Stocks of the Week!

In this email:

Turning Bots Into Billions 🤖💰

Don't Miss this Flight! ✈️

Turning Bots Into Billions 🤖💰

There’s been blood in the streets.

Nasdaq is down over 11% from recent highs & there’s no sign of stopping yet. If you thought buying big tech stocks was a good idea a month ago it should be a great idea now.

I’ve seen some worries that this is the AI “bubble” bursting but pullbacks & corrections are a very normal part of long term investing.

This is just one of those corrections.

And there’s one tech/AI stock that I think will do a better job of bouncing back & turning their bots into billions than the rest….

…Microsoft!

Let me tell you why I think it’s one of the better buys in the sea of red 👇

The Nasdaq is red, red, red right now. Buying QQQ wouldn’t a bad idea for wide exposure right now

Microsoft reported Q4 earnings this week & they smashed it out the park.

The stocks has dropped 5% since then & nearly 13% from recent highs. Somebody make it make sense.

I’m not complaining. I’ve got my wallet open & putting $MSFT straight in my basket while it’s on sale.

AI’s been integrated into their practically all of their services & it’s paying off in a big way.

Here’s how it looks up close 🔍

- Office for Commercial Customers: Sales soared to $48 billion, a massive leap from last year’s 10% growth. Copilot Pro subscriptions are doing wonders here.

- Office for Individual Users: Also on the up, with sales hitting $6.2 billion, up 4% compared to last year’s 2%.

- LinkedIn: A bit of a slow burner here, with a 9% growth (down from 10.5% last year). But not every segment can be a rockstar every year. I’ve hear rumours they’re going to be looking at short form video on the platform too which is all the rage right now…

- Dynamics ERP and CRM: Sales reached $6.3 billion, up 19%, beating last year’s 16% growth. The Copilot integration in Dynamics Contact Center is a game-changer here.

- Windows Sales: Made a comeback with $22.7 billion (up 8%).

- Gaming: Boosted by the Activision Blizzard acquisition. 16% total sales growth here.

- Bing: Rose to $14.3 billion, a modest 3% increase. I’m honestly surprised there’s any growth here. I love Microsoft but who’s using Bing?! 🤣

- Devices: Took a hit, dropping to $4.6 billion, down 15% YoY.

- Cloud and Servers: Rose a healthy 20% thanks to Azure’s 30% growth. Generative AI is only 8% of that growth.

Did you notice the trend?

It’s a main serving of super high growth with a small portion of modest increases.

And they’re not done squeezing the juice out of AI just yet.

CEO Satya Nadella made it abundantly it: AI is the future, and they’re investing big.

CapEx (money spent on things to help the business to grow) for FY2024 was a huge $45 billion & they’re cranking the “Spend” dial even higher.

This might squeeze profit margins a bit in the short term but it’s all part of the long game. And that’s what we invest for, right?

Market dominance and growth potential make Microsoft a solid buy & it gives me even more confidence when they’re spending more to stay ahead of the curve in one of the most competitive spaces.

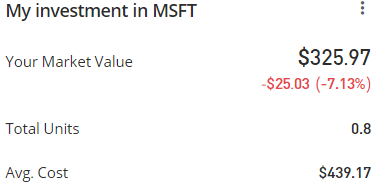

I’ll be adding to my position to bring down my average cost in Microsoft

Yes, the market looks scary right now. But if you only buy when it’s green you’re doing yourself a disservice.

Keep your eyes on the prize. And by prize, I mean the undervalued stocks available right now.

Microsoft already makes up over 7% of my portfolio. With it’s diverse ecosystem, continued investment in AI & software packages that have stood the test of time, I don’t think you can go too far wrong. I’ll be scaling into my position to lower my average cost over the next few weeks.

It’s more than reasonable to expect recent highs to return which would be around a 14% gain from current price. Beyond that, I’d expect price to reach around $500 which would gives me a 20% gain.

The Rising Demand for Whiskey: A Smart Investor’s Choice

Why are 250,000 Vinovest customers investing in whiskey?

In a word - consumption.

Global alcohol consumption is on the rise, with projections hitting new peaks by 2028. Whiskey, in particular, is experiencing significant growth, with the number of US craft distilleries quadrupling in the past decade. Younger generations are moving from beer to cocktails, boosting whiskey's popularity.

That’s not all.

Whiskey's tangible nature, market resilience, and Vinovest’s strategic approach make whiskey a smart addition to any diversified portfolio.

Don't Miss this Flight! ✈️

Did you jump on travel sector stocks post-pandemic?

I can’t blame you if you didn’t. A few went bust, some stagnated & then there were studs like Trip.com.

The China-based travel agent has been flying high post pandemic making gains of over 100% aka double your money.

Good news is there’s still room to get aboard this money train.🚂

Let’s talk numbers.

Trip.com’s revenues have skyrocketed, doubling in 2023 compared to the last couple of tough years.

This massive bounce-back is thanks to China lifting its zero-COVID policy. The zero-COVID policy had strict lockdowns, quarantines & severe travel restrictions.

You can see how that’d be less than ideal if you’re a travel agent where most of your revenue came from Greater China.

Needless to say, the policy change was amazing for trip.com. And they’ve not only recovered but also generating more revenue than pre-pandemic 🎉

With a 20% Compound Annual Growth Rate (CAGR) over the past decade and a jaw-dropping 41% 3-year CAGR, Trip.com is a powerhouse.

There is a lot of room for growth on this one

As of Q1 ’24, Trip.com is sitting pretty with $9.4B in cash & short-term investments against $6.5B in total debt. This healthy balance sheet means Trip.com has plenty of cash to cover its debts and then some. Plus, its investments are giving higher returns than its annual interest costs which is a great sign for it’s financial health.💰

Trip.com’s potential isn’t confined to China. The company is making big moves internationally, particularly in the Asia Pacific region. Management reported an 80% year-over-year surge in its overseas OTA platform. They’re aiming to become the go-to travel platform in Asia within the next 3-5 years—a goal that seems quite achievable given their current trajectory. 🌐

Given all these growth plans, a return to recent highs seems inevitable. That’d sit us at a 40%+ return. And the downside looks minimal right now.

As always, the biggest risk with Chine-based companies is exactly that. That they’re based in China.

Government regulations can be unpredictable, and there’s always a chance that Trip.com might struggle to gain a foothold outside Asia. Competition is always tough in the travel space & margins could take a hit as the company fights for market share. 🚧

All things considered, Trip.com has too much reward to be overly concerned with the minimal risk right now. Robust recovery, strong balance sheet, and promising international expansion.

It’s a no brainer.

I’ll probably look to keep my position size around 1-2% of the account & scale up over the next couple of months depending on how the market goes.

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️