Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 13th January 2025:

Please Make It Stop 😭

Get Paid Like Beyonce 💃

Prescription for Profit 💊

Please Make It Stop 😭

The markets been beating the Mario coins out of me.

Until we get some cold hard data on the real inflation numbers, investors are going to keep assuming the worst. What does that mean?

It means they’ll keep dumping stocks that’ll be most impacted by higher rates unless they get confirmation otherwise.

Now, everyone’s pacing around waiting for this week’s inflation numbers, which could make or break the market’s vibe. Here’s what’s in the diary:

Tuesday: Producer Price Index (PPI). This shows us what it costs to make the stuff we buy. Higher prices = inflation bad.

Wednesday: Consumer Price Index (CPI) aka the one we really care about. This one covers everything from milk to mortgages.

The stakes are high. I’d be lying if I said I wasn’t a little bit sweaty waiting on the data with $5,000 in Nasdaq futures at 20x leverage.

High risk, high reward play for me on the inflation data

If inflation is too hot, it’ll give the Fed a reason to keep interest rates up. Not ideal.

The Nasdaq’s down nearly 5% in the past week, as much as 8% at points. It makes me feel like a lot of the negative expectations around CPI data is half baked in. If there is more downside, I don’t think there’ll be much. I’ve got enough buffer to cover a 20%ish fall from highs.

Unless inflation looks like something straight out of Venezuela I’ll be scrambling to get more cash into these positions.

As it is right now, a climb back to previous highs nets me ~$4,000.

Market Movers 📈

The market’s been choppy but as I’m writing this it looks a little something like:

S&P 500: Down 0.1%. Flat is a win tbh.

Nasdaq: Tech stocks decided to take the day off, down 0.7%.

Dow: The MVP, up 0.6%. Blue chip stocks carrying the team.

Sectors are split. Oil is flying. Up 2% at writing but had been as high as 3.1% today. Energy stocks have been riding on the tailwinds of that rise, too.

Oil up 2% but has been as high as 3.1% today.

Worth noting, Oil futures are currently trading at a level they’ve struggled to break the last three time they’ve been there…

Oil has struggled to break much about $78ish the last few times it’s been there. Could this be different?

Tech & utilities both got spanked.

Bonds. Boring But Important 😴

The 10 year yield climbed to 4.80%. The market is wanting more cash for holding long term IOU’s. The 2-year yield dipped to 4.40%.

Why should you care?

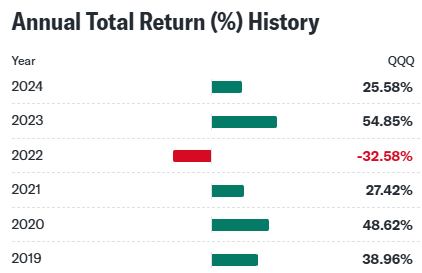

Rising yields make borrowing more expensive. That’s awful for growth stocks (aka tech). When the 10 year yield held above 4% in 2022, things didn’t look so hot for tech…

QQQ returns were hurt in 2022 by the 10 year yield sitting above 4%.

Earnings Season Underway 💰

Earnings season kicks off this week. These are guys taking the stand:

Citigroup (C)

Goldman Sachs (GS)

Wells Fargo (WFC)

JPMorgan Chase (JPM)

BlackRock (BLK)

Banks are the warm up act for earnings season. If they crush it, it could be the boost we need to get us moving in the right direction. If they flop? It could set the stage for a few more rough weeks.

Get Paid Like Beyonce 💃

When Beyoncé Gets Paid, So Could You

JKBX (pronounced “Jukebox”) lets you invest in royalties from global streaming platforms.

Earn potential quarterly payouts tied to music revenue.

Diversify with an uncorrelated, market-independent asset.

Visit www.jkbx.com/legal/offering-circulars for important Reg A disclosures. This content is not investment advice, nor is it an offer of securities. All investments involve risk and may result in loss.

Prescription for Profit 💊

In a sea of red there was one who managed gave me a life boat.

UNH up 3.72% for the day

UNH managed to finish the day up just shy of 4%. They’ve got a big date coming up too.

UnitedHealth Group (UNH) drops Q4 earnings on January 16th so there’s no time like the present to figure out if they need a spot in your portfolio. 🍋

My current holdings for UNH makes up 1.3% of my portfolio

What Wall Street Expects

Revenue? $101.76 billion 💵

EPS? $6.26. This’ll be a step back from Q3 but nothing to worry about just yet.

Now here’s why you might want to get in before earnings. UnitedHealth do not miss expectations on earnings. The last time they missed that I could find was in 2020. 🤯

Past performance ≠ future results but if I was a betting man which I am, then I’d say we’re ready for another beat.

UNH EPS consensus vs actual & projections for the next four quarters

UnitedHealth’s Tag Team: UnitedHealthcare & Optum

This company has two money printers.

UnitedHealthcare (UHC): Classic health insurance. Covers 29.7M members & keeps adding more thanks to Medicaid-backed offerings. Growth is steady, margins could improve if that pesky inflation stays at bay. 📈

Optum: The star of the show. It’s where health tech meets pharmacy services meets data wizardry.

Optum Rx: Shipped 410M prescriptions last quarter (up 30M YoY), stacking $5.4B in extra revenue.

Optum Health: Added $2.1B in revenue last quarter thanks to more users.

Optum Insights: The research nerd of the group. Data is money & they used it to pull in $800M in Q3 earnings.

Buy the Dip?

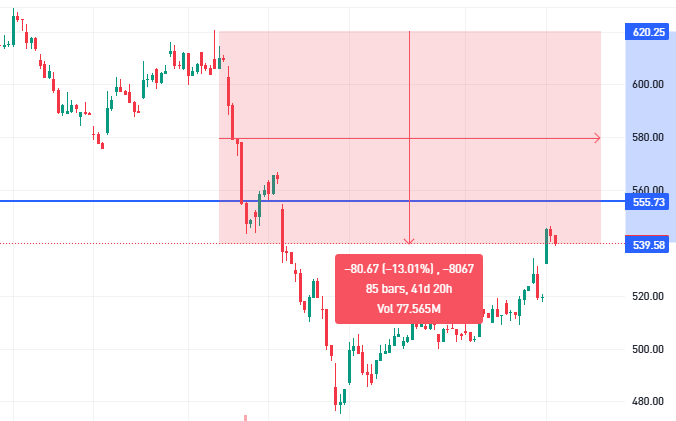

Now there was that whole thing with the CEO being shot a little while back.

That saw the stock drop nearly 24%. It’s still down nearly 13% from those peaks. For me, that means the valuation is still a bargain.

Still down 13% from pre-CEO murder highs

Forward PEG and price-to-cash flow are below 5-year averages. Dividend growth is on fire at a 14.6% CAGR over 5 years. The current yield just crossed 1.5%. It’s not huge but when you add the appreciation you’ll get buying at this valuation, it’s a nice little bonus.

What to Watch Out For Jan 16th 👀

Here’s some pointers on what to look for in the next earnings report.

Margins: Can UHC bring down its rising claims costs (up to 85.2% of premiums in Q3)? Lower inflation might help.

Optum’s Growth: Will Optum Rx & Optum Health keep raking in billions? Probably. The Q4 numbers will tell us for sure.

Dividends: With Q4 results on deck, they might even give a little bump on dividends, too.

My Plan 🗺

UnitedHealth isn’t a sexy, moonshot growth stock. It’s a (mostly) reliable pharma stock. And you know I need a little more stability in the portfolio right now to keep me sane. 😅

With its two-headed revenue monster (UHC + Optum), solid valuation, & recent dip, I’ll keep averaging in ahead of earnings.

January 16th might see a pop which’d be nice but either way I’m not too fussed. UNH is priced perfectly for a long term hold. And I can collect the dividends in the meantime.

P.S In the time it’s taken me to write this my portfolio has gone from down $750 for the day to a $45+ gain. Futures are not for the faint of heart. 🤣

What did you think of today's update?

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️