Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 26th November 2024:

The Diet Pill Jackpot 💊💰

111% Gain in 10 Days 🤯

The Diet Pill Jackpot 💊💰

It’s a great day to be selling weight loss cheat codes.

The Biden admin just made a move that could super-size the market for anti-obesity drugs. The market loved it & that’s what made Eli Lilly & Co my biggest gainer for today.

Most pharma stocks responded well to today’s news. Eli Lilly performed the best

So why did the market love it? What’s actually going to happen?

Right now, Medicare & Medicaid only cover anti-obesity meds for specific conditions like diabetes. The new proposal has the potential to put these drugs in the chubby hands of 3.4M more Americans.

If this passes, big pharma get access to 3.4 million more customers overnight. That’s why the market loved it.

Who’s Getting the Gains?🍟

Now we know why it’s good news, who’s set to make the most money? And more importantly, how can we make the most money out of it?

Here’s my plan. 🗒

Big Dogs: Novo & Eli Lilly are the reigning champs in this space. They own the GLP-1 drug market (aka the meds behind Ozempic & Mounjaro). These stocks are heavily undervalued right now even if the bill doesn’t come through. And if it does? No brainer to have these guys as part of a portfolio.

Underdogs: There’s also a few smaller guys that are undervalued & will benefit from this. I wrote a whole bit on Hims & Hers (HIMS) a few weeks ago that you can read here.

Insurers: The guys providing the insurance also stand to benefit with the higher enrollment numbers that could come about. I’m looking at companies like UnitedHealth (UNH), Humana (HUM), & CVS (CVS).

Show Me the Money🤑

If Biden gifting millions more more customers wasn’t enough, Morgan Stanley have also come out & raised their forecasts for the space.

Their 2030 obesity drug market forecast has bumped from a single patty $77B to a Big Mac $144B.

That’s a huge revision & only makes companies like Eli Lilly & Novo look like even more of a value play.

Why would you not want a part of the companies with a monopoly on a market expected to grow by $144 BILLION in the next 5 years?!

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

111% Gain in 10 Days 🤯

SMCI’s volatility is putting meme stocks to shame. What is going on with them? Is it worth trying to cash in?

Well, it’s a bit of a messy back story.

Last month, SMCI tanked 47% in four straight days.

Why?

Ernst & Young, their auditor, quit & said, “Yeah, we don’t trust your governance and internal controls.” 😬

Less than ideal. Even worse is this news came out the day after I bought my first position. 😭How’s that for timing the market….

Investors ran for the hills & you can’t blame them. And just when you thought it couldn’t get any worse, SMCI delayed its 10-K filing & dropped some “meh” guidance for Q2.

By November 15, the stock hit a 52-week low. Pain.

The Plot Twist 🌹

As this was going on I carried on averaging down. Only small positions. But I thought the risk/reward was worth it after such a huge drop. I already thought the company was good value before the price was cut in half. I wasn’t sold on the idea of them cooking the books so if that’s case I’d be stupid to not take advantage.

They didn’t let me down.🥳

They brought in BDO USA as their new auditor. Not one of the Big Four, but solid enough to calm nerves, make me feel better & keep Nasdaq delisting fears away.

A few analysts have also slapped them with an upgrade since & chucking around phrases like “bargain buying opportunity”.

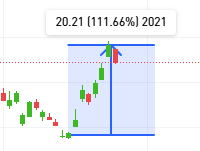

Over 111% gain in the space of 10 days for SMCI

Since bottoming out at around $16 SMCI gained over 111% in 10 days.

Because I’ve been averaging in, that’s left me with individual trades sitting at over 90% profit. Overall profit sits at over 20%.

My current open trades for SMCI

To be super clear - a position in SMCI is a big risk. But I think there’s huge upside here, too. I’m talking 200%+.

If they can manage to stay listed, updated audits come back clean & get a few solid quarters under their belt hitting growth forecasts, things should start to look sane again.

Another day, another double figure move for SMCI

Until then, expect to these double figure daily swings to be the norm. If you can stomach it & invest only what you’re happy to lose, this could be one of the better opportunities available right now.

What did you think of today's update?

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️