In today’s post:

When Will Bitcoin Be Back Above $100k? 🤔

The $80B AI Money Drain 💰

Is War Fueling This Rally? 💣

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

WHEN WILL BITCOIN BE BACK ABOVE $100K? 🤔

Bitcoin just pulled a full “main character loses confidence in Act 2” arc.

After flirting with $100K, BTC is now back under $70,000 — and the mood shifted fast.

On January 14, Bitcoin hit $97,939.

Since then?

📉 -31.5% from the peak

📉 -23.3% year-to-date

That’s a hard momentum reset.

The $100K Question

The last time Bitcoin traded above six figures was November 13.

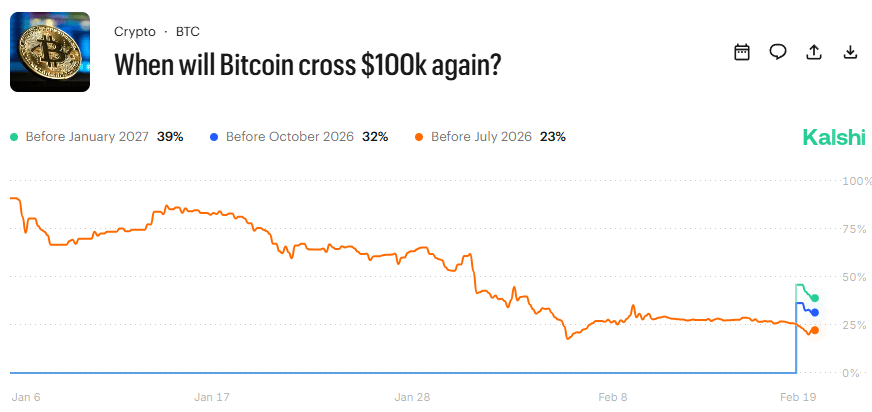

Now prediction market Kalshi is cooling expectations.

Here’s what traders are pricing:

39% — Before January 2027

32% — Before October 2026

23% — Before July 2026

17% — Before June 2026

11% — Before May 2026

6% — Before April 2026

2% — Before March 2026

Traders think $100K isn’t “imminent.” But a whole bunch think it’s “eventually.”

What This Actually Means

Sentiment flipped.

When Bitcoin drifts far from big round numbers, momentum traders step back and volatility picks up. That’s where we are.

Prediction markets aren’t prophecy — they reflect positioning. And right now, the crowd wants more proof.

Liquidity. ETF flows. Macro tailwinds. Something.

Until then?

The road back to $100K just got longer.

If you trust the process, it could be the time to get a bitcoin miner while it’s not as cool.

TL;DR

Bitcoin hit $97,939 in January.

It’s down 31.5% from that high and under $70K.

Kalshi gives just a 39% chance of $100K before 2027.

Sentiment cooled. Volatility didn’t.

Crypto doesn’t move in straight lines. And neither does conviction.

THE $80B AI MONEY DRAIN 💰

Anthropic is building a cloud money cannon.

And the people standing under it?

Amazon

Alphabet

Microsoft

The $80B “Rent” Bill

Anthropic expects to pay at least $80 BILLION through 2029 just to run Claude on their cloud servers.

That’s not profit share.

That’s just… electricity and server rent.

But wait. It gets juicier.

Because the cloud giants don’t just charge rent.

They take a cut of sales too.

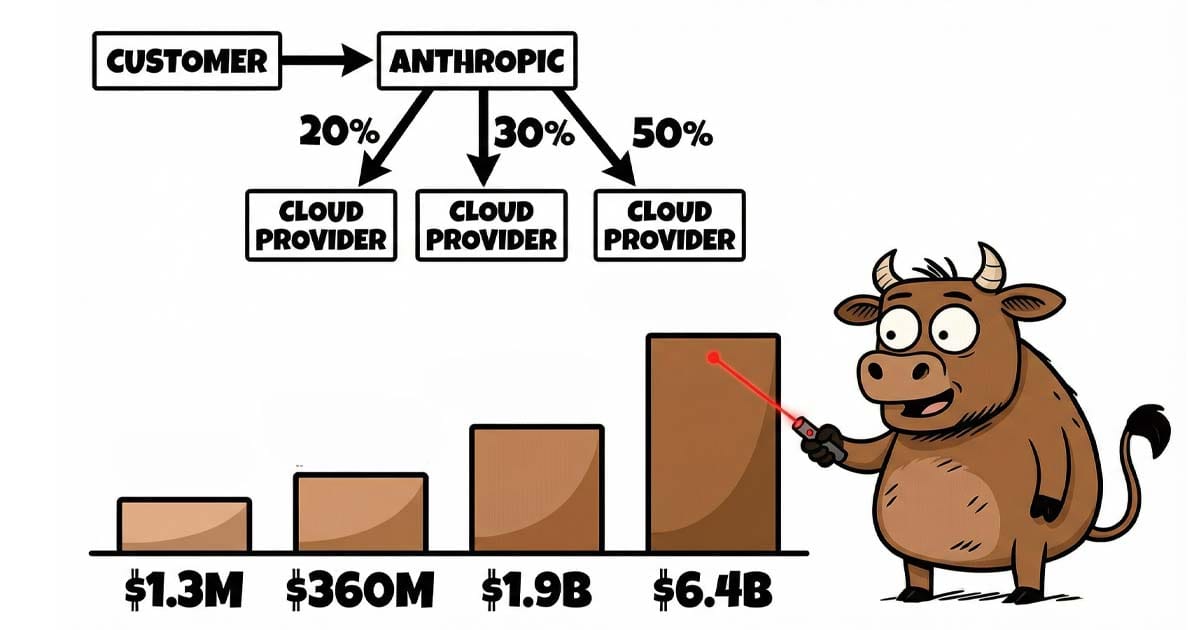

If a customer buys Anthropic’s AI through a cloud platform?

The cloud provider gets a slice.

And this slice is growing FAST.

Here’s how it’s scaling:

2024: ~$1.3M

2025: ~$360M

2026: ~$1.9B

2027: ~$6.4B

That’s not a typo. From pocket change… to billions… in 3 years.

At peak projections, these payouts equal ~10% of Anthropic’s total revenue.

That’s meaningful.

That’s “this better be worth it” money.

Why Would Anthropic Agree To This?

Because cloud providers become your sales army.

Example:

Microsoft reportedly lets Azure sales reps count Anthropic model sales toward their quota — just like Microsoft software or even OpenAI models.

Sales rep sees quota.

Sales rep sees commission.

Sales rep pushes Claude.

That’s distribution leverage.

How Big Are The Cuts?

Some spicy numbers from the report:

Around 50% of Anthropic’s gross profits on AI sold through AWS may go to Amazon.

Google typically takes 20–30% of net revenue when reselling partner software.

OpenAI pays Microsoft 20% of total revenue under their deal.

Yes. Total revenue.

Not profit.

Total.

And OpenAI is expected to pay over $13B in revenue share in 2026–2027 alone.

AI is expensive. But distribution is more expensive.

The Cloud Is Winning Either Way

Cloud providers make money from Anthropic in multiple ways:

Compute to run models (~$80B through 2029)

Training costs (could reach $100B through 2029)

Revenue share on resale

Hardware usage (think Nvidia GPUs + proprietary chips)

Anthropic relies on:

Nvidia GPUs

Amazon’s Trainium chips

Google’s TPUs

So even when Anthropic sells AI directly to customers (first-party sales), it still mostly runs on AWS.

The house always wins.

Anthropic vs OpenAI: Different Strategy

Anthropic says working with all three cloud giants gives it an edge.

Why?

Because each cloud provider can push its models to their enterprise clients.

Meanwhile, OpenAI leans heavily on Microsoft distribution.

Different strategy.

Same outcome:

Cloud providers skim the toll.

Big Picture: Who Has The Power?

Anthropic forecasts up to $18B revenue in 2026.

That’s monster growth.

But here’s the twist:

Most of that revenue (as of last summer) came from direct sales, not cloud resales.

Which means:

The cloud share slice could get even bigger

—or get renegotiated.

Everything in AI is still fluid.

Except the cloud bill.

That’s very real.

What This Means For Investors

If you own:

Amazon

Microsoft

Alphabet

You don’t even need to pick the AI winner.

You own the toll booth.

AI startups burn billions training models.

Cloud providers collect the meter fees.

It’s like selling shovels during a gold rush…

except the shovels cost $100B.

TL;DR

Anthropic will pay $80B+ in cloud costs through 2029.

It will also pay billions more in revenue share to cloud partners.

Some deals may give cloud providers 20–50% of profits on resold AI.

Training costs could hit $100B.

OpenAI is paying Microsoft ~20% of total revenue.

The real AI winners might be the infrastructure giants.

1. Own the AI Toll Booths

Anthropic may build the brains… But Amazon, Microsoft, and Alphabet own the land, the power grid, and the checkout counter. They get Cloud rent (compute). Training spend, revenue share (20–50% in some cases). This is picks-and-shovels investing — without having to guess which AI model wins.

📌 Action: Gradually accumulate $AMZN ( ▲ 1.81% ), $MSFT ( ▲ 0.69% ), or $GOOGL ( ▲ 0.43% ) on pullbacks. Focus on cloud growth trends in earnings (AWS, Azure, GCP). Treat AI demand as a multi-year infrastructure cycle, not a hype trade.

2. Track AI Capex → Follow the Chip Money

Anthropic expects up to $100B in training costs through 2029. That money doesn’t disappear. It flows to Nvidia GPUs, Custom silicon (Trainium, TPUs), Data center buildout. Even if model margins compress, chip demand stays structural.

📌 Action: Allocate exposure to $NVDA ( ▲ 1.63% ) and monitor hyperscaler capex guidance each quarter. Rising capex = confirmation the AI buildout is still accelerating. If capex slows materially, reassess position sizing.

3. Prioritise Distribution Moats Over Model Hype

Anthropic and OpenAI both share revenue with cloud partners. AI companies need distribution. Cloud giants control enterprise pipelines. Sales reps are incentivised to push these models. That’s sticky.

📌 Action: When analysing AI stocks, overweight companies with embedded enterprise distribution (cloud platforms, enterprise software ecosystems) over standalone AI startups. Lean toward integrated ecosystems $MSFT ( ▲ 0.69% ) $AMZN ( ▲ 1.81% ) $GOOGL ( ▲ 0.43% ) rather than pure-model speculation.

IS WAR FUELING THIS RALLY? 💣

Gold just pulled a classic.

Two red days.

Twitter doom.

Then bam — dip buyers showed up like it’s Black Friday at Costco.

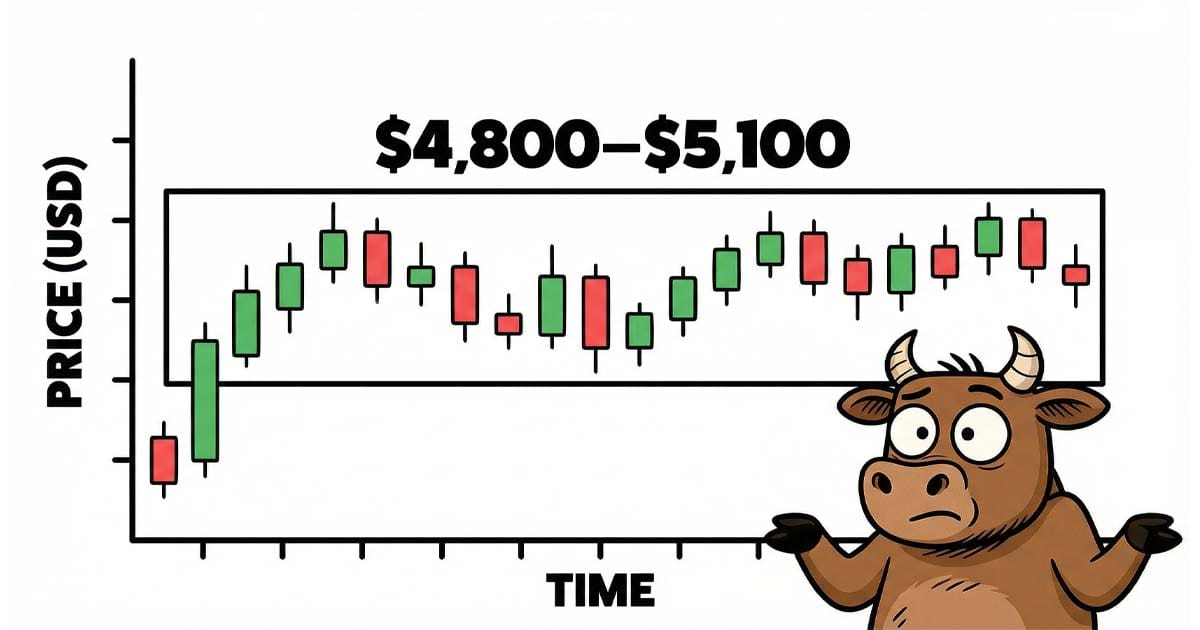

Gold futures bounced 2.1% to $4,986/oz.

Silver ripped 5.5% to $77.50/oz.

Not bad for metals that were “dead” 48 hours ago.

Still — let’s zoom out.

We’re well below this year’s record settlements:

• Gold: $5,318/oz

• Silver: $115/oz

Meanwhile… the world is on edge

Peace talks between Russia and Ukraine lasted… two hours.

That’s shorter than most Netflix movies.

Ukraine’s President called the talks “difficult” and accused Russia of stalling.

In other words: no breakthrough. Then things escalated elsewhere.

Iran said nuclear talks were “constructive.” The U.S. said… not so fast.

Vice President Vance made it clear Iran hasn’t met U.S. red lines.

And President Trump is keeping “all options” on the table.

Axios dropped a spicy headline saying the U.S. could be closer to a major Middle East war than most Americans realise.

Cool. Cool cool cool.

Oh — and Iran + Russia are doing naval drills in the Sea of Oman.

Right after Iran ran exercises in the Strait of Hormuz.

You know. The chokepoint for global oil.

If geopolitics were a stock, it’d be trading at ATH anxiety levels.

So why aren’t metals mooning?

Good question.

According to Marex analyst Edward Meir, we’re stuck in a tight trading range.

Lots of tension. Not enough conviction.

Gold isn’t screaming “crisis.” It’s whispering “maybe.”

Then the Fed entered the chat

After markets closed, the Federal Reserve dropped the minutes from its January meeting.

The vibe? Not in a hurry to cut rates.

Most officials want to see more inflation progress before easing.

A couple wanted a cut.

Some wanted neutral language.

But overall? Patience.

And higher-for-longer rates are like gravity for gold.

Because gold doesn’t yield anything.

When cash yields 3.5–3.75%, investors think twice before parking money in shiny rocks.

There’s also a calendar effect

Asian trading has been thin because of Lunar New Year.

Less liquidity = softer price action.

BMO analysts think that creates a “soft patch” window for bargain buyers.

In other words: If you believe the macro chaos sticks around, this dip might look tasty.

If you think tensions cool and rates stay high? Maybe not.

The real takeaway

Gold and silver aren’t exploding higher because markets are still playing “wait and see.”

• Will geopolitics actually escalate?

• Will inflation cool enough for rate cuts?

• Will the Fed blink first?

Until one of those breaks decisively, we’re range-bound.

Nervous. But not panicking.

TL;DR

Gold +2.1%, silver +5.5% after two-day dip

Still well below record highs

Russia-Ukraine talks fizzled

Middle East tensions heating up

Fed minutes show little appetite for rate cuts

Thin Asian trading may be creating dip-buy windows

Here’s the link to today’s Daily Bull Run Premium+ stock analysis if you haven’t seen it in your inbox already today!

Hyperscalers are about to spend $666B next year — up 76% — but the stock most exposed to that surge isn’t the one everyone’s tweeting about. We break down the new price target, the margin risk nobody’s pricing in, and why the real acceleration may not hit until 2H26–FY27.

Read it here 👇