In today’s post:

This Crash Will Make Millionaires💰

Amazon’s $200B Gamble 🎲

Bitcoin Will be Worth $0?! 😨

200+ AI Side Hustles to Start Right Now

While you were debating if AI would take your job, other people started using it to print money. Seriously.

That's not hyperbole. People are literally using ChatGPT to write Etsy descriptions that convert 3x better. Claude to build entire SaaS products without coding. Midjourney to create designs clients pay thousands for.

The Hustle found 200+ ways regular humans are turning AI into income. Subscribe to The Hustle for the full guide and unlock daily business intel that's actually interesting.

THIS CRASH WILL MAKE MILLIONAIRES 💰

Wall Street just crowned a new main character for 2026.

And it’s not the shiny AI kid everyone’s been fawning over.

It’s Apple.

Apple’s glow-up era?

Dan Ives is planting his flag early: 2026 is Apple’s breakout year.

On CNBC, he tossed out a spicy number — AI could add $75–$100 per share to Apple’s valuation.

Not market cap.

Not revenue.

Per. Share.

And no, he’s not sweating European regulators. He sees Apple playing offense — quietly embedding AI where it already owns your attention, your wallet, and your soul.

He even compared it to Alphabet’s monster run last year.

You know.

The one everyone wishes they bought earlier.

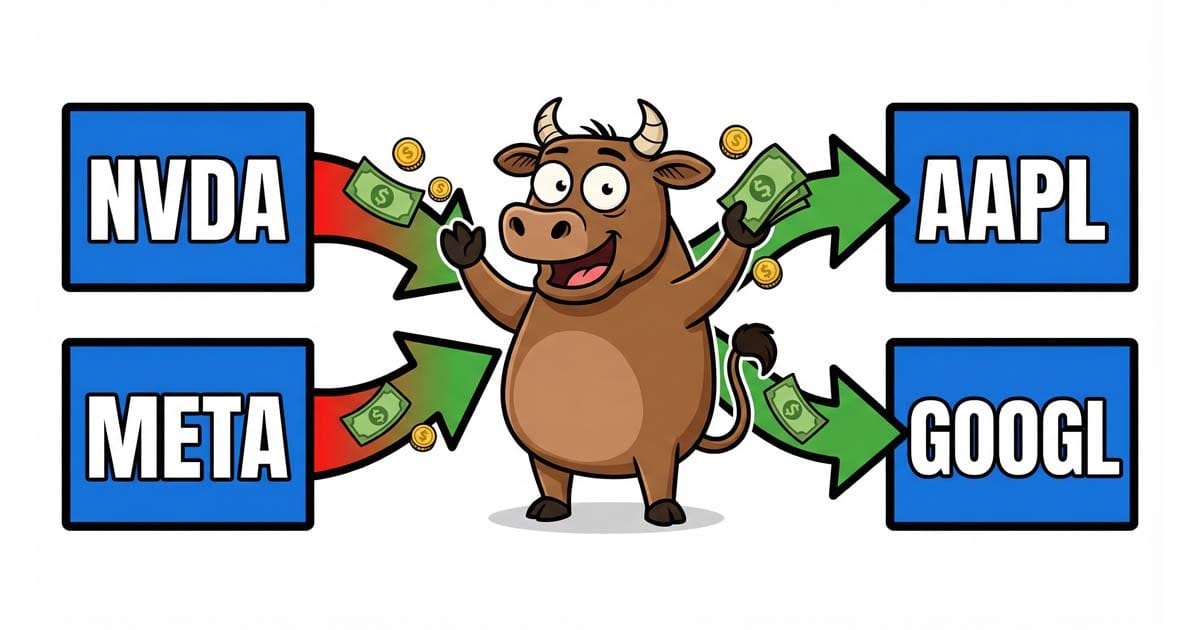

The great rotation (aka: sell winners, buy the ignored kids)

Jeff Kilburg says investors are doing the classic Wall Street cha-cha:

Selling last year’s darlings $NVDA ( ▲ 7.87% ) $META ( ▼ 1.31% )

Rotating into laggards $AAPL ( ▲ 0.8% ) $GOOG ( ▼ 2.48% )

Especially during April’s tariff-driven panic sell.

Same movie.

Different year.

Same retail investors watching it after the good part.

Why Kilburg is “giddy” about Google

Kilburg didn’t just hype Alphabet. He fanboyed.

Alphabet just crossed $400B in annual revenue for the first time. Casual flex.

But the real juice?

Google’s Gemini now processes 10B tokens per minute

Serving costs are down 78% year-over-year

That’s operating leverage on steroids.

His verdict?

“I get giddy about Google… the tip of the spear moving forward.”

Wall Street analysts don’t say “giddy” unless something very real is happening.

It’s the same scale-then-optimise playbook that keeps popping up in tech history — the kind that made The Innovator’s Dilemma a permanent fixture on investors’ desks for years. If you want to give it a read, it’s here.

Software apocalypse = shopping season

Dan Ives called the recent selloff a “software apocalypse.”

AKA everyone panicked at once and sold everything with a logo.

His response?

Good.

He says this is a “table-pounder” moment… the kind you look back on and wish you bought more. And I strongly agree with that sentiment.

Names he’s circling like a bargain hunter on Black Friday:

Salesforce

CrowdStrike

Microsoft

Oracle

ServiceNow

Massive selloffs.

Solid businesses.

Same story every cycle.

Crypto’s gut check (and one falling knife)

Crypto didn’t escape the carnage.

Kilburg called MicroStrategy a “falling knife” after it dropped 72% from all-time highs.

Ouch.

His take? When markets get stressed, crypto doesn’t just react — it overreacts.

It becomes a mood ring for global macro panic.

Still… that doesn’t mean the long-term story is dead but I’ll be staying away from $MSTR ( ▲ 26.12% )

Panic ≠ paradigm shift

Both analysts agree on one thing:

This isn’t the end.

It’s digestion.

Ives calls it a “digestion period”, not a structural breakdown.

The market ate too much hype too fast… now it’s walking it off a little.

And while everyone else is staring at red candles, these guys are quietly loading shopping carts.

TL;DR

Apple could add $75–$100 per share from AI, according to Dan Ives

Investors are rotating out of NVDA/META and into AAPL/GOOGL

Alphabet hit $400B revenue and slashed AI serving costs 78% YoY

The tech selloff is being framed as a buying opportunity, not a warning sign

Crypto’s shaky, MicroStrategy is down 72%, but long-term optimism remains

This looks less like “the end” and more like markets catching their breath

Sometimes the best trades don’t feel good.

They feel boring.

Or scary.

Or obvious in hindsight.

Welcome to that moment.

1. Buy the Rotation, Not the Hype

Money is rotating out of last year’s winners and into names that lagged but still print cash. This article screams institutional rebalancing, not fear.

📌 Action: Gradually build positions in $AAPL ( ▲ 0.8% ) and $GOOG ( ▼ 2.48% ) on red days. Use staggered buys over weeks, not one lump sum. When big funds rotate, they don’t rush — they accumulate quietly.

2. Accumulate Oversold Software Leaders

The “software apocalypse” hit everything indiscriminately — good businesses got sold with bad ones. That’s where the edge is.

📌 Action: Start long-term positions in oversold software leaders like $MSFT ( ▲ 1.9% ) (which we did a deep dive on in todays premium newsletter which you can read here), $CRM ( ▲ 0.73% ), or $NOW ( ▼ 1.84% ). Buy partial positions now, add if volatility continues. Think months, not days.

3. Use AI Efficiency as a Signal

AI isn’t just hype anymore — it’s cutting real costs. Alphabet processing 10B tokens per minute while slashing serving costs 78% YoY is an operating leverage story.

📌 Action: Treat AI efficiency leaders like $GOOG ( ▼ 2.48% ) as core holdings, not trades. Hold through noise. When costs fall faster than revenue grows, margins do the heavy lifting

AMAZON’S $200B GAMBLE 🎲

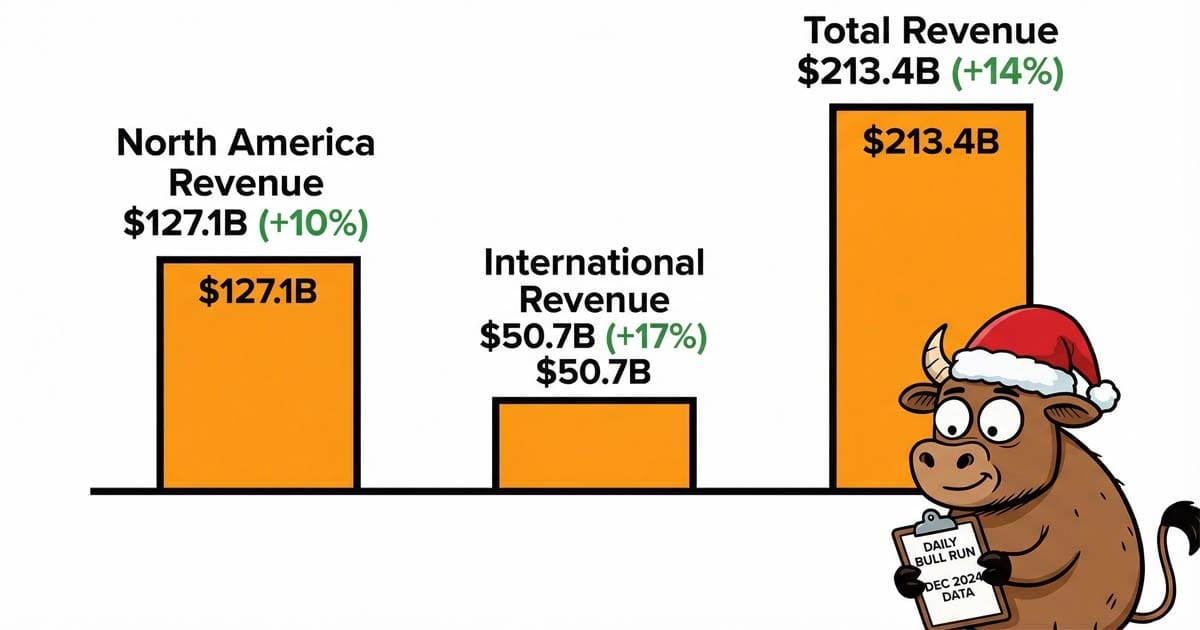

Q4 is Amazon’s Super Bowl. Black Friday, Cyber Monday, last-minute panic buying — the works.

And the top-line? Solid.

North America revenue: $127.1B (+10% YoY)

International revenue: $50.7B (+17% YoY)

Total revenue: $213.4B (+14% YoY)

Consensus: $211.5B

That’s a beat. Not a blowout… but a beat.

Think: winning the game, not storming the field.

AWS Keeps Printing

Amazon Web Services once again showed up like the responsible adult in the room.

AWS revenue: $35.6B (+24% YoY)

Consensus: $34.9B

That’s real growth at real scale.

Meanwhile:

Online stores: $83.0B vs. $82.3B expected

Third-party seller services: $52.8B (+10% YoY)

Amazon’s ecosystem is humming. Sellers sell, Amazon takes a cut, everyone keeps paying AWS.

Profits? Surprisingly Juicy

Operating income came in hot:

Total operating income: $25.0B

Consensus: $24.8B

Guidance range: $21.0B–$26.0B

Breakdown:

North America: $11.5B

International: $1.0B

AWS: $12.5B

AWS is still doing the heavy lifting — like a gym bro carrying the entire moving van.

Then… The Cash Flow Plot Twist

Here’s where the vibes shifted.

Trailing twelve-month free cash flow: $11.2B

Last year: $38.2B

That’s a big drop.

Why? Amazon went full send on spending:

$50.7B increase in property & equipment purchases

Mostly for AI infrastructure

Basically: Amazon didn’t lose money — it reinvested it aggressively.

This wasn’t a cash problem.

It was a “we’re building the future, deal with it” problem.

Andy Jassy Basically Said: “Hold My CapEx”

CEO Andy Jassy didn’t exactly calm investors down:

Amazon expects to invest about $200 billion in capital expenditures across the company in 2026.

AI. Chips. Robotics. Satellites.

Amazon is trying to build Skynet… but with Prime delivery.

The bet? Strong long-term return on invested capital.

The cost? Investors’ short-term patience.

This is peak Amazon: misunderstood early, dominant later — straight out of The Everything Store.

Guidance: Good, But Not Good Enough

Looking ahead to Q1:

Revenue guidance: $173.5B–$178.5B

Midpoint: $176.5B

Consensus: $175.5B

Revenue = fine.

But profits?

Operating income guidance: $16.5B–$21.5B

Midpoint: $19.0B

Consensus: $22.2B

Oof.

And yes… Amazon reiterated $200B in capex.

After-hours: −8.8%

Regular session: −4.4%

Wall Street saw massive spending, softer profit guidance, and said:

“Cool story. We’re out.”

TL;DR

Amazon beat revenue expectations across the board

AWS growth stayed strong at +24% YoY

Operating income topped estimates

Free cash flow dropped hard due to massive AI investment

Management plans $200B in capex, and the market hates it

Stock sold off nearly 9% after hours

1. Follow the AI Infrastructure Wave

Amazon isn’t “cutting margins” — it’s building the rails. They’re dropping $200B in capex on AI, chips, robotics, and data centers. That spend doesn’t live in a vacuum. It leaks into the entire AI supply chain.

📌 Action: Accumulate AI infrastructure exposure via semis + data-center enablers (think GPUs, networking, power). Use broad ETFs if you want diversification, or scale in during tech pullbacks caused by capex fear headlines. When hyperscalers spend this aggressively, suppliers eat first — and eat well.

2. Buy Quality on Capex Panic

The market just threw a tantrum because free cash flow dipped and guidance softened. But revenue beat, AWS grew 24% YoY, and operating income topped expectations. This wasn’t a demand problem — it was a spending one.

📌 Action: Scale into $AMZN ( ▼ 5.56% ) gradually on selloffs tied to capex headlines. Use limit orders and patience — not all-in hero buys. Markets hate spending today for profits tomorrow. Long-term investors get paid for tolerating that discomfort.

3. Rotate Toward Cash-Flow Winners

Amazon reminded everyone of a brutal truth: AI leaders ≠ free cash flow machines (yet). Some companies benefit from AI without torching cash on infrastructure.

📌 Action: Balance AI-heavy names with businesses that generate strong free cash flow right now. Rebalance quarterly. Let Amazon-style builders coexist with cash cows in your portfolio. You reduce volatility while still staying exposed to the AI megatrend — best of both worlds.

BITCOIN WILL BE WORTH $0?! 😨

Bitcoin to zero. Not “down a bit.” Not “crypto winter.”

Zero. As in… unplug the chart.

That’s the call from Richard Farr, chief market strategist at Pivotus Partners. And no, he says it’s not clickbait.

“Our BTC price target is 0.0. That’s not shock value. That’s math.”

Ouch.

His core argument? Bitcoin hasn’t behaved like a hedge. It hasn’t behaved like money.

It’s behaved like a leveraged tech stock wearing a trench coat.

Bitcoin ≠ digital gold

More like Nasdaq with extra steps

Farr says Bitcoin has failed the one job crypto fans keep advertising:

• Hedge against the dollar

• Hedge against debasement

• Hedge against chaos

Instead, BTC has moved in sync with risk assets, tracking tech stocks like it’s on the S&P’s payroll.

In his words: “a speculative instrument correlated to the Nasdaq.”

When markets panic, Bitcoin doesn’t protect you.

It panics with you.

Institutional adoption? Farr says “lol, no”

One of Farr’s sharper shots:

“No serious central bank will ever own something where Michael Saylor controls the float.”

The concern isn’t just ideology — it’s concentration risk.

When one corporate figure (👋 Michael Saylor) holds an enormous chunk of supply through Strategy $MSTR ( ▲ 26.12% ), decentralization starts looking… theoretical.

Hard sell to central banks.

Harder sell to conservative institutions.

Impossible sell to regulators.

Mining economics: the treadmill from hell

Farr also goes after Bitcoin’s plumbing.

• Miners bleeding cash

• Network slow and inefficient

• Energy usage off the charts

His verdict?

Bitcoin is a terrible transaction processor and an expensive one to maintain.

You don’t need ideology to see the issue.

You just need a calculator and an electricity bill.

Enter: the “death spiral” crowd

Farr isn’t alone.

Michael Burry, yes that Burry, has been waving a big red flag too.

His warning: a self-reinforcing Bitcoin death spiral.

We took a closer look at Michael Burry’s theory in yesterday’s newsletter which you can read here if you missed it.

The hedge myth officially on life support

Burry doesn’t mince words.

Bitcoin, down over 40% from its October peak, is now:

“Exposed as a completely speculative asset.”

Not a debasement hedge.

Not digital gold.

Not silver 2.0.

Just risk — with a ticker.

And the data backs him up.

BTC’s correlation with the S&P 500 has climbed to 0.50.

That’s not diversification.

That’s co-signing volatility.

ETFs didn’t “fix” Bitcoin — they turbocharged it

Remember when spot ETFs were supposed to legitimize crypto?

Burry says they did the opposite.

• Increased speculative flows

• Tightened links to equities

• Made BTC trade even more like a stock

Great for liquidity.

Bad for anyone selling the “safe haven” story.

The $50K line in the sand

Burry’s nightmare scenario starts at $50,000 BTC.

If that level breaks:

• Miners could go bankrupt

• Capital markets could shut for MSTR

• Tokenized metals could collapse “into a black hole”

• Corporates de-risk by dumping anything liquid

He notes that up to $1B in precious metals was already liquidated at month-end — collateral damage from crypto stress.

Everything is connected.

And leverage makes sure it spreads fast.

Zoom out: the damage is already real

In just three weeks:

• ~$1 trillion wiped off Bitcoin’s market cap

• BTC hovering around $67,300

• Confidence leaking faster than liquidity

Whether you think zero is extreme or inevitable, the direction of travel is doing all the talking.

TL;DR

• A top strategist says Bitcoin’s fair value is zero — based on math, not vibes

• BTC has traded like a tech stock, not a hedge

• Institutional adoption faces concentration and governance issues

• Mining economics are ugly and getting uglier

• Michael Burry warns of a self-reinforcing death spiral

• BTC’s correlation with stocks is now 0.50

• ETFs increased speculation instead of stability

• A drop to $50K could trigger cascading failures

• ~$1T in BTC market cap has already vanished

Here’s the link to today’s Daily Bull Run Premium+ stock analysis if you haven’t seen it in your inbox already today!

Microsoft just triggered a textbook market overreaction. Today’s newsletter breaks down how this setup actually gets traded to make money!

Still on the free plan? You're already behind.

Premium+ members get daily, high-conviction stock picks — backed by research, charts, and timing.

You get... a blurred-out mystery.

What you're missing right now:

Today’s top-performing stock pick

Clear buy thesis & risks explained

Early access before we go public

Join Premium+ today. And if we don’t help you grow your portfolio, you’ll get a full refund.