Stocks of the Week!

In this email:

My AI Wild Card🃏🤖

The Short-Seller Scandal 👀💣

My AI Wild Card🃏🤖

If I asked you to name a company that can grow from AI but isn’t always in the headlines, who would you think of?

I bet Adobe didn’t top the list. And why would it? Everything they make is supposed to help creatives which is arguably one of the industries most scared of AI replacing them.

But that’s exactly why I think there’s value to be had here as Adobe go full steam ahead on AI integration. Let me explain.

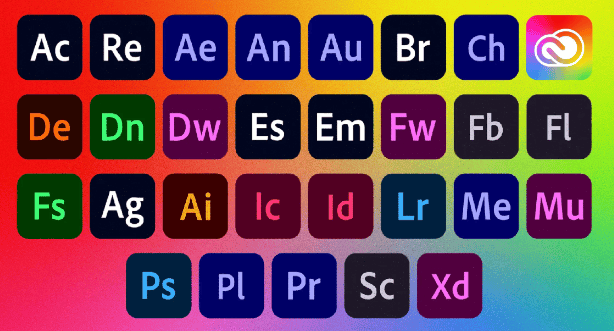

Adobe’s suite is a one stop shop for all things creative

Adobe saw the future & said, “Nah, we’re not gonna pull a BlockBuster here.” They’ve decided to embrace the new trends & doubled down on AI by adding AI-powered tools like Firefly into Photoshop, Illustrator, & Lightroom.

I love this move. Rather than existing in a bubble & pretending AI isn’t happening to make all the creatives feel better, they’re welcoming it with open arms & a fresh perspective which is this:

Adobe’s AI isn’t here to replace creators; it’s here to boost them. AI tools make everything faster, easier, &, believe it or not, more creative. The digital Bob Ross’ among us get supercharged workflows & enhanced efficiency which should mean increased product satisfaction. You know what people do when they love a product, right?

They keep paying for it. That means more recurring revenue for Adobe which is exactly what we want to see growing. From the revenue beat last earnings, it looks like it’s working, too!

Moats, Margins & Money 🎯💸

So of that revenue, how much are they are actually keeping? Turns out, a pretty decent chunk.

A lot of tech companies struggle to balance R&D costs with staying profitable but Adobe’s managed to keep things steady. Over the last ten years, their gross margins have actually grown as they scaled. More margin = more money Adobe gets to keep from every sale. Nice.

Revenue & earnings beat on the last report is a good look

Now AI is in the mix, Adobe’s pushing their margins even more, reporting a 23% jump in earnings per share in Q3 of this year. This means Adobe can pump money back into new features (like that fancy AI), keep customers happy, & keep the competition at arms length.

It looks like a win, win, win from where I’m standing so is Adobe trading at a fair price right now?

Valuation Check – Hint: It looks Good 🤑

No matter how good a stocks Cinderella story is, you should always ask the question: “Is it worth the current price?”

If the answer isn’t “Yes!” or “It’s worth way more than the current price!” then you don’t don’t but it. Simple.

So where does Adobe fall on that spectrum? Considering it had a run up over over 130% a few years ago, it isn’t as expensive as you might think.

Adobe run up over 130% from it’s lows in late 2022 before cooling off

Adobe’s stock price has cooled off over 23% since then & is sitting at a reasonable level for SaaS royalty, especially if you compare Adobe to its peers. Price is trading at a midpoint of its historical valuation range, which isn’t demanding for a company with its track record. The growth isn’t faster in the space, but its consistent profits & big fat margins make it a pretty safe bet that lets you sleep at night.

Competition - A Real Talk Moment ⚔️

Sounds good so far but it can’t all be sunshine & rainbows, right?

If there’s one thing to watch out for, it’s Adobe’s rivals.

Adobe tried to buy Figma, a big up-and-comer in the design space, but regulators said no-go. Now Figma, Canva, & AI-driven tools have all got their mouths open trying to take a bite out of Adobe’s market share. But here’s the thing: Adobe’s products are so embedded in how companies operate that they’re basically non-negotiable at this point. Need a pro-level design tool? For most, Adobe’s still the go to tool kit & I can’t see that changing any time soon.

Adobe’s Got the Goods 🧳✨

Where does all that leave us?

If you’re like me, it’s on your broker placing an order for Adobe stock. 😅

All jokes aside, I do think if you’re looking for a tech stock with steady growth, a serious AI angle, & a long track record, Adobe’s has to be part of the portfolio. Between AI-powered tools that creators actually want, rock-solid margins, & a reasonable price, Adobe is buy in my book.

Analysts consensus is just over $600 which would give around a 23%ish gain from current price & I think that’s about fair. It’d keep us below previous highs.

The potential for gain from current price looks very appealing

If they can rattle off a few more solid quarters it might be enough to fuel the rocket to previous highs seen a few years ago which’d put us closer to a 45% gain.

Fingers crossed that comes to fruition & I don’t have to Photoshop it on to the charts….🎨

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

The Short-Seller Scandal 👀💣

This one is spicy. It’s like “Keeping Up with the Kardashians” took a stroll on Wall Street.

It’s got drama, bargain prices & a bit of risk if you can take it. Go get your popcorn! 🍿

Why SMCI’s Price Looks Juicy Right Now 🤤

First, let’s talk about SMCI’s price. It’s been on a nosedive & it was made worse by the accounting accusations (I’ll come back to this) that caused a drop of over 20% in a single day. SMCI’s stock is now sitting firmly in the “bargain bin,” & here’s why I think that’s actually exciting:

1/ It’s Undervalued Like Crazy: SMCI’s Forward Price-to-Earnings (P/E) ratio is 13.46x. Compare that to the industry average of 23.83x, & you see why some investors think this stock is wearing a discount tag it doesn’t deserve.

2/ PEG Ratio (0.25x) is Screaming “Growth!” The PEG ratio is a biggie here. SMCI’s is 0.25x, a fraction of the industry’s 1.84x median. Translation? You’re getting a whole bunch of potential future growth per dollar. 📈

So you’re in the know…💡

You’ve probably heard me talk about the P/E (price-to-earnings) ratio, which is like a basic "Is this stock overpriced or cheap?" tool. But there’s a secret weapon that goes even deeper into value: the PEG ratio (Price/Earnings to Growth ratio). Think of it like the P/E ratio’s smarter, better looking sibling.

The PEG ratio helps you figure out if a stock’s price is actually worth it based on future growth. Here’s the formula:

PEG Ratio = (P/E Ratio) / (Expected Growth Rate)

If the PEG ratio is below 1, that stock might just be a gem in the rough (it’s cheap relative to its growth potential). If it’s above 1, the stock may be pricey given its growth speed. So the P/E ratio tells us if it’s cheap today, the PEG ratio tells us if it’s a good deal for tomorrow too. 📈

3/ The Floor’s in at $38–$40: SMCI recently hit a low around the $38–$40 range & it looks like it’s holding steady there. Consolidation usually comes before a breakout & with the fundamentals mostly looking solid, I think we’ll get a break above the range.

Since the fall at the end of August, it looks like SMCI has found a bottom & been trading in this range ever since

But don’t throw your money at this just yet. There’s a lot more going on behind the scenes, especially when it comes to what SMCI actually does.

The Secret Sauce: SMCI & the AI/Data Center Boom 🤖

SMCI isn’t just your regular tech stock. It builds the infrastructure that powers every investors favourite buzzword - AI. As more companies jump on the AI bandwagon (like Adobe in the first segment), the hotter the demand for data centers gets. SMCI have their surfboard out ready to ride that wave.

I’m not sure if the surfboard analogy works here. I don’t think people that innovate in AI data centers would surf very much…. anyway…

The Big Boys like Nvidia, Broadcom, & Palantir are already working alongside SMCI to make data storage faster, cheaper, & smarter. Demand for data center capacity is expected to boom through 2025, which means long-term tailwinds for SMCI as companies pour cash into new tech infrastructure. 🏗️

In short? SMCI is in the AI game, and it’s cheap. That’s the perfect combo for anyone looking for insane growth.

🚨 The Risky Bits: Short Sellers & Margin Squeeze 🚨

Okay, now let’s talk about the ugly. Short interest in SMCI is high. Like 20.15% high. When a lot of investors bet against a stock, it can get messy & volatile. Take GameStop as exhibit A. Granted GameStop did have over 100% of their float shorted but you get the point.

For context, a company like Nvidia currently has 1.09% of their float shorted.

SMCI have attracted plenty of short interest

All that to say, if SMCI doesn’t perform well in their upcoming earnings call on October 30, we could see the stock take another hit.

And do you remember the accounting accusations I mentioned earlier that I said I’d come back to?

Well thanks to a short-seller report that hit like a bombshell questions were raised around SMCI’s accounting practices & transparency. The accusation was that they might have “massaged” numbers to look more profitable than it actually is. 📉

The stock then tanked over 20% on the day.

Remember, this claim is coming from a short seller. Someone who gains if the price of SMCI falls. Are they legit claims or is it just fearmongering for profit?

SMCI hit back with a firm denial, sticking by their numbers & pointing at the strong demand for their data center products as proof. I’m inclined to lean with SMCI on this one because of the source of the accusations & the fact that all AI companies in this space are seeing great growth. How likely would it be that SMCI would be the only company to get left behind? Not very, in my opinion.

If I believe all that to be true, that means the huge fall just gives me more of a discount but here’s one last point.

Revenue beat by those thinner margins caused a miss on the EPS

SMCI’s gross margins have been getting squeezed, falling to 11.2% last quarter (down from 14%+ pre-pandemic). That’s partly because they’re ramping up production of new AI tech, which costs more up front. If SMCI can boost efficiency as it scales, those margins might bounce back so something to keep an eye on.

So, Is SMCI a Buy, Hold, or Avoid? 🤔

For now, SMCI looks like a classic risk/reward play. Here’s what we’re looking at:

1/ Short-Term Uncertainty, Long-Term Potential: If you’re up for a little volatility, SMCI’s long-term setup is super interesting. They’re in a fast-growing market, & with AI & data infrastructure demand not slowing down, this could be a big opportunity for gains.

2/ The Price is Right: At these levels, you’re paying for a company with big upside potential at a relatively low price so the downside from here is minimal. Remember, those short sellers are lurking but if you can beat them out I do think there’s the potential for triple figure gains.

I don’t think this one will be for the faint hearted but with 160% gain on the cards if we can see old highs & a 40% gain to be reasonably expected, I’m willing to roll the dice with a very small part of my portfolio.

If they have a another solid earnings report next week & the stock price stays in it’s current range or comes down even more, I’ll keep adding to my position size!

What did you think of today's update?

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️