In today’s post:

WHAT JUST HAPPENED? 😲

Trade Deal or Trade Dud?🤝

Lockheed Hit By Friendly Fire ✈

WHAT JUST HAPPENED? 😲

Wall Street hit the snooze button.

Stocks opened strong, but when I checked again in the afternoon... the gains were gone. All three major indexes closed in the red:

S&P 500: -0.3% (still clinging to the 6,000 level 💪)

Nasdaq: -0.5%

Dow: Flat, barely moved

Why the mood swing?

Blame it on a lack of follow-through from earlier trade optimism… and a healthy dose of “wtf is this” from investors who want actual details, not headlines.

Investors need cold hard facts in black & white to get some confidence going

But guess what did rally?

Bonds. Bonds got hot. Yields got dropped. Inflation cooled. Fed cuts might be back on the table.

10-year Treasury yield: ↓ 6bps to 4.42%

2-year yield: ↓ 8bps to 3.95%

The May Core CPI came in softer than expected:

+0.1% M/M (vs. +0.3% expected)

+2.8% Y/Y (in line, but moving in the right direction)

That’s a pretty strong signal that price pressures are easing. If inflation isn’t running hot, the Fed doesn’t need to keep interest rates high to fight it.

Lower inflation = less urgency to keep rates up = more flexibility to cut rates if needed.

And that’s why:

Bonds rallied

Bond yields dropped (because traders now expect potential rate cuts sooner)

The Fed can breathe a little easier without worrying they’re falling behind inflation. Markets like that.

Bull Moves 🧠

1. Position for Rate Cuts with Bond ETFs

If rate cuts come sooner, longer-term bonds will likely gain in value as yields fall further. You’re front-running the Fed pivot.

📌Action: Buy longer-duration bond ETFs (e.g., $TLT ( ▲ 0.18% ) $IEF ( ▼ 0.02% ) or $VGIT ( ▼ 0.07% ))

2. Rotate into Rate-Sensitive Stocks

These sectors tend to perform well when rates fall. Lower rates makes borrowing cheaper and boost valuations. Especially for high-growth, cash-burning tech.

📌Action: Add exposure to real estate $XLRE ( ▲ 0.28% ), utilities $XLU ( ▲ 1.11% ) , or growth tech $NASDAQ ( 0.0% )

3. Watch for Pullbacks to Buy the Dip

The market sold off on bad sentiment, not bad fundamentals. With inflation cooling and rate cut hopes rising, dips could be short-term buying opportunities.

📌Action: Set buy targets for high-quality stocks that dipped with the market

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

TRADE DEAL OR TRADE DUD?🤝

Trump jumped on Truth Social to shout about a “done” trade deal with China… but markets didn’t bite.

The supposed agreement includes:

China resuming rare earth exports to the U.S.

Chinese students keeping access to U.S. universities

Sounds great. But where’s the papers? Or signatures? Or final approvals? Nowhere to be seen. Even Trump admitted the deal needs sign-off from Xi Jinping.

All talk but where’s the signed paperwork

Wall Street felt the same.

We’ll believe it when we see it. And right now, it’s not very clear at all. I feel like Velma on my hands & knees looking for my specs to see things a little better.

Even with a deal, tariffs on Chinese goods will stay as high as 55%. It doesn’t seem like much of a resolution at all.

Tariffs as high as 55% still feel like not much of a deal

Trump flip-flops so much it’s made it hard for investors to commit their hard earned cash on the back of his tweets. Everyone’s still playing defense.

Bull Moves 🧠

1. Play Rare Earth Tensions with U.S. Suppliers

China resuming exports sounds good… if it actually happens. Any breakdown boosts demand for non-Chinese supply.

📌 Action: Add exposure to U.S.-based rare earth producers like MP Materials $MP ( ▲ 4.92% ) or ETFs like $REMX ( ▲ 3.69% ) for a speculative upside if the deal collapses.

2. Stay Defensive Until the Dust Settles

Markets aren’t buying the hype. And Trump’s track record isn’t helping. Until there’s a signed deal, who wants to jump in with both feet? Not me.

📌 Action: Rotate into defensive sectors like healthcare ($XLV ( ▼ 0.42% )) consumer staples ($XLP ( ▲ 0.87% )) , or utilities ($XLU ( ▲ 1.11% )) to ride out the noise.

3. Trade the Tweet-Driven Whiplash

Uncertainty breeds volatility. And Trump’s headlines usually move China-linked stocks… fast.

📌 Action: Track ETFs like $FXI ( ▼ 0.8% ) or $KWEB ( ▼ 0.09% ) for sharp intraday or multi-day swings. Buy on overreactions, sell into rebounds. Use tight stop-losses and clear entry/exit rules.

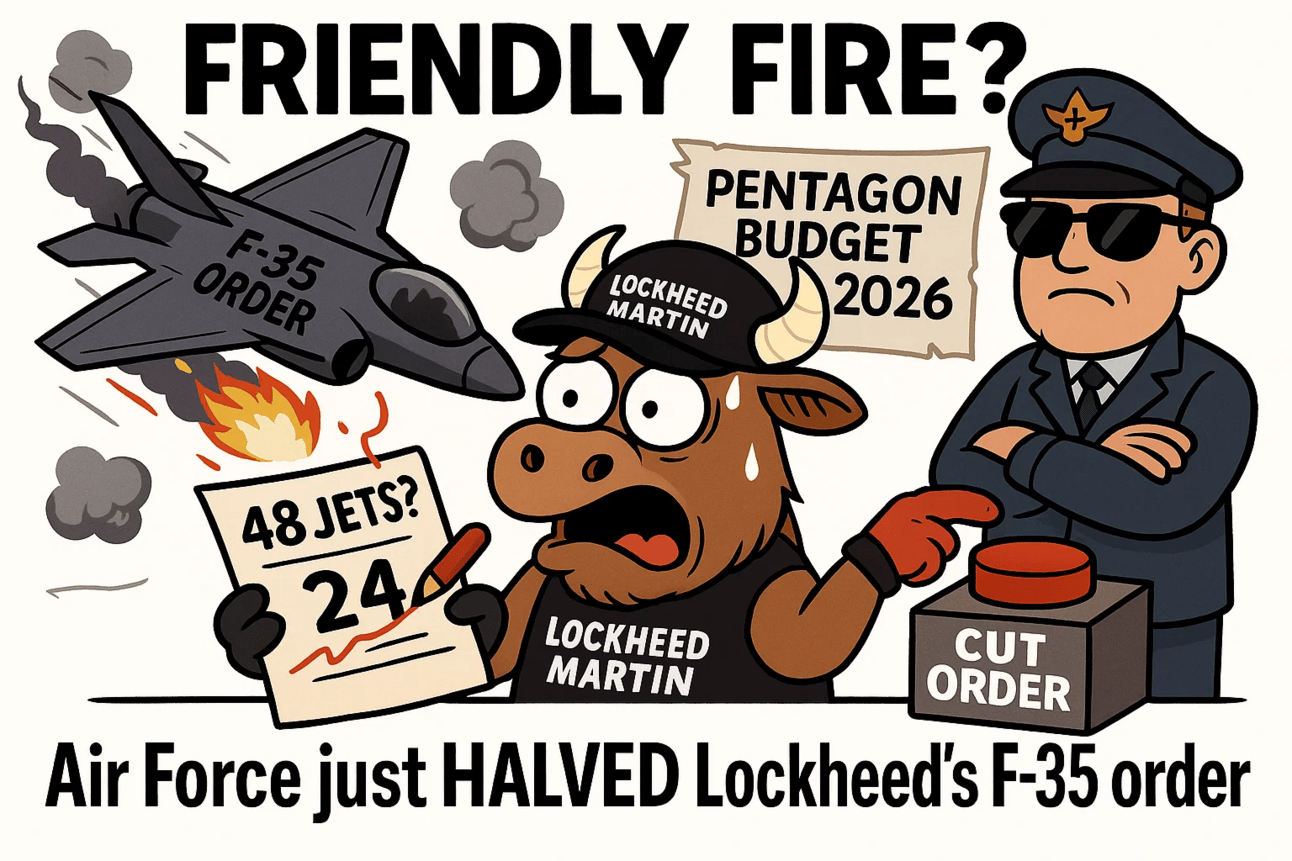

LOCKHEED HIT BY FRIENDLY FIRE ✈

Lockheed Martin $LMT ( ▲ 0.58% ) dropped as much as 7% today. It’s their biggest fall since March and closed the day down 4.3%.

The reason?

Friendly fire. One of their biggest customers pulled their purse strings. The U.S. Air Force.

According to a new Pentagon budget doc, the Air Force is only asking for 24 F-35 jets in fiscal 2026. That’s half the number it originally projected (48). Oof.

Halving the order is not ideal

This could be part of Defense Secretary Pete Hegseth’s plan to trim military spending over the next 5 years.

But there might be hope if you’re a Lockheed Bag holder. The budget isn’t final.

Congress still has to weigh in, and they’ve historically been very pro-F-35. Especially since the program touches jobs across a bunch of districts.

It wasn’t just Lockheed that took a hit:

Northrop Grumman: -2.2%

RTX (Raytheon): -0.7%

Defense stocks got clipped, but this story isn’t over yet. The F-35 program is too big (and too political) to ground without a fight.

Bull Moves 🧠

1. Buy the Dip in Defense Blue Chips

A 4.3% drop on a non-final budget cut? That’s a classic overreaction. Especially with Congress likely to restore funding.

📌 Action: Accumulate quality defense names like Lockheed Martin $LMT ( ▲ 0.58% ) or Northrop Grumman $NOC ( ▲ 0.32% ) on weakness. Focus on long-term contracts and government backing.

2. Watch Congress for the Green Light

The F-35 is a jobs program in disguise. Congress has a track record of stepping in to protect it, especially in election years.

📌 Action: Track defense budget negotiations. If funding is reinstated, expect a sharp recovery in LMT and related names. Set alerts for committee updates or bill amendments.

3. Spread the Risk with a Defense ETF

If you want exposure without betting on one name, the entire sector could bounce if the F-35 budget gets saved.

📌 Action: Buy the dip in a diversified defense ETF like $ITA ( ▲ 0.77% ) (iShares U.S. Aerospace & Defense) or $XAR ( ▲ 1.44% ) (SPDR S&P Aerospace & Defense). Great way to benefit without company-specific risk.