In today’s post:

Undervalued & Unstoppable 📈

The Inside Scoop 👀

AI Day Flopped…. But I’m Still Buying ❤

UNDERVALUED AND UNSTOPPABLE 📈

Adobe $ADBE ( ▲ 3.44% ) just delivered Q2 earnings. Let’s take a look.

Revenue: $5.87B (beat by $70M)

EPS: $5.06 (beat by $0.09)

Growth: +11% YoY

Adobe’s latest earnings report was a beat across the board

Super impressive. Where’s all the juice coming from? AI.

Every legacy company is saying they love AI more than me than when I watch the Bigfoot Vlogs (if ya know, ya know) but Adobe actually walks the walk. Their AI-powered tools like Firefly and Adobe Assistant aren’t just for the buzzwords. They’re printing money.

Digital Media Is the Money Printer 🚀

This one division brings in 74% of Adobe’s revenue. I’m talking stuff like Photoshop, Illustrator, Premiere Pro. The holy trinity of content creation. (The tools I use to get this newsletter out to you❤)

What’s wild is the big growth isn’t even coming from the U.S. anymore. It’s popping off in places like:

Latin America

India

Eastern Europe

Adobe’s going global but its margins stay local… and high.

The Profits? Still Chunky 💰

Gross profits hit $5.2B

Gross margins? Super strong

Top-line and bottom-line growth? Still in sync

That’s rare. Usually when companies start investing heavy in AI, you see profits take a hit. And to be fair, it’s a pretty good excuse. But a company that can growth both? You have to pay attention.

AI = Tailwinds on Tailwinds 🧠

Companies are forecasted to spend $643.9B on generative AI this year, up 76.4% from last year.

Firefly is perfectly positioned to hoover up a chunk of that spend. It’s turning heads in the creator world. Adobe’s deep moat in that market gives it major pricing power, too.

Bonus points: they just raised full-year revenue guidance too.

The Valuation? Still A Bargain 📊

P/E: 18.99X forward earnings

Peer average: 23.8X

Industry average: 24.0X

What does all that mean? Adobe’s trading at a discount.

And that’s even with its projected EPS growth higher than the industry average.

The Bull Case 📈

At the current price of $390 the downside looks minimal. Wall Street tends to agree. But what about the upside?

The average upside estimate from Wall Street is 25% but I think we can squeeze a little more out

33% upside if it re-rates to peer P/E

Fair value target: ~$550 (still well short of 2024 highs of $635)

It’s a long-term buy if you believe creators will keep creating (spoiler alert: they will)

A move back to $550 gives us a 40%ish gain.

The Risk⚠️

AI is a double-edged sword. It’s helping Adobe now, but do you know who else it helps? Little guys get ahead faster.

AI might help small startups to build Adobe-lite versions with way less overhead.

If Adobe loses its edge in AI or growth stalls, that could flip the story. Just something to be mindful of.

TLDR:

Adobe’s AI plays are working.

Revenue’s up. Profits are chunky. Guidance is strong.

And the stock’s still undervalued.

If you’re looking for a software company that’s actually using AI to grow (instead of just talking about it), Adobe might be the one.

THE INSIDE SCOOP 👀

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

AI DAY FLOPPED… BUT I’M STILL BUYING ❤

AMD $AMD ( ▲ 8.77% ) just held its big AI Day. You’d think we’d get a rally right? Wrong.

Shares dropped 2%. 😭

But while everyone’s squinting at AMD’s AI chops, they’re missing what really matters right now: server CPUs.

Probably not the reaction they were hoping for… but it’s fine…

AI Day Was... Fine.

CEO Lisa Su stood on stage with Sam Altman. They talked up the next-gen Instinct MI400 GPUs. Dropped some impressive specs. Even introduced a new interconnect tech called UALink to rival Nvidia’s NVLink.

Cool names. Cooler charts. The crowd yawned.

MI400 isn’t even shipping yet. What’s out now is the MI355X. And yeah, it’s going up against Nvidia’s B100 and B200 chips, (which have already been chewing up market share). So far, AMD’s GPU game isn’t lighting the AI world on fire.

Even with aggressive pricing and solid partnerships (Tesla, xAI, Meta, Oracle), this part of the business isn’t moving the needle… yet!

Here’s What Is Moving the Needle: Server CPUs 📈

While the AI headlines grab attention, the CPU business is quietly stealing Intel’s lunch.

AMD had basically 0% of the server market in 2017

Today? They’re at 39.4% and climbing

Forecasts say they could hit 50% by 2026

How’s it happened? EPYC processors.

AMDs real power play…

AMD’s delivering on performance and undercutting Intel on power and price. Intel’s still stumbling around trying to figure out where they left their moat.

In Q1 alone:

Server CPU share jumped 3.1% sequentially

Up 6.1% year-over-year

Client CPU share also grew 10.2% year-over-year

The best part? It’s happening now. These aren’t some hypothetical AI future figures promised five years away.

So What Now? 🤔

I think AMD is a strong buy. But that doesn’t mean I think it’s cheap.

Forward P/E: 62x

EV/Sales: 7x

But those numbers are coming down. And I think it’s one of those “you get what you pay for” stocks. Growth is coming. And it’s not just hype.

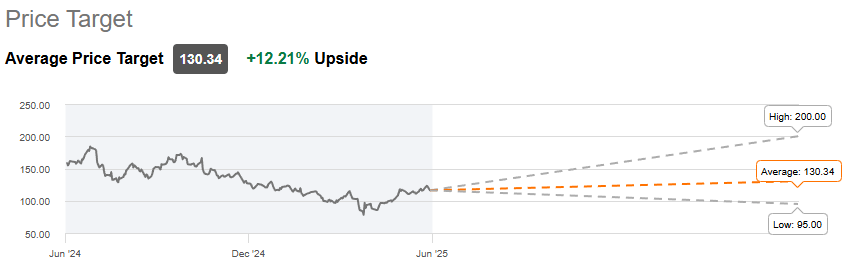

Wall streets average upside is 12%. I think that’s pretty conservative with what AMD has cooking.

Nvidia will continue dominating AI for the foreseeable future. There’s no getting around that. But AMD is carving out a real lane in the datacenter, paved with server chips. It’s worth having in the portfolio.

So forget the fireworks. Forget the buzzwords. The quiet compounding power is coming from CPUs, not GPUs.

I’m in.