already has deep ties to Nvidia’s chips.

Meanwhile, Nvidia is also in the middle of a $100 billion multi-phase investment with OpenAI, the ChatGPT parent. OpenAI plans to build 10 gigawatts worth of AI data centers running entirely on Nvidia’s systems — that’s around 40 to 50 million GPUs when all is said and done.

Phase one kicks off in 2026 using Nvidia’s upcoming Vera Rubin platform.

AMD wants a piece too

Huang claims he didn’t even know about AMD’s separate deal with OpenAI. That one involves 6 gigawatts of AMD’s Instinct MI450 GPUs, set to roll out starting in late 2026.

AMD also issued OpenAI a warrant for 160 million shares, which will vest if certain performance milestones are hit.

So while Huang’s stacking Musk chips, AMD’s quietly sliding into OpenAI’s DMs.

Big picture

Between Musk’s xAI, Altman’s OpenAI, and a handful of GPU-rich infrastructure companies like CoreWeave, one thing’s clear: the race for AI compute is now bigger than the AI models themselves.

And Nvidia’s sitting right in the middle — collecting checks from everyone.

TL;DR

Nvidia invested in Elon Musk’s xAI and could put in up to $2B.

xAI’s total raise is $20B, backed by Nvidia GPUs through a special SPV.

Jensen Huang regrets not investing more in CoreWeave.

Nvidia’s also backing OpenAI with a $100B deal for GPU-powered data centers.

AMD’s countering with its own OpenAI deal worth 6 gigawatts of GPUs.

Nvidia keeps winning, no matter who builds the future of AI.

1. Ride the AI Infrastructure Wave

Nvidia, AMD, and CoreWeave are all fueling the data center arms race. Every AI model needs massive GPU power, and the buildout is only accelerating.

📌 Action: Add exposure to AI infrastructure plays like $NVDA ( ▲ 0.68% ), $AMD ( ▲ 8.77% ), and data center REITs such as $EQIX ( ▲ 0.66% ) or $DLR ( ▲ 1.22% ). Hold through 2026 as AI compute demand ramps.

2. Follow the Musk AI Money Trail

Elon’s xAI just raised $20B, heavily backed by Nvidia. Wherever Musk goes, hype — and capital — follow.

📌 Action: Watch for suppliers tied to xAI’s “Colossus 2” buildout (power, cooling, chips). Consider picks-and-shovels stocks like $SMCI ( ▲ 1.37% ) or $NVDA ( ▲ 0.68% ) to capture indirect upside.

3. Bet on GPU Demand, Not the Chatbots

While everyone chases the next ChatGPT killer, the real money’s in the hardware wars underneath.

📌 Action: Focus on GPU ecosystem plays — semiconductor equipment $ASML ( ▲ 0.8% ), chip packaging $TSM ( ▲ 4.25% ), and cooling tech $CARR ( ▲ 0.11% ). Skip the hype, own the bottlenecks.

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.