In today’s post:

The CPI Bomb Drops Friday 💣

What do Soybeans, Rare Earths & Fentanyl Have In Common? 🤔

Australia’s $1B Jackpot 🦘

Daily Bull Run Premium+ Analysis

Crypto’s Most Influential Event

This May, Consensus will welcome 20,000 to Miami for America’s largest conference for crypto, Web3, & AI.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus is your best bet to market-moving intel, get deals done, & party with purpose.

Ready to invest in your future?

Secure your spot today.

THE CPI BOMB DROPS FRIDAY 💣

Traders showed up Monday like college kids before finals. Jittery, over-caffeinated, and pretending they’re “ready.”

Spoiler: they’re not. But the market still finished green across the board as everyone braced for two big events — Earnings Week and the all-powerful CPI report.

The Scoreboard

Nasdaq: +1.3% — Tech bros leading the charge as usual.

S&P 500: +1.1% — A solid middle child performance.

Dow Jones: +1.1% — Even Grandpa Dow’s got some pep today.

Out of the 11 S&P sectors, 9 finished positive.

Best performer? Communication Services — apparently talking pays off.

Worst? Consumer Staples — nobody’s in the mood for toothpaste and toilet paper when AI stocks are printing tendies.

The Calm Before The CPI Storm

Bond yields barely moved. The 10-year Treasury slipped 2 basis points to 3.98%, while the 2-year just sat there doing nothing at 3.45%. Basically, the bond market’s equivalent of a shrug.

Everyone’s waiting for Friday’s CPI report. The inflation data that could make or break the Fed’s next move.

Deutsche Bank’s Henry Allen said they expect +0.42% MoM, pushing year-over-year inflation up to 3.1%, the hottest since January… Brace yourselves, rate-cut hopers.

Meanwhile On The Trade Front…

Trump and Australia’s PM Albanese signed a deal to team up on critical minerals and rare earths.

In English: America’s trying to ghost China and find a new plug for the good stuff that goes into EVs, chips, and basically everything shiny. More on this later in today’s newsletter…

Earnings Season = Chaos Season

We’ve got a stacked lineup this week:

$NFLX ( ▲ 2.66% ), $KO ( ▲ 0.2% ), $TSLA ( ▲ 2.39% ), $INTC ( ▲ 5.71% ), $T ( ▼ 0.6% ), $IBM ( ▲ 2.67% ), and $PG ( ▲ 0.07% ) — aka, the corporate Avengers.

Investors are especially watching Big Tech.

Rick Gardner from RGA Investments says everyone wants to see if AI hype is actually making money, not just headlines.

Because if the “AI revolution” doesn’t start paying rent soon… Wall Street might call it another dot-com cosplay.

Movers & Shakers

Super Micro Computer $SMCI ( ▲ 1.37% ): +5.4% — AI servers are hot, and this stock’s still chugging along like the little GPU that could.

AppLovin $APP ( ▲ 3.31% ): -5.5% — Guess investors didn’t “love” it that much.

Bottom line

The market’s partying before the exam — CPI’s the test, and Big Tech’s earnings are the essay.

Let’s see who studied and who’s just winging it.

TL;DR

Stocks popped across the board — Nasdaq up 1.3%.

9 of 11 sectors in the green, led by Communication Services.

Bond yields barely budged.

Trump & Australia link up to mine more rare earths (China’s not invited).

Big CPI drop Friday — expect fireworks.

Earnings week is here: Big Tech’s profitability is on trial.

SMCI soared, AppLovin faceplanted.

1. Play the Big Tech Earnings Wave

AI hype’s about to meet reality as Netflix, Tesla, Intel, and friends drop results this week. If earnings confirm AI’s turning hype into profit, tech could rip higher. If not, expect a sentiment reset.

📌 Action: Accumulate strong AI-exposed names like $NVDA ( ▲ 0.68% ), $SMCI ( ▲ 1.37% ), or $MSFT ( ▲ 1.18% ) before reports, and trim positions into strength post-earnings. Momentum favors early birds.

2. Position for CPI Shockwaves

Friday’s CPI could swing the entire market. A hotter-than-expected print might spook rate-cut bulls and pop yields, while a cooler one could trigger a relief rally.

📌 Action: Build a “CPI straddle” portfolio without options — balance inflation-sensitive plays like $XLF ( ▲ 0.49% ) (financials) and $XLE ( ▼ 0.09% ) (energy) against rate-sensitive growth names like $QQQ ( ▲ 1.07% ). Shift weight after the print.

3. Capitalize on Rare Earth Momentum

The U.S.–Australia mineral deal highlights the ongoing “de-Chinafication” of supply chains. Rare earth and critical mineral producers are set for long-term tailwinds.

📌 Action: Add exposure to Western-aligned miners like $MP (MP Materials) or Australia’s $LYSDY ( ▲ 2.4% ) (Lynas Rare Earths). These plays could quietly run while everyone’s distracted by AI.

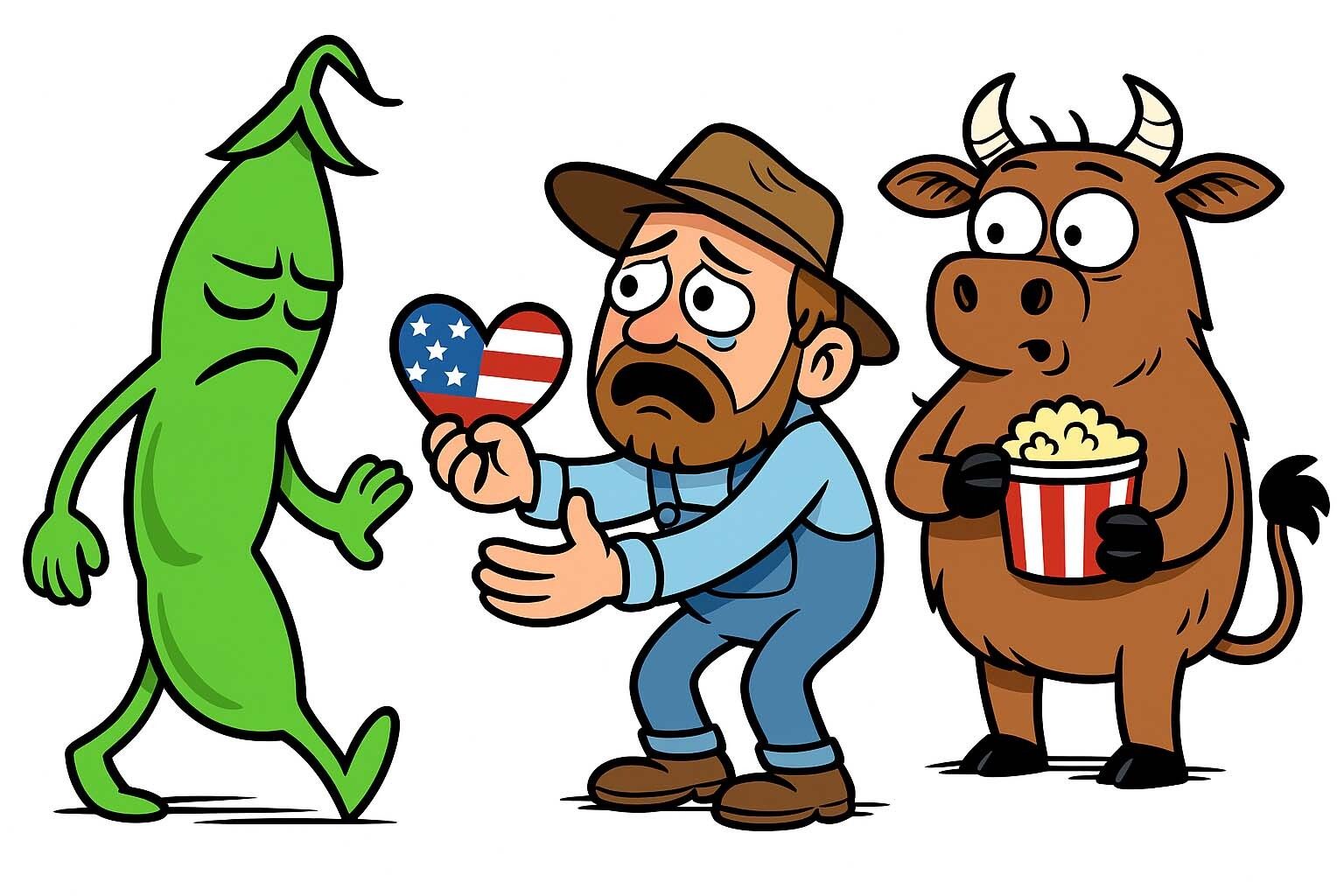

WHAT DO SOYBEANS, RARE EARTHS & FENTANYL HAVE IN COMMON? 🤔

Trade talks between the U.S. and China are kicking off again this week in Malaysia — and Trump just dropped his three-item wish list like he’s ordering from Amazon Prime for geopolitics.

The list? Rare earths, soybeans, and fentanyl.

Yup. The holy trinity of “stuff that keeps America running, fed, and occasionally overdosing.”

1️⃣ “Don’t play the rare earth game with us.”

Trump’s first beef: rare earth minerals. The magic dust inside everything from iPhones to fighter jets.

China basically controls the supply chain like the final boss in a video game.

So when Beijing hinted it might tighten export rules, Trump hit back with a threat: “I’ll slap a 100% tariff on your shipments.”

Translation: Don’t test me. I’ve got tariffs and I know how to use them.

If he actually pulls the trigger on Nov 1, expect U.S. tech and defense companies to sweat harder than a trader watching CPI data drop.

2️⃣ Soybeans — America’s awkward ex

Next on the list: soybeans.

China used to buy $12.6 billion worth of U.S. soybeans last year. Then they ghosted and started seeing South America instead.

Trump wants that relationship status changed back to “it’s complicated (but profitable).”

Why? Because soybean farmers in the Midwest are basically the collateral damage of every trade war.

3️⃣ “And stop with the fentanyl!”

Trump also doubled down on his push for China to crack down on fentanyl exports — the deadly opioid flooding the U.S.

It’s a rare moment where the trade war overlaps with the drug war.

Less supply = fewer overdoses = political win.

The Bigger Picture

This week’s Malaysia meeting isn’t just another round of finger-pointing.

It’s shaping up like a geopolitical three-ring circus — minerals, agriculture, and narcotics all fighting for stage time.

If any progress happens, it could mean:

Relief for U.S. farmers 🌾

Stability for tech supply chains ⚙️

Maybe fewer fentanyl headlines 💊

But if talks flop? Expect markets to react faster than Trump’s next tweet.

TL;DR

Trump’s heading into China trade talks with a bold (and bizarre) to-do list

Tell China to quit hoarding rare earths

Start buying U.S. soybeans again

Stop exporting fentanyl.

Tariffs could hit Nov 1 if things go south — and that could get messy fast.

1. Ride the Rare Earth Renaissance

China’s tightening grip on rare earth exports could spark a Western supply chain scramble. Expect U.S. and Australian miners to get the spotlight as investors hunt “non-China” sources. 🌎

📌 Action: Build positions in rare earth producers like Lynas Rare Earths $LYSDY ( ▲ 2.4% ) or MP Materials $MP ( ▲ 4.92% ). Scale in before trade talk outcomes and hold through supply chain diversification plays.

2. Bet on the Bean Bounce

If China restarts U.S. soybean purchases, American agri exporters could finally catch a break. Farm commodities might rally as trade tensions ease. 🌾

📌 Action: Add exposure to agriculture ETFs like $DBA ( ▲ 0.15% ) or agribusiness leaders like $ADM ( ▲ 0.49% ) and $BG ( ▲ 0.98% ). Take profits on post-deal headlines or export spike data.

3. Back the Border Control Boom

A renewed U.S. push to combat fentanyl imports means more spending on enforcement and border tech. Think scanners, sensors, and security contracts. 🚨

📌 Action: Watch for upside in defense and border tech names like Leidos $LDOS ( ▲ 1.24% ), OSI Systems $OSIS ( ▲ 1.44% ), or Axon $AXON ( ▲ 4.5% ). Buy early before government budgets and grants catch up to the policy noise.

AUSTRALIA’S $1B JACKPOT 🦘

So, President Trump just signed a “let’s be besties” deal with Australia — but not for beaches, kangaroos, or Tim Tams.

Nope, this one’s all about rare earths and critical minerals. The spicy ingredients powering everything from iPhones to fighter jets.

Basically: the U.S. wants to stop depending on China for the shiny stuff that makes tech go brrr.

The $2 Billion Bromance

The details are still hush-hush (government things, y’know), but here’s the gist:

The U.S. and Australia will each throw in $1 billion over the next six months.

That cash funds joint rare earth projects, processing facilities, and other “let’s not let China control everything” ventures.

Australia’s got the goods — the world’s 4th-largest stash of rare earths — and they’re ready to crank up production.

Think of it like the U.S. saying: “Hey, can I copy your homework, but let’s pretend it’s teamwork?”

Timing? Chef’s Kiss

This deal didn’t just fall from the sky. It landed right after China slapped more restrictions on exporting critical minerals.

Trump saw China’s move and hit back with an “Oh yeah? Watch this.”

And get this — Trump also said the AUKUS pact (U.S.–U.K.–Australia defense alliance) is “moving along very rapidly.”

So, the bromance is military and mineral.

The Big Winner: Lynas Rare Earths 💎

There’s one company that’s already doing a victory dance — Lynas Rare Earths.

They’re the only heavy rare earth producer outside China, based right in Australia.

Their stock popped +14.1% on Monday like it just got added to Trump’s Christmas card list.

Investors see this as the start of a potential non-China rare earth supply chain — and Lynas might be the MVP.

Why This Matters

Rare earths are the unsung heroes of modern tech — from EV motors to missiles.

If you control the supply, you control the game.

China’s been the boss for decades… but now, the U.S. and Australia are trying to build their own sandbox.

This deal? A baby step toward mineral independence… and one giant middle finger to Beijing’s export controls.

TL;DR:

Trump & Australia signed a $2B rare earth alliance to reduce China dependence.

Each side is dropping $1B for new mining & processing projects.

Australia = 4th-largest rare earth holder, with room to expand.

China just tightened export rules — so the timing is chef’s kiss.

Lynas Rare Earths stock popped +14% on the news.

In short: The U.S. and Australia just launched the “Make Rare Earths Great Again” plan — and China’s not on the guest list.

1. Ride the Rare Earths Rally

Trump’s $2B deal with Australia is a green light for non-China rare earth producers. Demand’s about to pop as Western nations scramble for supply independence.

📌 Action: Accumulate shares of Lynas Rare Earths $LYSDY ( ▲ 2.4% ) or MP Materials $MP ( ▲ 4.92% ) on dips. Both stand to gain from new U.S.–Australia projects.

2. Bet on the Builders Behind the Boom

New rare earth facilities mean infrastructure, engineering, and mining equipment contracts flying out the door.

📌 Action: Look at industrial players like Caterpillar $CAT ( ▲ 1.56% ) and Komatsu — both benefit from expanded mining operations in Australia.

3. Play the Clean Tech Ripple Effect

Rare earths are the lifeblood of EVs, wind turbines, and high-end electronics. If supply chains get stronger, production costs could ease — boosting margins.

📌 Action: Position in downstream beneficiaries like Siemens Energy $ENR.F ( 0.0% ) that rely heavily on rare earth materials for growth.

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.