Gainers📈 & Losers📉

Our Biggest Gainers & Losers of the Day in the $100,000 Build Portfolio

For the 21st August 2024:

Upgraded & Ready to Rocket! 🚀

They Sold All of It?! 😮

Upgraded & Ready to Rocket! 🚀

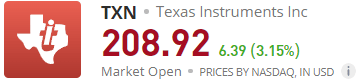

Stock rating’s tend to be self-fulfilling. We’ve seen it earlier in the week with McDonalds & it’s given me my biggest gainer again today. Texas Instruments Inc.

A 3%+ gain for TXN today on the back of CitiGroup upgrading their rating

So who gave them the upgrade?

Well, it was Citigroup giving TXN the thumbs up by upgrading them from a “Neutral” to a “Buy”

They also moved the price target from $200 to $235 which is about 12% upside from current price.

And why did they get the upgrade?

The analysts think TXN’s profit margins have hit their lowest point & now set to rebound. They’ve reached that conclusion for a few reasons.

Over the last few years TXM has been investing a bunch into new tech & manufacturing facilities. That’s heavily increased their capital expenditure or CapEx for short (money a company spends on acquiring or upgrading physical assets like buildings and equipment for long-term growth) which reduces profits in the short term. CapEx is slowing down now & as new manufacturing facilities come online they’ll get a boost operational efficiency & reduce costs.

There’s also supply chain pressures easing, demand in key markets stabilizing & moving the focus to high margin products.

All of the above means more profit.

In fact, Citi think’s it means TXN’s profits are going to double & expecting a 100% growth in earnings per share (EPS)

And when profits go up, the stock usually follows. EPS growth is a key driver of stock prices—when profits go up, the stock usually follows.

TXN makes up a very small part of my portfolio right now, about 0,5%. With Citi’s upgrade & the growth expectations I think I’ll be looking to increase this position size.

I actually think the $235 target is pretty conservative & we’ll see price reach higher if future earnings meet these expectations. And if they exceed them I wanna be aboard that rocket. 🚀

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

They Sold All of It?! 😮

My biggest loser today is a great opportunity to buy in & that’s what I’m going to be doing.

I’m talking about Jd.com. They were down over 8% at some points today but already recovered some of those losses, sitting at around -5% right now.

Down over 5% but that’s after recovering over 3%

So why the huge drop?

Walmart sold their entire 10.35% stake in Jd.com for $3.7billion after holding for 8 years.

Before we go any further, we need to look at why Walmart got involved with JD & what’s made them sell up.

They initially jumped into JD.com back in 2016 after deciding that building their own Chinese e-commerce platform was more hassle than it was worth. Instead, they swapped their Yihaodian site for a piece of JD.com. That gave them access to JD’s ready-made delivery network & massive customer base.

Initial stake was 5% Walamart even increased their stake later that year.

But fast forward to now, and Walmart has decided it’s time to cash out.

Sale price was at $24.95 each & Walmart would of made a hefty profit on that from their average price back in 2016 but why sell now?

According to Walmart, this move lets them focus on their operations in China, particularly Walmart China and Sam’s Club, & reallocate capital to other priorities. In a sentence, they’re putting their money where they see the best opportunities.

It could also have something to do with growing tensions between the U.S. & China, puts pressure on companies operating in both markets. Walmart has been in China since 1996 but has struggled to grow as quickly as local competitors. The sale could also Walmart’s way of taking some money off the table in China with geopolitical tensions on the rise.

Now, all that said, I do think the huge drop is an overreaction & is a buying opportunity.

Just last week, JD.com reported a 92% rise in quarterly profit, beating expectations. That’s even with super tough competition from Alibaba & PDD.

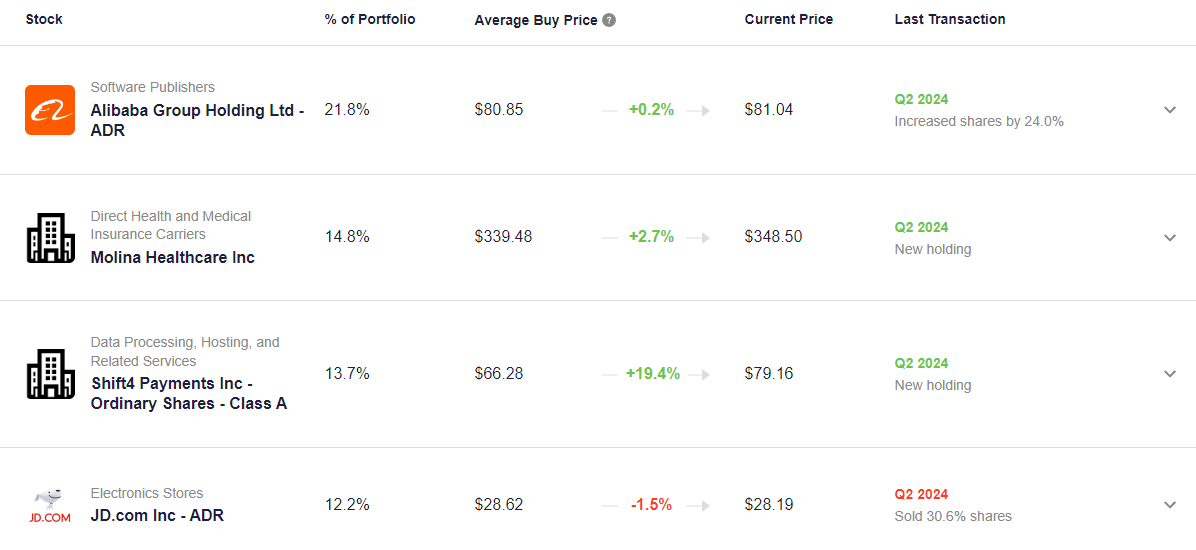

Michael Burry’s largest holdings

That fact does make me question Walmart’s decision to sell even more Are they taking profits while the going’s good? Do they see challenges behind the scenes that we can’t as retail investors?

Either way, with that increase in profit & a now 5% discount, I think it’s worth a buy.

And JD.com makes up 12.2% of Michael Burry’s (the guy from “The Big Short”) portfolio which he’s added to recently. If it’s good enough for him, it’s good enough for me.

That’s all! See you same time tomorrow week 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️